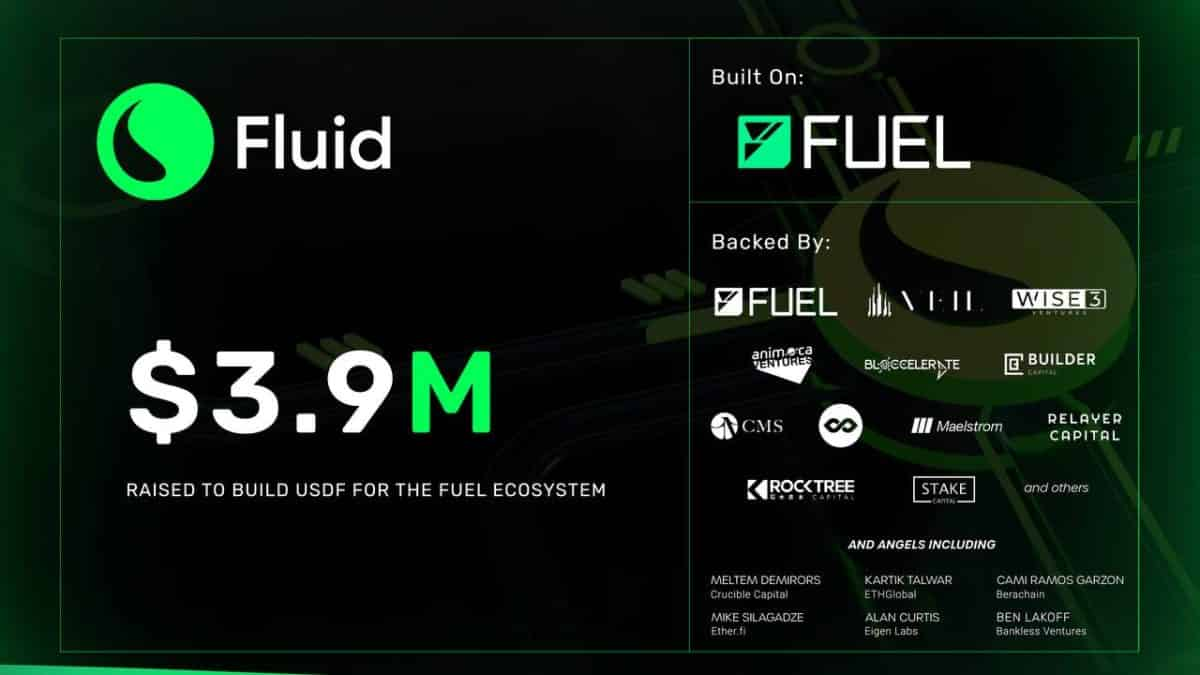

Fluid Protocol Secures $3.9 Million Seed Funding to Launch USDF, the Native Stablecoin of Fuel Network

Following a $3.9M seed round with participation from Bloccelerate, Animoca Ventures, CMS Holdings, Maelstrom and others, Fluid will launch USDF, the native stablecoin of Fuel network, a modular execution layer. In addition to the seed capital, Fluid previously secured a direct investment and a grant from Fuel Labs. The Fluid Team was founded by David Mass and Meir Bank, who were previously at Citibank and AngelDAO.

Additional Investors in the round included Veil VC, Builder Capital, Infinity Ventures, RockTree Capital, Wise3 Ventures, Stake Capital, Relayer Capital, and others. Angel investors who contributed to the fundraise included Meltem Demirors, Kartik Talwar, Cami Ramos Garzon, Mike Silagadze, Alan Curtis, and Ben Lakoff.

The capital infusion from the seed round will accelerate the development and launch of USDF, fund security audits to secure the protocol, and expand the team.

David Mass, Co-founder and CEO, shared his excitement:

"We have been actively building in the space for a few years and committed to the Fuel ecosystem in the summer of 2022. Our goal is to build a strong brand and community, inspired by the success of protocols like Liquity. We will be well entrenched within the Fuel ecosystem, supporting multiple collateral types which will bootstrap USDF’s adoption.”

Fluid has teamed up with top builders in the Fuel ecosystem including Ether.fi, Renzo, Kelp DAO, Pyth, Redstone, Spark, Thunder, Mira, and others. “Fluid is an essential piece of Fuels ecosystem pushing the boundary of stablecoin design with deep commitment to decentralized values,” said Fuel Labs Founder, Nick Dodson.

What is Fluid Protocol?

Fluid Protocol is an over-collateralized, decentralized borrowing platform specifically built for Fuel Network. Fluid provides users with a secure and efficient way to unlock liquidity from their collateral without selling their underlying assets, thereby enabling maximum capital efficiency.

USDF, the flagship product, is an over-collateralized native stablecoin soft-pegged to the US Dollar. By depositing collateral, borrowers can draw 0% interest-free loans, offering immediate liquidity while retaining ownership of their collateral—all without incurring interest charges or recurring fees. This battle-tested approach meets the demand within the Fuel community for a decentralized, stable unit of account.

Getting Ready for Mainnet

Fluid committed to building on Fuel over two years ago, and has diligently developed strategic partnerships throughout the Fuel ecosystem. Fluid anticipates to launch on mainnet imminently.

“As we embark on this exciting journey, we remain dedicated to creating a governance-free and immutable protocol that prioritizes security, efficiency, and user empowerment. By offering innovative solutions that align with the evolving needs of our users, Fluid Protocol is poised to become a cornerstone in the DeFi landscape on Fuel," David Mass explains.

X

Website

Discord

This post is commissioned by Hydrogen Labs and does not serve as a testimonial or endorsement by The Block. This post is for informational purposes only and should not be relied upon as a basis for investment, tax, legal or other advice. You should conduct your own research and consult independent counsel and advisors on the matters discussed within this post. Past performance of any asset is not indicative of future results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale increased his holdings of 200 BTC 2 hours ago, worth $16.55 million

BTC falls below $80,000

BNB drops below $550