Research Unlock: An overview of Avalanche DeFi Ecosystem and BOOST Campaign

Quick Take The Avalanche DeFi ecosystem has seen significant growth driven by the BOOST campaign, which incentivizes liquidity for well-established assets through AVAX token rewards. The campaign has positively impacted the ecosystem’s total value locked (TVL) and liquidity, particularly in protocols like Trader Joe and GMX, while also supporting less prominent exchanges like Pharaoh. Lending protocols such as Aave and Benqi have shown varied success with their use of incentives, directly affecting their l

Decentralized finance (DeFi) protocols play an integral role in user activity on blockchains today. For example, decentralized exchanges (DEXs) now constitute a significant percentage of overall crypto trading volume and are typically the primary source of user-generated transaction fees for smart contract platforms and their node operators. In 2024, memecoin trading has grown into a dominant driver of user attention and onchain activity, further underscoring the utility of DEXs and other DeFi protocols that provide permissionless access to core financial services.

One of the key challenges for DeFi protocols is the retention of user capital, which serves a vital role in the product experience for other users. On DEXs, deep liquidity enables tighter price spreads and lower slippage for trades. On lending protocols, more liquidity means more attractive rates for borrowers and better capital efficiency for lenders. Liquidity also has a self-perpetuating effect; lower trading fees and borrowing costs attract more volume, generating higher yields for liquidity providers (LPs), which in turn attracts more liquidity, further reducing user costs, and so on. Today’s DeFi landscape is more competitive than ever, with different ecosystems constantly vying for liquidity fractured across protocols and blockchains. In this report, we explore the state of the Avalanche AVAX +1.30% DeFi ecosystem, currently bolstered by the Avalanche Foundation’s BOOST campaign intended to incentivize DeFi liquidity throughout the ecosystem.

BOOST Campaign

The BOOST campaign is an incentive program designed to reward users and LPs across key DeFi protocols in the Avalanche ecosystem. Protocols participating in the program include the DEXs Trader Joe, GMX, and Pharaoh, and WooFi, the Benqi lending protocols Aave and Benqi, and the DeltaPrime leveraged yield farming protocol. Each protocol manages individual strategies for the distribution of AVAX token incentives provided by the Avalanche Foundation through the BOOST campaign, which began in July 2024 and is expected to last through October.

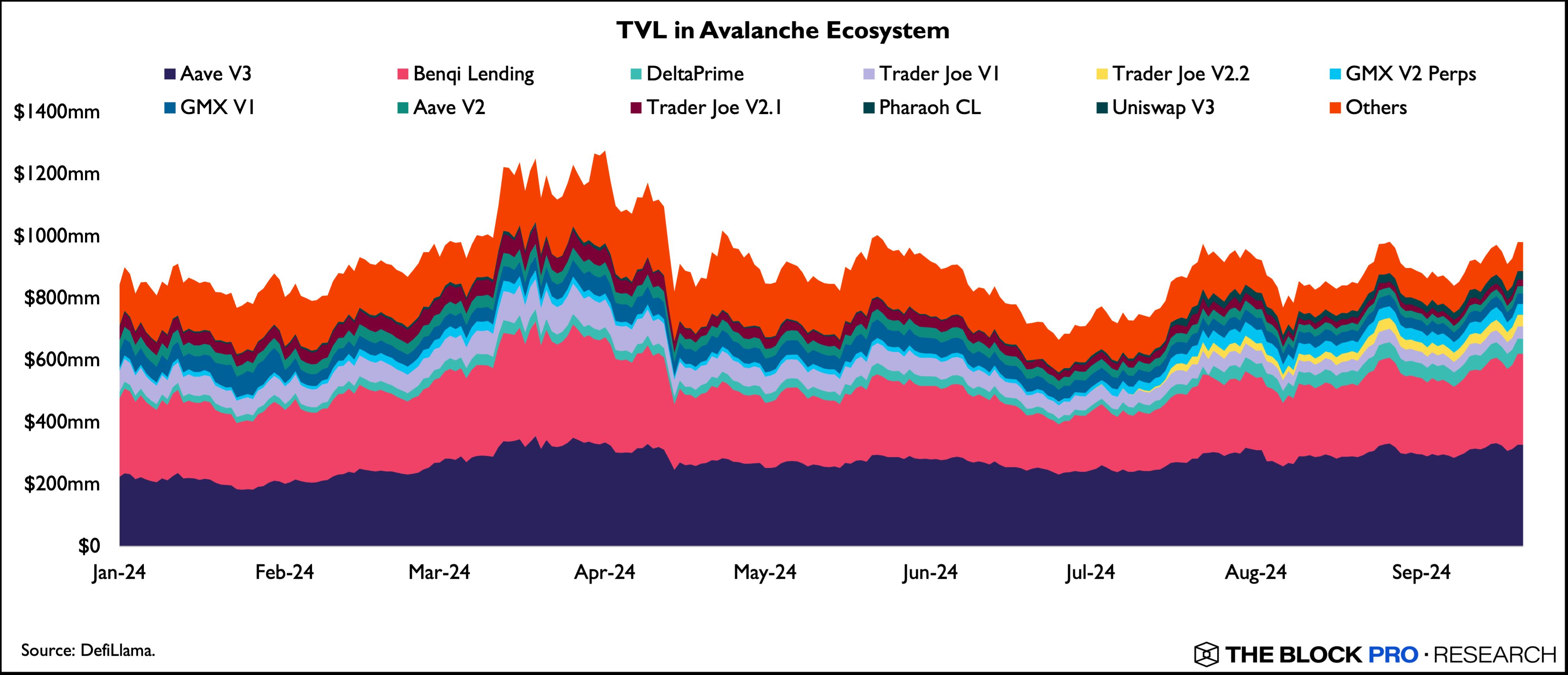

The BOOST campaign is reminiscent of the Avalanche Rush incentive program launched back in August 2021, which played a major role in pushing the Avalanche ecosystem’s TVL to its all-time high (ATH) of ~$11.4 billion in November 2021. Earlier this year, the Avalanche Foundation launched the Memecoin Rush incentive program that specifically targeted memecoin liquidity, whereas the BOOST program is catered more towards improving liquidity for well-established assets like BTC.b, USDC, USDT, etc. As of this writing, TVL on Avalanche sits at ~$980 million, up by ~$137 million since the start of 2024 and down slightly from its year-to-date (YTD) peak of ~$1.27 billion.

Since the beginning of July, TVL has risen by ~$249 million for a gain of ~34%, suggesting that the BOOST campaign has had a positive effect on the Avalanche ecosystem’s overall liquidity. TVL is also up by ~22% when denominated in AVAX over this period, implying that the liquidity increase is likely due to an influx of capital rather than the price appreciation of existing liquidity alone.

Lending Yield Aggregation

TVL in the Avalanche ecosystem is largely dominated by its two largest lending protocols, Aave V3 and Benqi, which collectively make up ~63% of overall TVL. Aave initially distributed BOOST rewards in select lend/borrow markets for a limited period in late July, which are slated to return in the coming weeks, while Benqi has continued to offer both lender and borrower incentives as of this writing. The effect of these contrasting strategies is clear when comparing TVL growth between the two protocols in recent months. Since the beginning of July, Aave’s TVL has increased by ~34%, while Benqi’s has increased by ~54% over the same period, highlighting the impact of incentives on capturing liquidity.

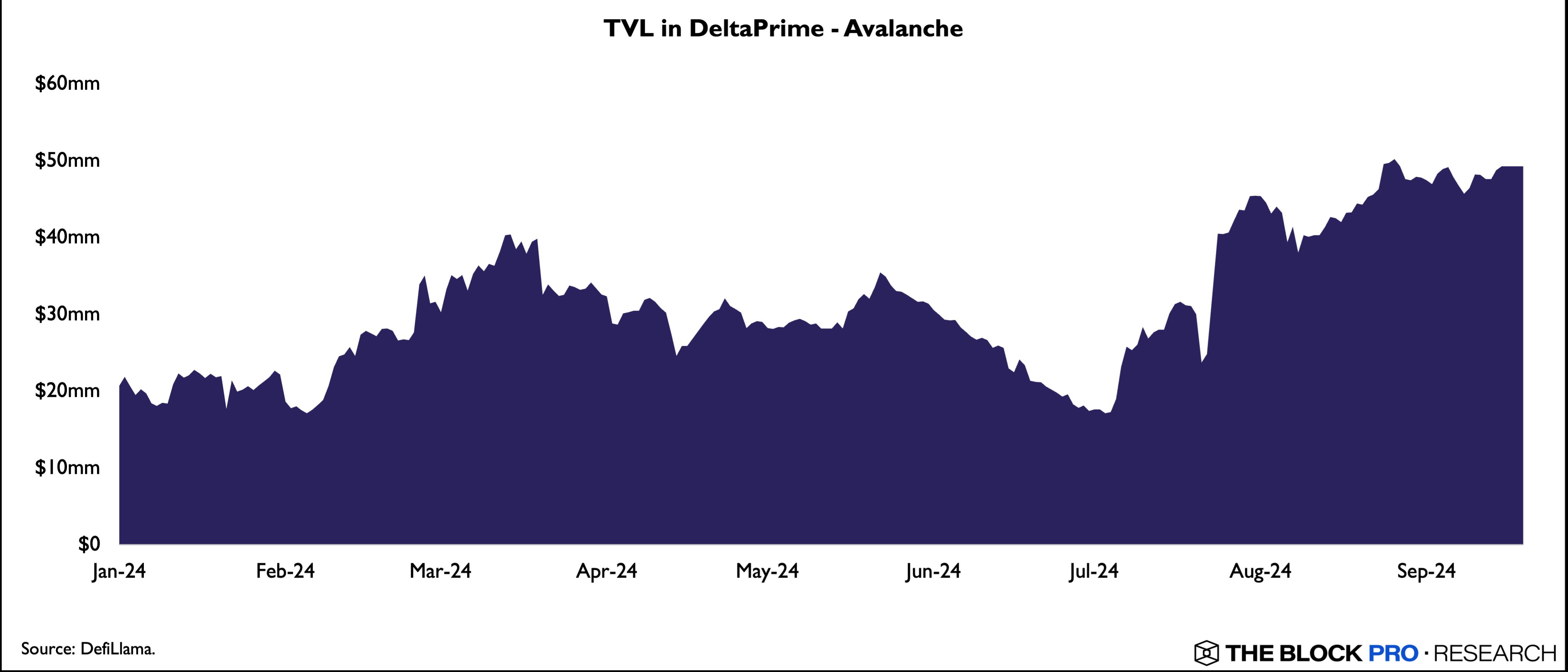

Incentivized liquidity in lending markets can also create a trickle-down effect for yield aggregators and leveraged farming protocols, which typically allow users to further increase their effective yield by borrowing against their incentivized, yield-bearing assets and re-depositing them via automated “looping” strategies. For instance, Yield Yak takes advantage of Benqi’s BOOST participation to maximize native yield from lending, as well as the incentivized yield from both borrowing and lending. As a BOOST partner, DeltaPrime is able to maximize net yields for users even further by offering additional AVAX incentives for depositors in its leveraged farming strategies.

This multi-layer incentive structure has been especially beneficial for DeltaPrime, which has seen its TVL grow by ~179% since the start of July as of this writing. It is worth noting that while leveraged farming protocols contribute to deeper liquidity within DeFi ecosystems, they also introduce additional risks for users due to the use of leverage and the integration of multiple protocols, each with its own underlying safety assumptions. Recently, on September 16th, DeltaPrime’s Arbitrum deployment was exploited for ~$6 million due to a private key compromise, incurring losses for users who would have otherwise been unaffected if they had only used the underlying protocols. Thus far, the exploit does not seem to have impacted DeltaPrime on Avalanche, which has a time lock on contract owners as an extra safety feature.

DEXs

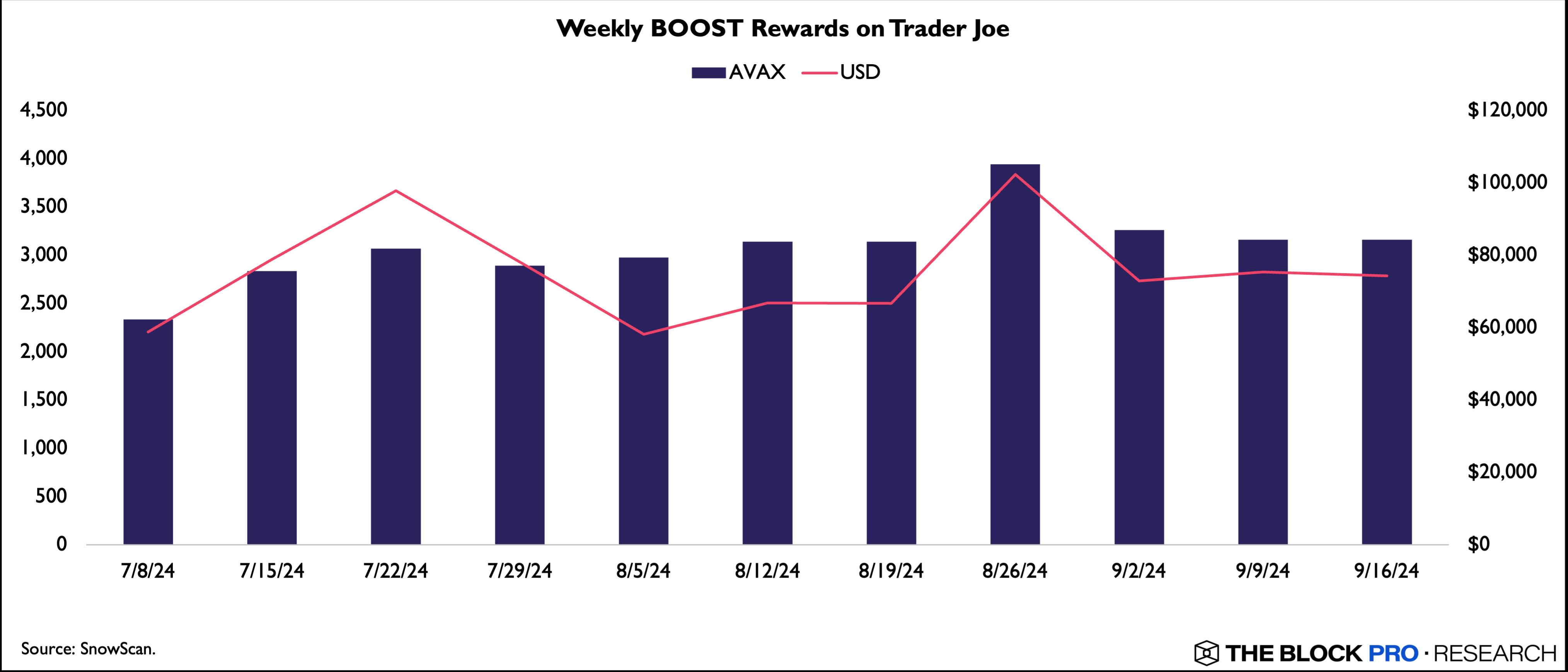

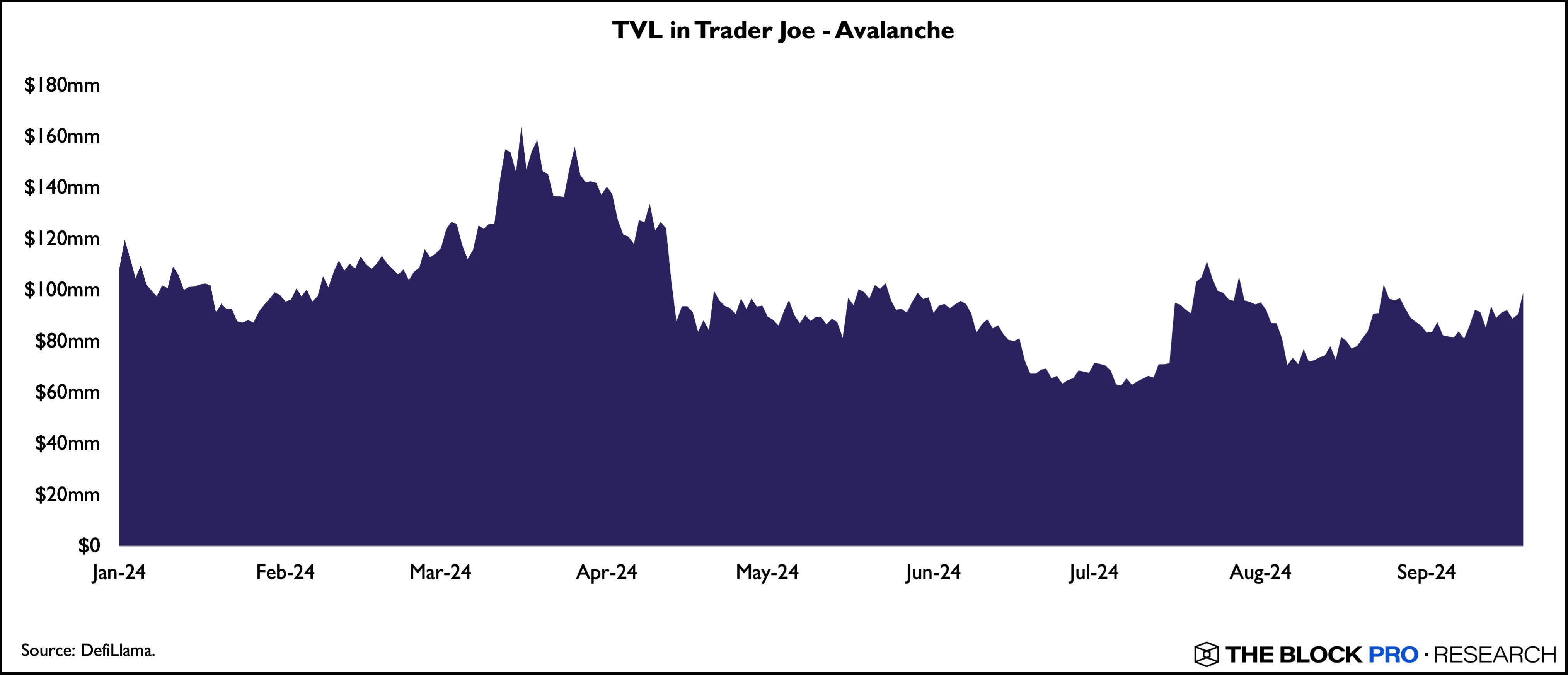

Aside from lending protocols, perhaps the most important sources of liquidity in the Avalanche ecosystem are its DEXs, which are essential for facilitating trading both on the C-Chain and on Avalanche subnets. Trader Joe is the most dominant DEX in the Avalanche ecosystem in terms of both liquidity and volume and is a key participant in the ongoing BOOST program. AVAX rewards are distributed to LPs for select pools on Trader Joe and are adjusted weekly in terms of amount and pool allocation.

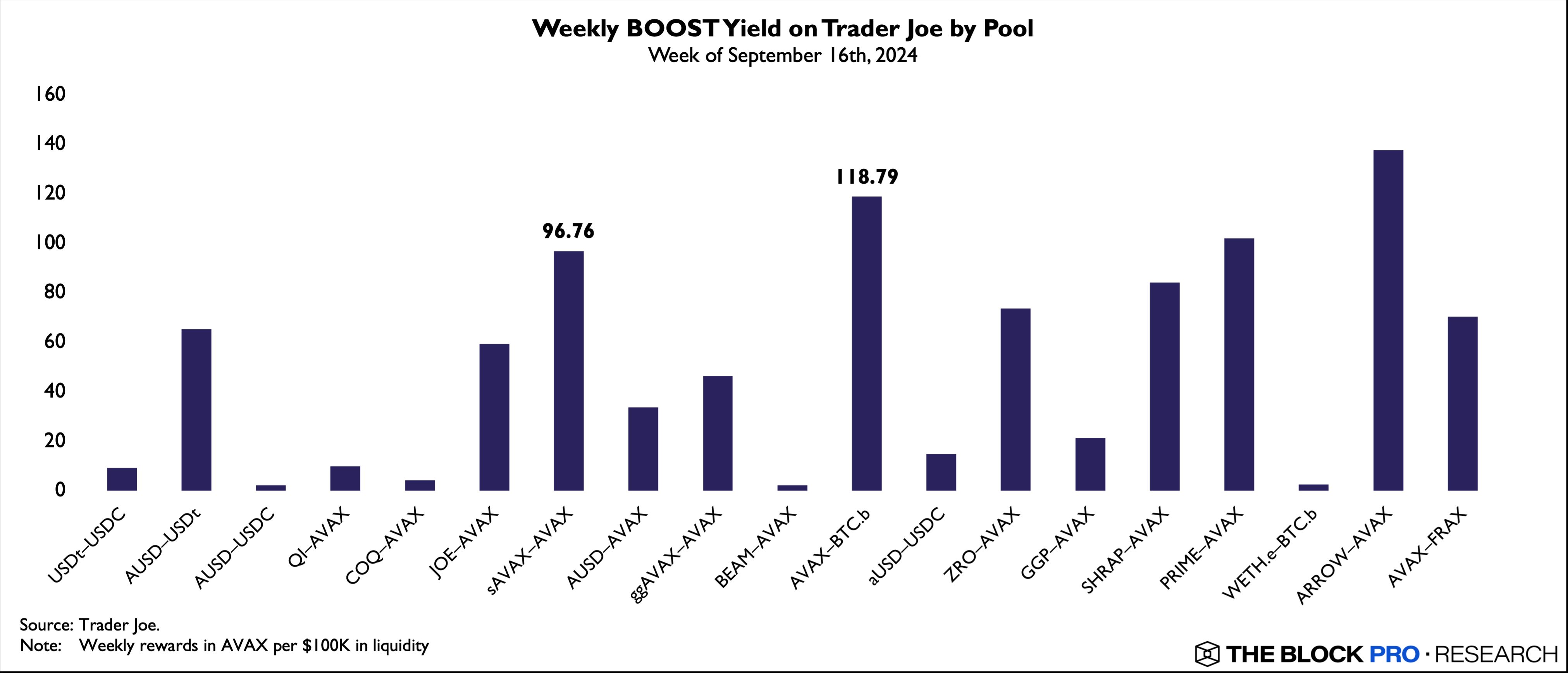

Based on on-chain data visualized in the chart above, we can see that Trader Joe has distributed an average of ~3082 AVAX, equivalent to ~$75.4K per week in BOOST incentives since the start of the program in early July. This amounts to a total of ~33.9K AVAX, or ~$830k, in incentives distributed to LPs on the platform thus far. Incentives were initially allocated to 13 liquidity pools in the first week of the program and have since been expanded to 19 pools, including stablecoins, wrapped L1 tokens, liquid-staking tokens (LSTs), and long-tail assets. The Trader Joe team’s strategy for the BOOST campaign is centered around incentivizing its concentrated liquidity pools, with rewards only accruing to positions within active price ranges. In theory, this encourages LPs to set tighter price ranges for liquidity, which should result in lower slippage for users as well.

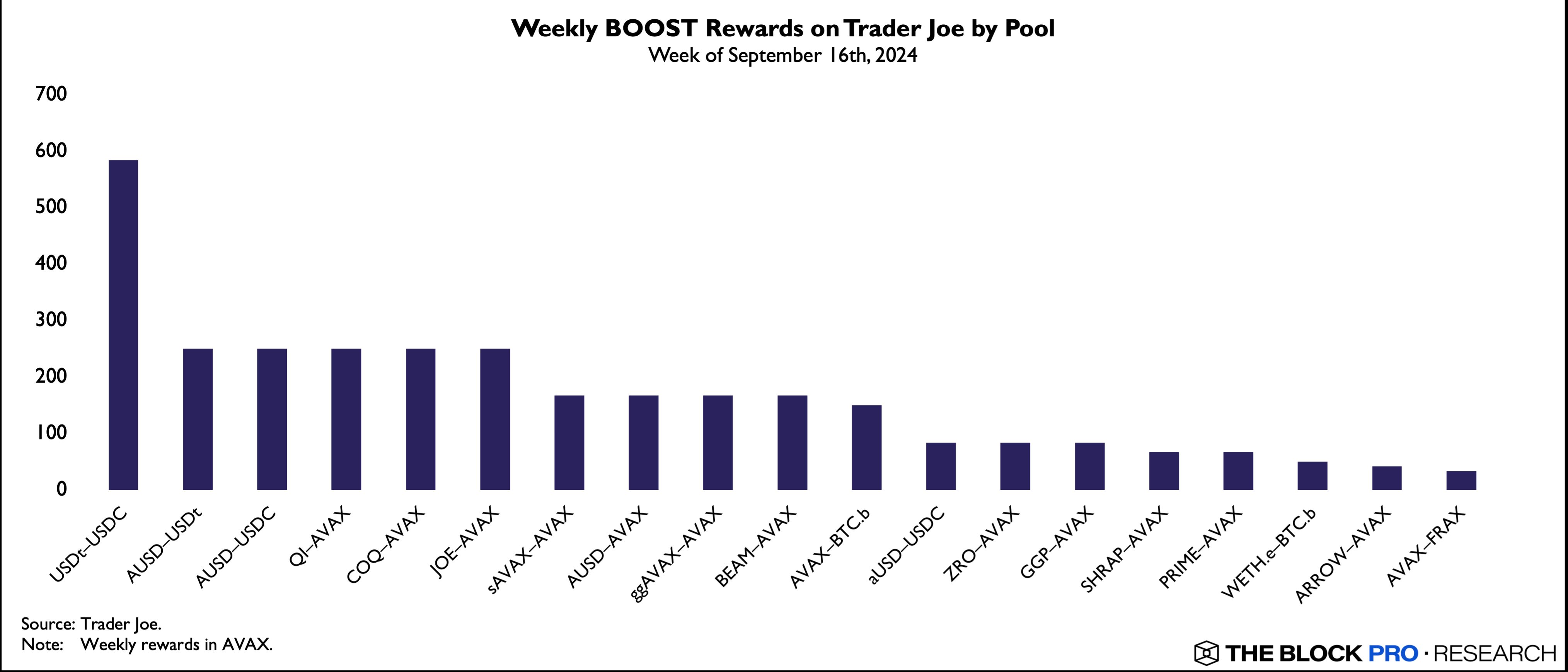

Trader Joe’s BOOST incentives are mostly targeted at stablecoin pairs, with the USDT-USDC pool receiving the largest allocation of AVAX for the week of September 16th. The five pools receiving the 2nd-largest allocation for the week include two stablecoin pairs (AUSD-USDT and AUSD-USDC), two BOOST participant token pairs (QI-AVAX and JOE-AVAX), and one memecoin pair (COQ-AVAX). Agora Dollar (AUSD) is a fiat-backed stablecoin launched by the asset-tokenization protocol Agora and has already grown to a market cap of ~$21 million in the Avalanche ecosystem since deploying there on August 27th , thanks in part to its partnership with Trader Joe and Benqi. If we break down Trader Joe’s BOOST distribution further from the perspective of rewards yield, we can see how Trader Joe’s strategy also aims to support the growth of key tokens in the ecosystem that have relatively less liquidity.

Among pools with at least $100K in liquidity (thus excluding low-liquidity memecoins), the AVAX-BTC.b and sAVAX-AVAX pairs are receiving the most incentives relative to pool liquidity for the week of September 16th. This points to a deliberate effort to improve liquidity for liquid-staked AVAX (sAVAX) and Bitcoin (BTC.b) in the Avalanche ecosystem. Overall, the BOOST campaign appears to have been beneficial for liquidity on Trader Joe, with TVL growing by ~$27.3 million since the start of July, for a gain of ~38%.

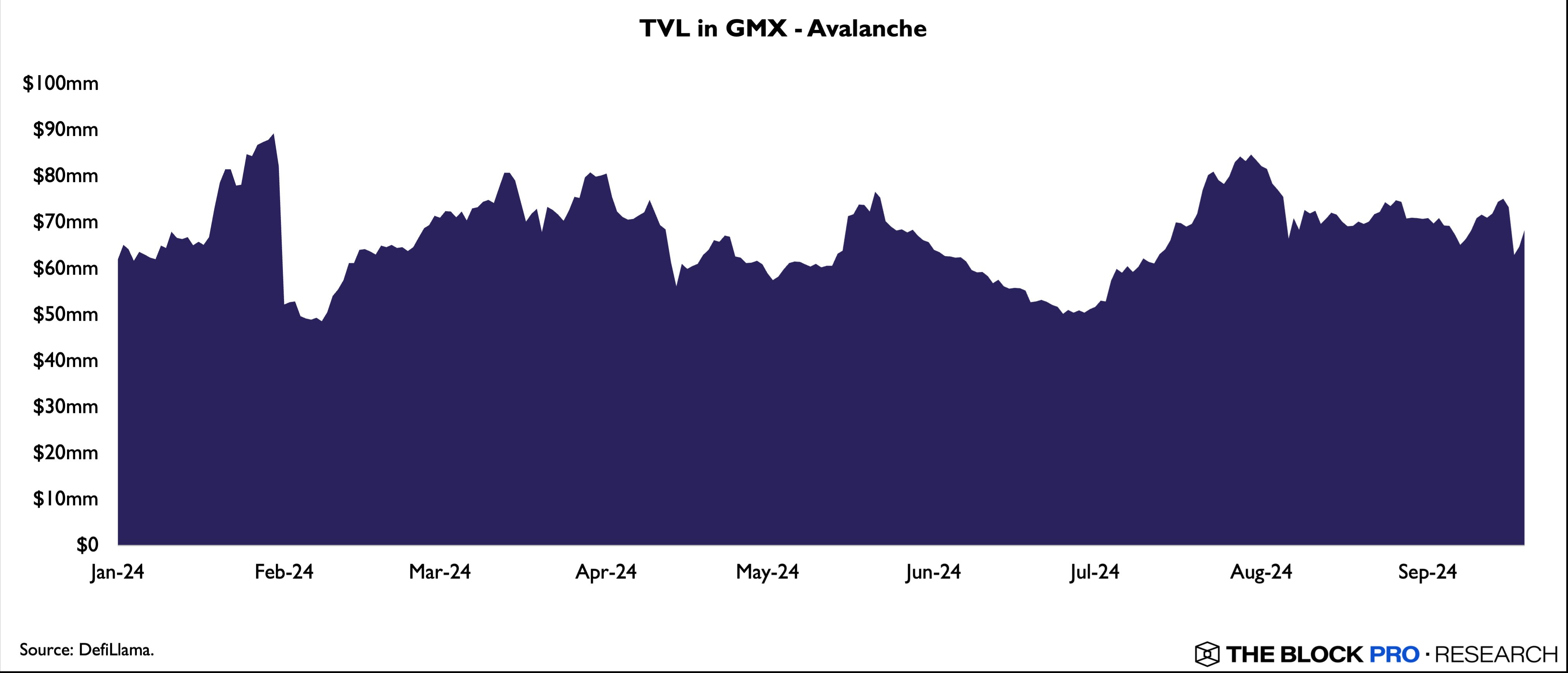

GMX, another popular DEX on Avalanche, has also benefited from its participation in the BOOST campaign over the past ~2.5 months. GMX offers AVAX incentives for 10 liquidity pools on its platform, in addition to reduced trading fees for the duration of the program. Since the start of July, TVL in GMX has grown by ~$16.6 million for a gain of ~32%.

One of the smaller exchanges in the Avalanche ecosystem, Pharaoh, has seen an outsized benefit from incentivizing liquidity through the BOOST program. Although its current TVL of ~$15.9 million is several times lower than Trader Joe’s, it has grown by ~$14.3 million for a gain of ~863% since July alone. Pharaoh represents an interesting case where incentives can be especially effective due to the exchange’s lesser popularity in the ecosystem, which likely received a boost from its partnership with the Avalanche Foundation as well.

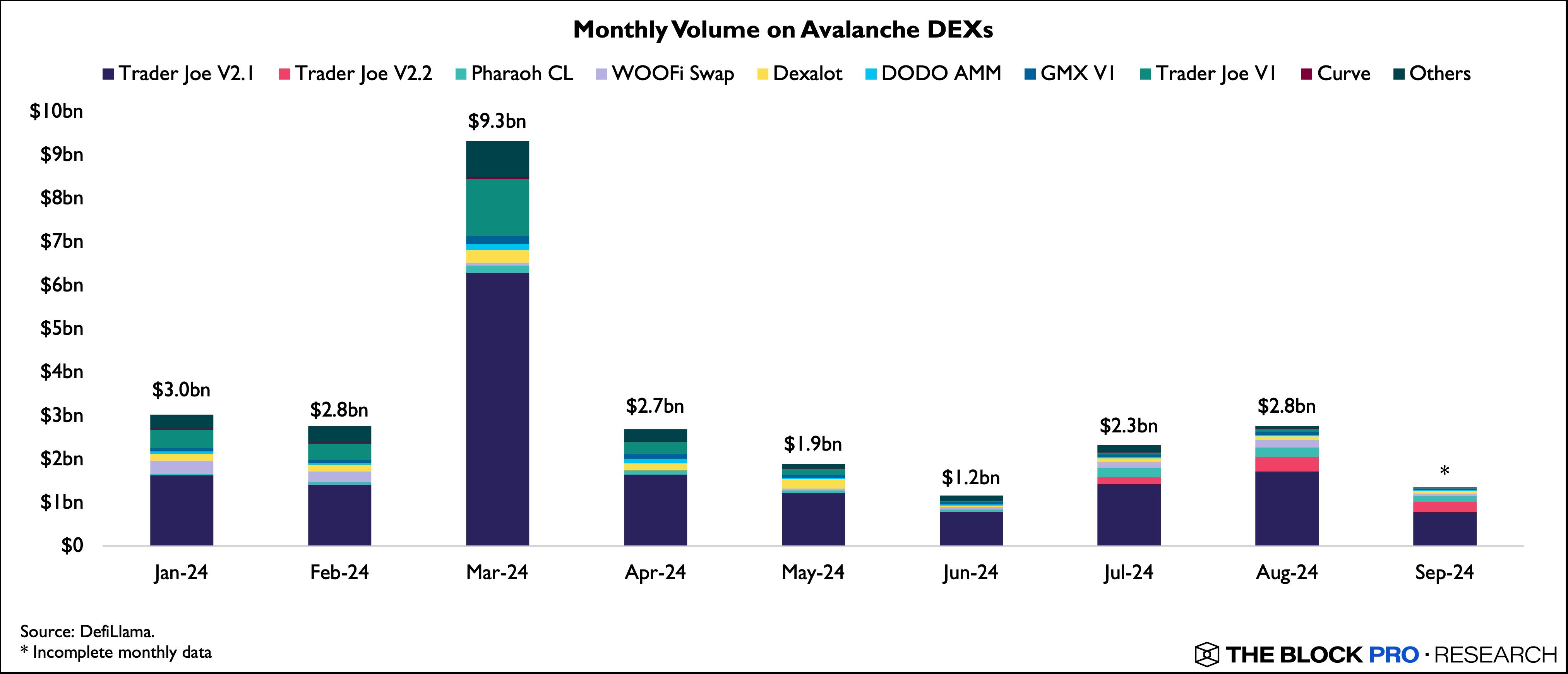

Taking a look at monthly volumes across spot DEXs on Avalanche also reveals that Pharaoh has been able to grow its market share from just ~1.2% in January to a high of ~9.4% in July and ~8.2% in August. As of now, Trader Joe continues to dominate the market in terms of trading volumes, reaching consecutive YTD highs of ~68.4% and ~73.8% in July and August, respectively.

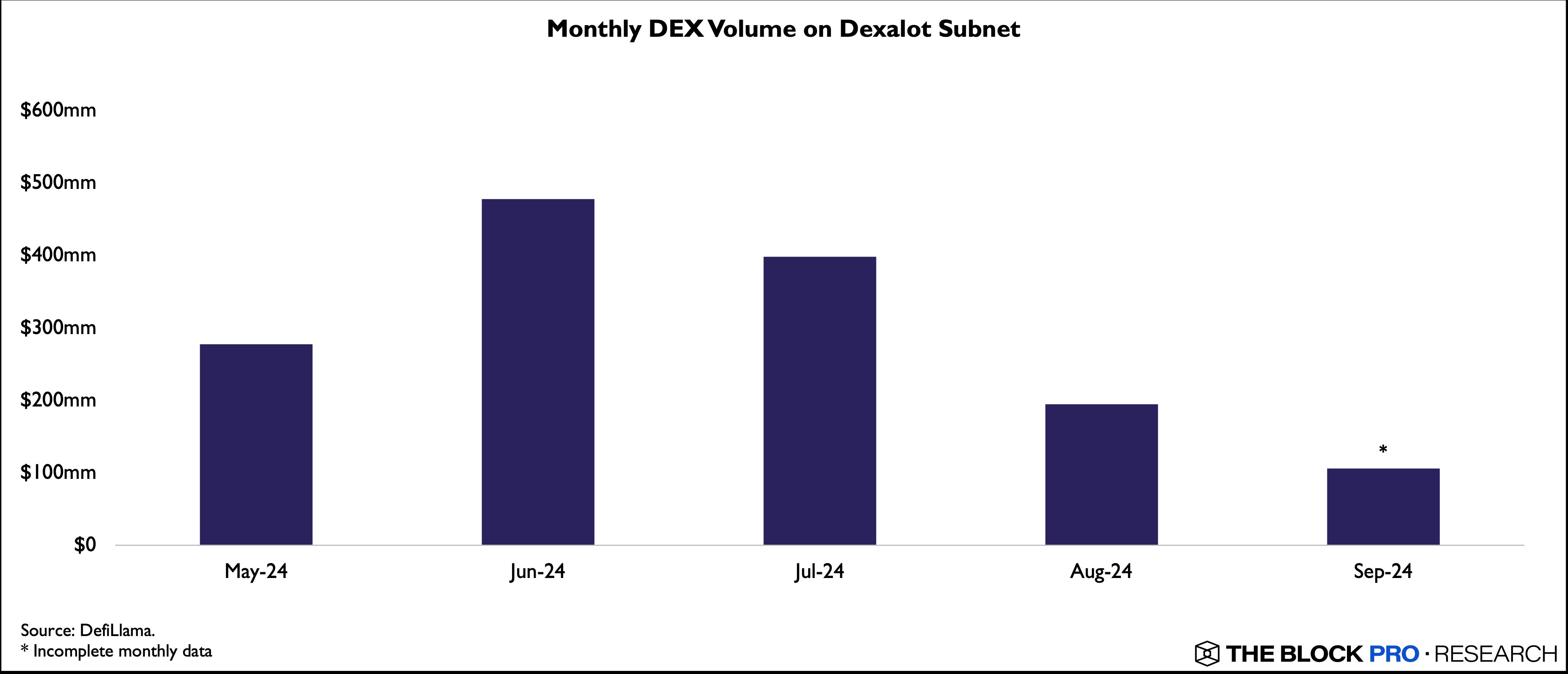

Monthly DEX volumes in the Avalanche ecosystem remain well below their March peak of ~$9.3 billion, but August’s total of ~$2.8 billion marks the highest monthly volume since the start of Q2 2024, which can likely be attributed to the BOOST program’s liquidity incentivization beginning in July, at least in part. One DEX that appears to have been negatively impacted by the increased trading volume on Avalanche C-Chain is Dexalot, which runs on its own Avalanche subnet.

In June, DEX volumes on Dexalot reached a peak of ~$478 million, surpassing all other DEXs on Avalanche C-Chain with the exception of Trader Joe. With the launch of the BOOST campaign in July, Dexalot’s volumes have since declined noticeably, with a total of ~$398 million in July and ~$195 million in August. In this case, the recent shift in user attention to C-Chain DEXs may have played a role in this decline, which is further exacerbated by the fragmentation of liquidity between C-Chain and the Dexalot subnet. Still, Dexalot’s ability to maintain relatively high DEX volumes in the past few months - with the help of ongoing incentives from the Avalanche Foundation and Benqi - is an indication that subnets may start to play a larger role in the broader Avalanche ecosystem in the future.

Stablecoins

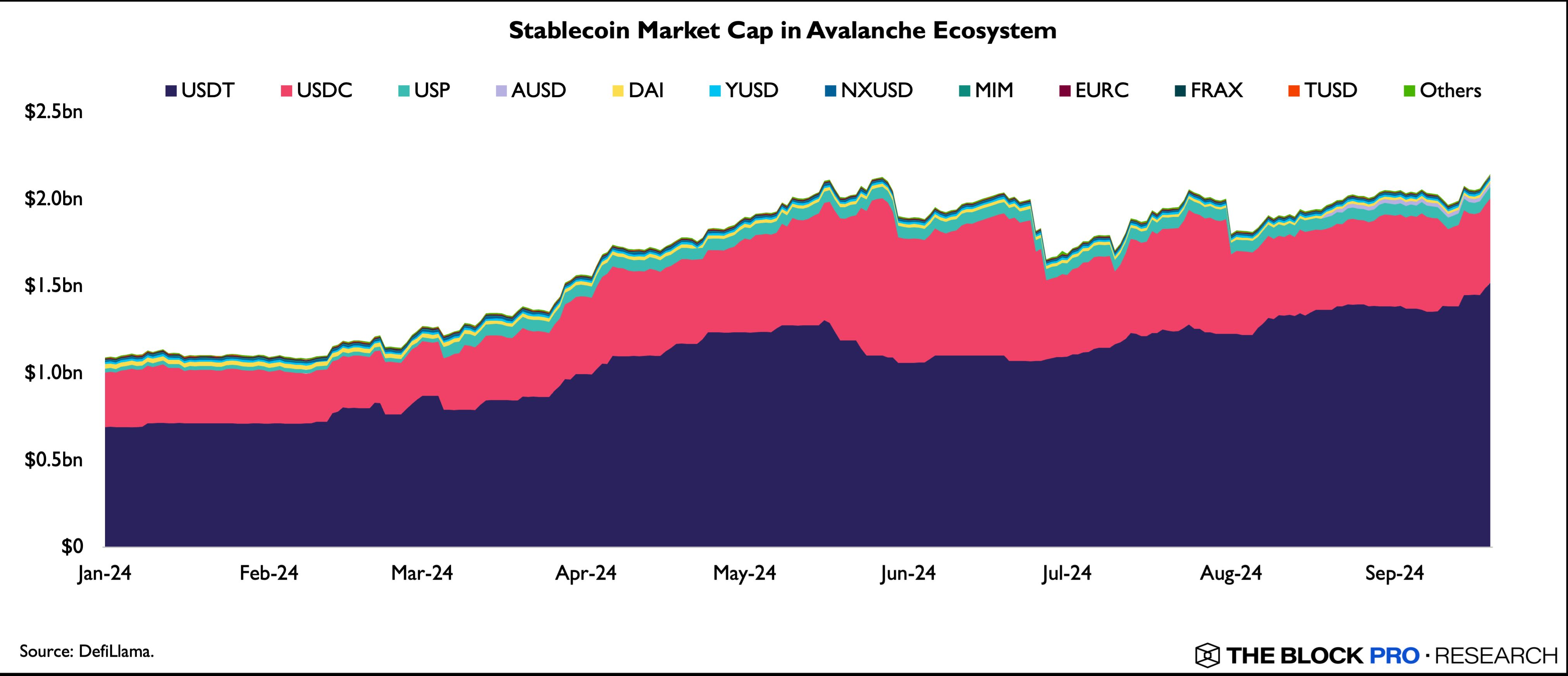

One final indicator worth examining is the supply of stablecoins in the Avalanche ecosystem. Since the beginning of July, Avalanche’s stablecoin market cap has grown from ~$1.69 billion to ~$2.14 billion as of this writing for a gain of ~27%, or ~$458 million.

This growth is a notable sign of new capital inflows to the Avalanche ecosystem, given that USD-backed stablecoins like USDT and USDC are the most common unit of account amongst crypto traders and users in general. As such, stablecoins are also a key component of liquidity in DeFi and serve as a useful indicator of ecosystem stability and user interest. Overall, the Avalanche Foundation’s BOOST program appears to have played an important role in supporting liquidity within the Avalanche ecosystem in recent months based on the metrics discussed in this report. The continued influx of stablecoins - largely consisting of USDT and USDC - only provides further confirmation of the program’s impact.

Incentives can be a highly effective way to attract user attention and capital, but the most important factor going forward is whether the Avalanche ecosystem can continue to sustain and grow its overall liquidity, especially if incentives start to wind down over time. As we have seen with protocols like Trader Joe, it will be important for teams to be strategic and adaptive with respect to the amount of incentives given, as well as the assets and users they intend to support with incentives. Ultimately, one of the key goals for the Avalanche ecosystem in the coming months will be to build enough stable liquidity across its many DeFi protocols such that it can become self-reinforcing and conducive to further user growth over the long term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

FET falls below $0.7

Trump: DeepSeek does not pose a security threat, the United States can benefit from its innovation

PlanB: The bull market will continue for another 9 months

Rapper Kanye West: Will Not Issue Tokens to Defraud Fans