Chiliz Slumps by 7% to $0.07366 as Trading Volume Slows Down Sharply

- Chiliz faces a 7% fall as market activity weakens.

- The token is struggling to break the $0.08 resistance level.

- Low trading volume signals a challenging path ahead for CHZ.

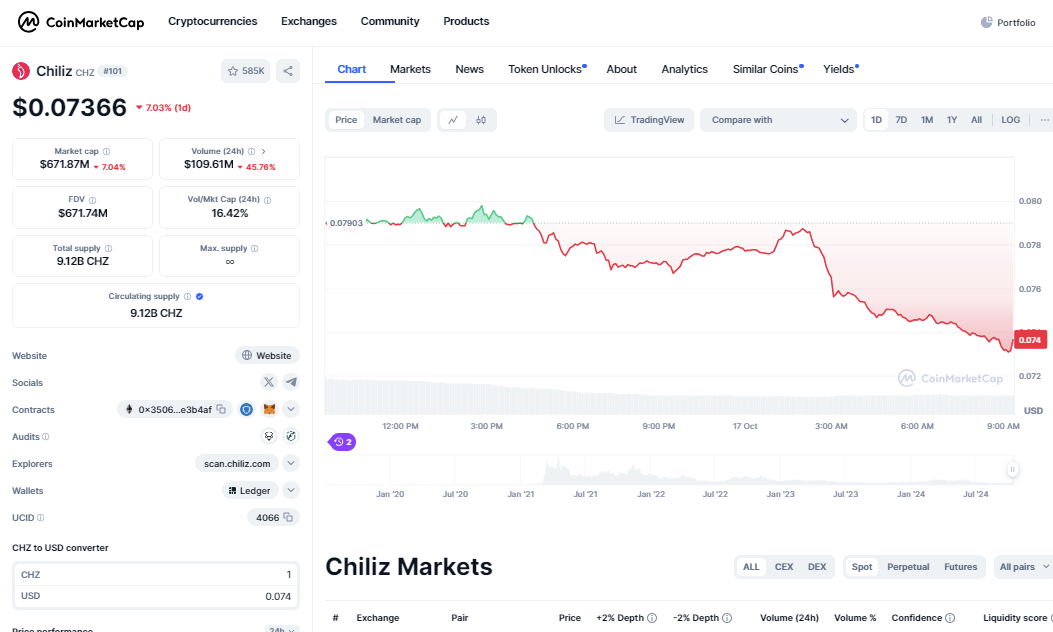

CHZ, a cryptocurrency known for sports fan engagement, has fallen 7% to $0.07366. This drop came with a precise decrease in trading volume, which also fell 45.78% to $109.61 million. Additionally, the market cap decreased to $671.87 million, reflecting the overall struggles of the cryptocurrency market. A prominent crypto analyst, Crypto Winkle, expounds on the advantageous aspects that would be in favour of the coin by illustrating technical indicators and its essence and history.

Relevant Drop in Trading Volume

Chiliz saw an essential decline in its trading volume, showing reduced buyer desire. The 45.78% drop in volume means less liquidity, which makes price recovery harder according to the latest data from Coinmarketcap . A lower volume can also indicate that there is less confidence in short-term development. With the current volume-to-market cap ratio at 16.42%, the economic balance shows clear signs of slowing down.

Source: Coinmarketcap

In addition to trading volume, the market cap fell to $671.87 million. This aligns closely with the token’s fully diluted valuation of $671.74 million, showing a lack of short-term optimism for significant price increases. The decline in both trading volume and market cap shows that Chiliz is being affected by the larger market’s downturn.

Facing Resistance at $0.08

The token is up against strong resistance at the $0.08 mark. The coin briefly hit $0.07903 before falling back. If the price cannot break this resistance, further declines may be likely. However, if it manages to rise past this level, it could indicate a potential turnaround for the token.

Read CRYPTONEWSLAND on google newsThe total circulating supply of Chiliz is 9.12 billion tokens, and this large supply limits the chances for quick price jumps. The resistance at $0.08 remains a key barrier to its price movement. Whether it can break through that level remains uncertain.

Short-Term Prospect Looks Challenging

For now, Chiliz’s outlook remains difficult. The low trading volume has made it hard for CHZ to recover quickly. Besides, the refusal at $0.08 is adding further pressure, making instantaneous gains unlikely. The Crypto Winkle basically addresses that unless trading activity picks up, the token may struggle to break out of its current downward trend.

disclaimer read moreCrypto News Land, also abbreviated as "CNL", is an independent media entity - we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

NFTScan Joins Conduit Marketplace to Expand NFT Data Access Across 20+ Blockchains

Shibarium Daily Transactions Drop 99%: Details

US Officials Allegedly Don’t Know How Much Bitcoin They Hold – Here’s More Allegations of Mismanagement

It is alleged that US authorities do not know the amount of cryptocurrencies they have seized so far and obtained through forks.

Bittensor (TAO) Poised for 125% Surge, Says Popular Analyst