- According to Eric Balchunas, $22 billion in Bitcoin ETFs traded in the last five days.

- BlackRock’s IBIT alone traded over $1 billion daily in the past week.

- ETF inflows resulted in an impressive rally for Bitcoin, with the price soaring above $60,000.

Bloomberg’s Senior ETF Analyst, Eric Balchunas, observed a significant development in the spot Bitcoin ecosystem. Balchunas revealed $22 billion in Bitcoin ETFs traded in the last five days, a volume usually traded in one month before now.

The ETF analyst showed that BlackRock’s IBIT alone traded over $1 billion daily in the past week, with other ETF products performing well. However, he remained conservative with his expectations, noting he would observe how the ETFs perform in the coming week. That would confirm whether a new trend has emerged in the Bitcoin ecosystem.

Meanwhile, Balchunas’ post revealed the top three performers in the past week include BlackRock’s IBIT, Grayscale’s GBTC, and Fidelity’s FBTC. These ETFs consistently returned significantly high volumes, confirming expectations by the Bitcoin community that spot Bitcoin ETFs will attract significant inflows into the ecosystem.

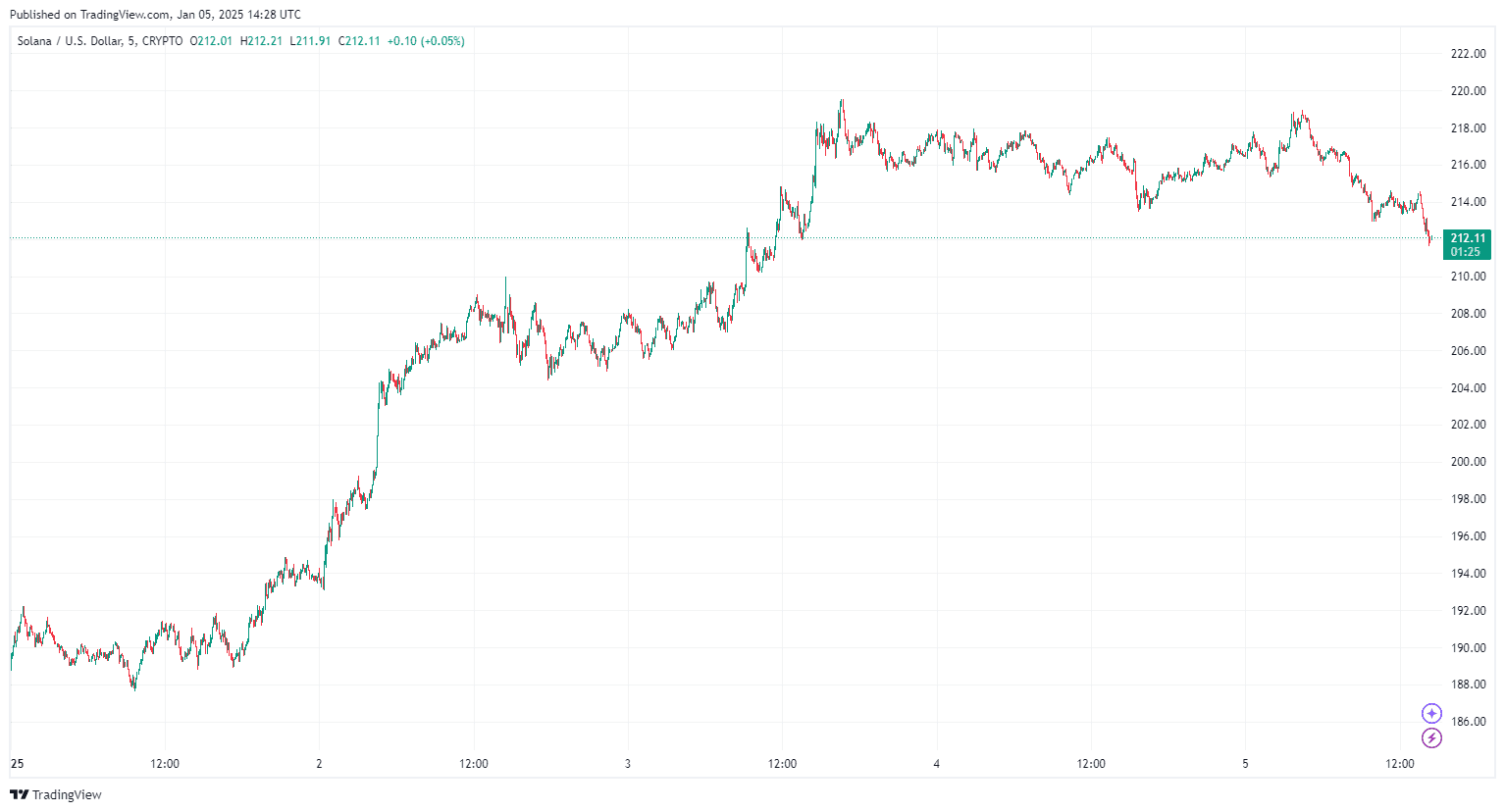

Notably, the spot ETF inflows resulted in an impressive rally for Bitcoin, with the price soaring above $60,000 for the first time since the last bull cycle. The flagship cryptocurrency opened trading last Monday at $51,738. The price surged all through the week, reaching a season-high of $64,000, according to data from TradingView .

Bitcoin’s latest rally reflected about 25% weekly gain for the pioneer crypto, a weekly performance not experienced by Bitcoin in several years. The recent rally confirmed many users’ opinions that the spot Bitcoin ETF will significantly impact the upcoming bull run.

The recent move began after a BTC price dump followed the ETF approvals. At the time, several experts noted the dump resulted from capital rebalancing, following which the price reversed, putting up an impressive rally.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.