Are Bitcoin Miner Sales Preventing Breakout to Higher Prices?

Today’s downside breach below the current low point of Bollinger Band bears watching for even weaker prices in the near future.

The price of bitcoin (BTC) has more than reversed last week’s rally, returning to the low end of its recent range near $29,700 on sluggish volume.

Recent market action has been notable for quick price reversals anytime bitcoin appears poised for a sustained breakout above the $31,000 level. One explanation might be sales by bitcoin miners on price rallies, a possible sign that they are in need of capital, are bearish on BTC short term, or a combination of the two. There are also two technical indicators to explore.

Have bitcoin miners turned bearish?

As bitcoin prices have pushed past $30,000 for most of this month, bitcoin miners have been decreasing their overall net position. According to on-chain analytics firm , the 30 day change of supply in miner addresses has been negative for 20 consecutive days.

This marks a distinction from the time period between April 10 and June 27, when the industry’s net position was positive for all days but one.

Does the change indicate a shift in sentiment or simply a need for cash-strapped miners to sell into strength to fund operations? The answer is likely a combination of the two.

Given BTC’s 80% gain year to date, it’s not unreasonable to expect that bitcoin miners would be apt to take some profits off of the table. Overal l trading volume, however, has not been strong enough to indicate their mass exodus from the asset.

Additionally, miners' overall bitcoin balances are currently 1.83 million coins versus 1.82 million on January 1, implying that recent activity may simply be a rebalancing of their overall position rather than a commentary on price level.

Bitcoin has breached the lower range of its Bollinger Bands

Bollinger Bands are a technical indicator which tracks an asset’s 20 day moving average agains t price levels two standard deviations above and below that average. As prices are expected to stay within two standard deviations of its average 95% of the time, breaches above or below are statistically significant events.

A recent bullish example occurred on June 14, with prices moving sharply higher shortly following an upside breach.

Action today is potentially bearish, with the current price of $29,750 being a minor downside breach of the $29,800 low end of the Bollinger Band range.

Signific ant price agreement exists at the $30,000 level

Absent a new catalyst, BTC prices seemed poised to continue resting near the $30,000 level. Bitcoin’s volume at price profile shows substantial activity at $30,500 since May. These high activity levels by price point are often called “high volume nodes,” indicating significant price agreement between traders and thus often signaling areas where prices stabilize.

This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our .

Edited by Stephen Alpher.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

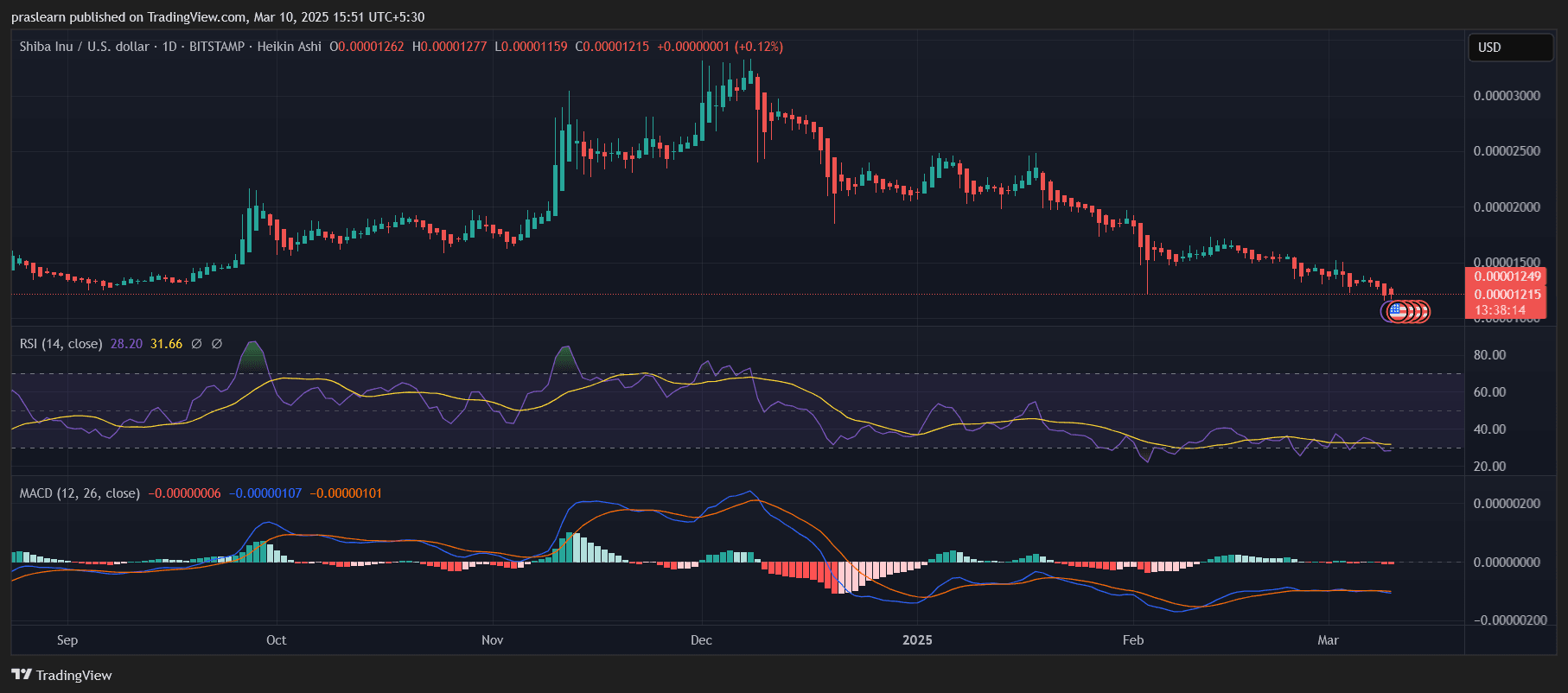

SHIB Price: Will Shiba Inu Price Crash to Zero?

4 reasons why Solana (SOL) price could rally back to $180

VIPBitget VIP Weekly Research Insights

Over the past few weeks, BTC has repeatedly tested the $100,000 resistance level, briefly breaking through multiple times before failing to hold, resulting in sharp declines Altcoins have entered a technical bear market, though SOL has shown resilience during both downturns and rebounds. However, the trading frenzy surrounding Solana-based memecoins has cooled, while discussions of institutional unlocking have gained traction on social media. On the night of March 2, Trump announced plans to establish a strategic crypto reserve, explicitly mentioning BTC, ETH, XRP, SOL, and ADA. This statement briefly reignited market sentiment amid oversold conditions, triggering a sharp crypto rebound. However, macroeconomic conditions remain largely unchanged, and liquidity recovery is a gradual process. The rally sparked by Trump's comments quickly faded, suggesting the market may still face further downsides. The following recommendations highlight projects worth monitoring in the current cycle, though they may not yet have reached an optimal entry point.

Texas Senate Passes Bitcoin Reserve Bill With 80% Votes in Favor

Texas' Bitcoin Reserve bill cleared the Senate with strong bipartisan support. Without mandatory Bitcoin purchases, it now moves to the House for a final vote.