- Brazil’s crypto market reports 42% growth, driven by stablecoin usage and institutional interest.

- Institutional transactions increased in late 2023, indicating renewed market confidence.

- Stablecoins account for 70% of Brazil’s exchange flows, surpassing Bitcoin in transaction value.

Brazil’s crypto market is changing, with strong growth in stablecoin usage and renewed institutional interest from major financial entities. According to data from Chainalysis , the stablecoin market in Brazil is booming, making Latin America the second-fastest-growing region for crypto adoption, with a yearly growth rate over 42%.

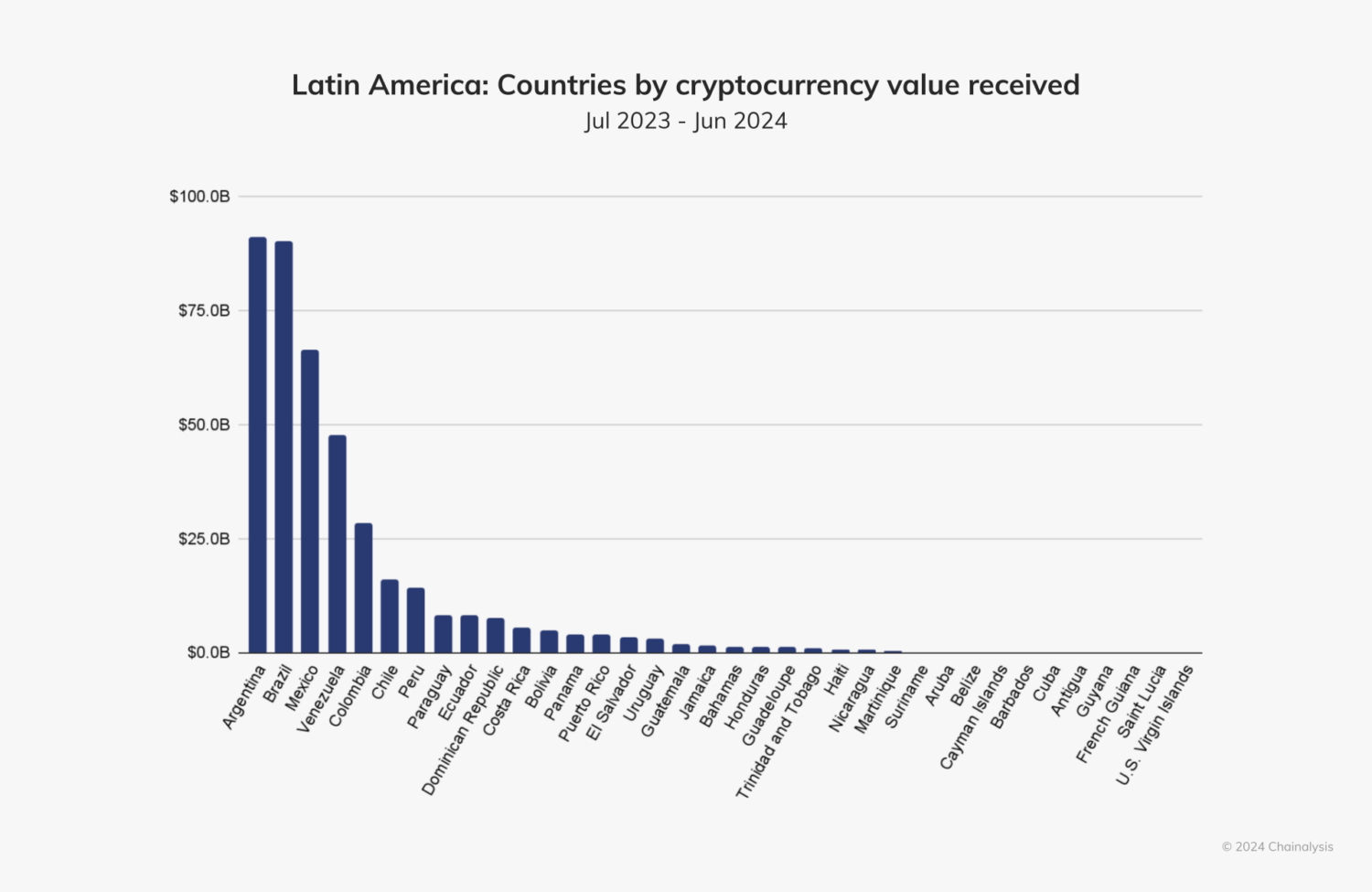

Between July 2023 and June 2024, Brazil had nearly $90.3 billion in crypto transactions, second only to Argentina, which had around $91.1 billion.

Source: Chainalysis

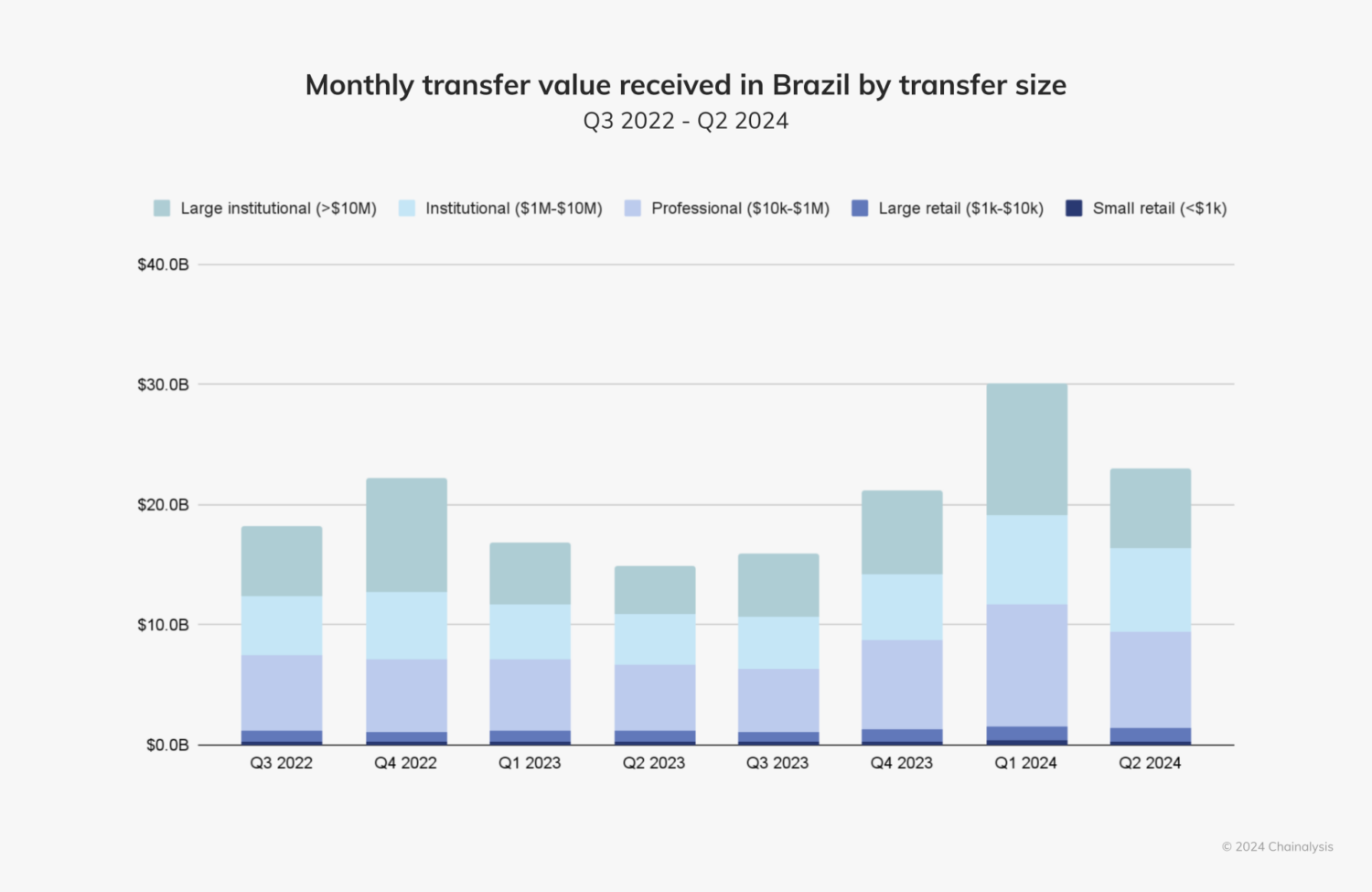

Source: Chainalysis

As the financial markets face challenges, digital assets are increasingly seen as acceptable alternatives. The Brazilian market is resilient, and the country’s financial authorities are becoming more open to crypto technology.

Institutional Activity on the Rise

Brazil’s institutional activity rose after a decline in early 2023. This renewed interest comes from a 29.2% increase in institutional-sized transactions (over $1 million) between the last two quarters of 2023 and a substantial 48.4% increase from Q4 2023 to Q1 2024.

Source: Chainalysis

Source: Chainalysis

André Portilho, the Head of Digital Assets at BTG Pactual, noted that investors are growing their portfolios by adding digital assets, which are seen as valuable for increasing returns.

Growing Interest in Bitcoin Transactions

Bitcoin transactions in Brazil have also increased. From September 2023 to March 2024, the transaction value surged, in line with the U.S. SEC’s approval of spot Bitcoin ETFs.

Read also : Argentina Looks to El Salvador’s Bitcoin Policy for Insight

Bitcoin prices nearly doubled during this period, leading to increased trading volume. However, stablecoins beat Bitcoin and other altcoins in terms of transaction value on local exchanges, with a 207.7% year-over-year increase.

Stablecoins now make up approximately 70% of the indirect flows from Brazil’s local exchanges to global exchanges. Many Brazilian exchanges and fintech firms are focusing on USD-pegged stablecoins, seeing them as a store of value for customers.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.