Bitcoin Tops $100K. Are Bulls Out of the Woods?

The price of Bitcoin , the leading cryptocurrency by market capitalization, briefly managed to reclaim the $100,000 level on the Bitstamp level earlier today.

The cryptocurrency reached an intraday high of $100,510 after spiking by more than 2% on Wednesday.

The rally comes after a Reuters report stating that the SEC will start overhauling its crypto policies immediately following the imminent departure of SEC Chair Gary Gensler.

Bitcoin also got a boost after December's core inflation readings, which exclude food and energy, ended up being better than initially expected. This revived traders' hopes of the U.S. Federal Reserve implementing several rate cuts this year.

Earlier this month, Bitcoin briefly slipped below $90,000 due to the Fed potentially scaling back easing in 2025.

However, the bulls might not be out of the woods just yet. As reported by CNBC, banking giant Standard Chartered recently predicted that another drop below the $90,000 level could lead to a much steeper correction.

The bank noted that spot Bitcoin ETF purchases were merely breaking even as of recently. On Tuesday, these producers logged a total of $209 million worth of outflows.

Bitcoin is lagging behind altcoins

Despite its impressive price gains, Bitcoin is still lagging behind major altcoins.

The Ripple-affiliated XRP token is stealing the show with a 10% price spike.

Ethereum (ETH), Solana (SOL), and Cardano (ADA) have also substantially outperformed Bitcoin.

However, BNB has notably underperformed the crypto king with a relatively modest 1.8% increase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

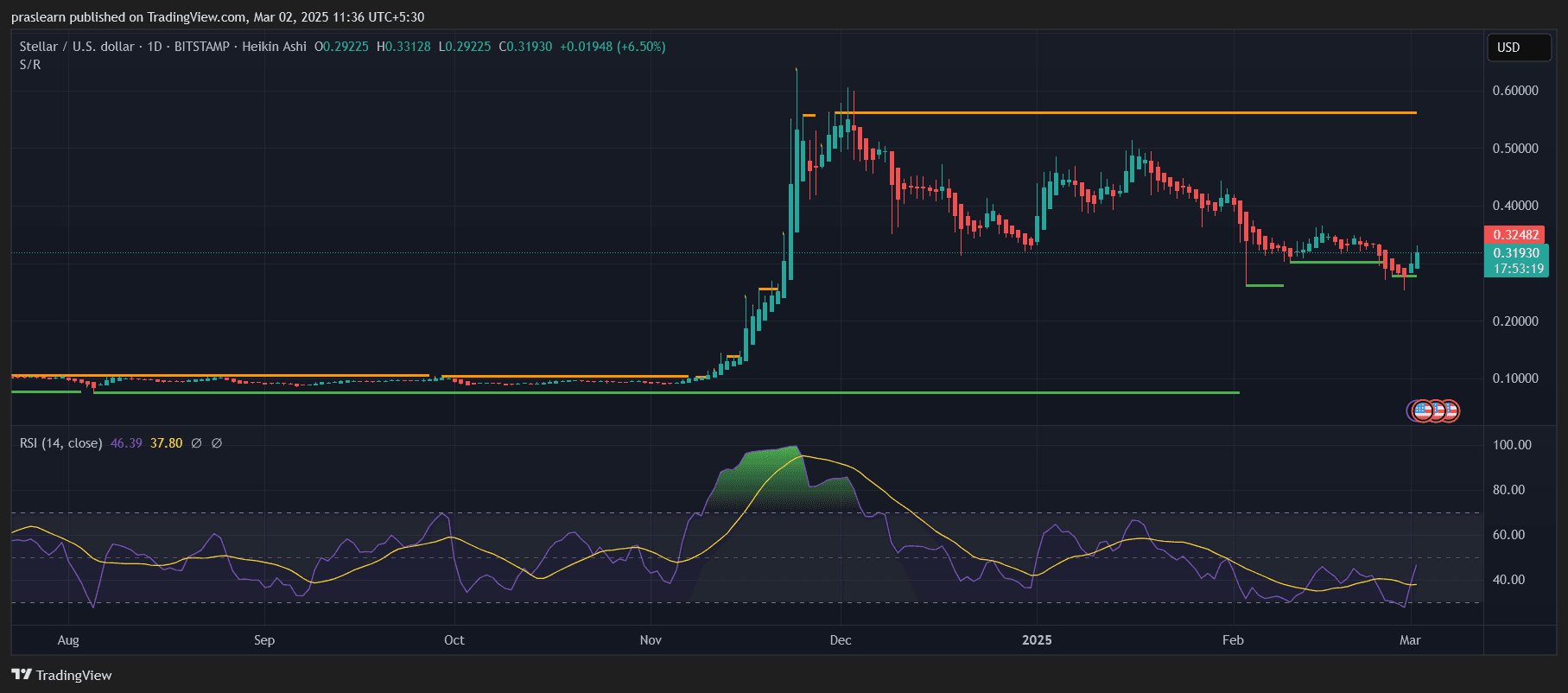

Stellar (XLM) Price Prediction: Is XLM Poised for a Rebound or More Downside?

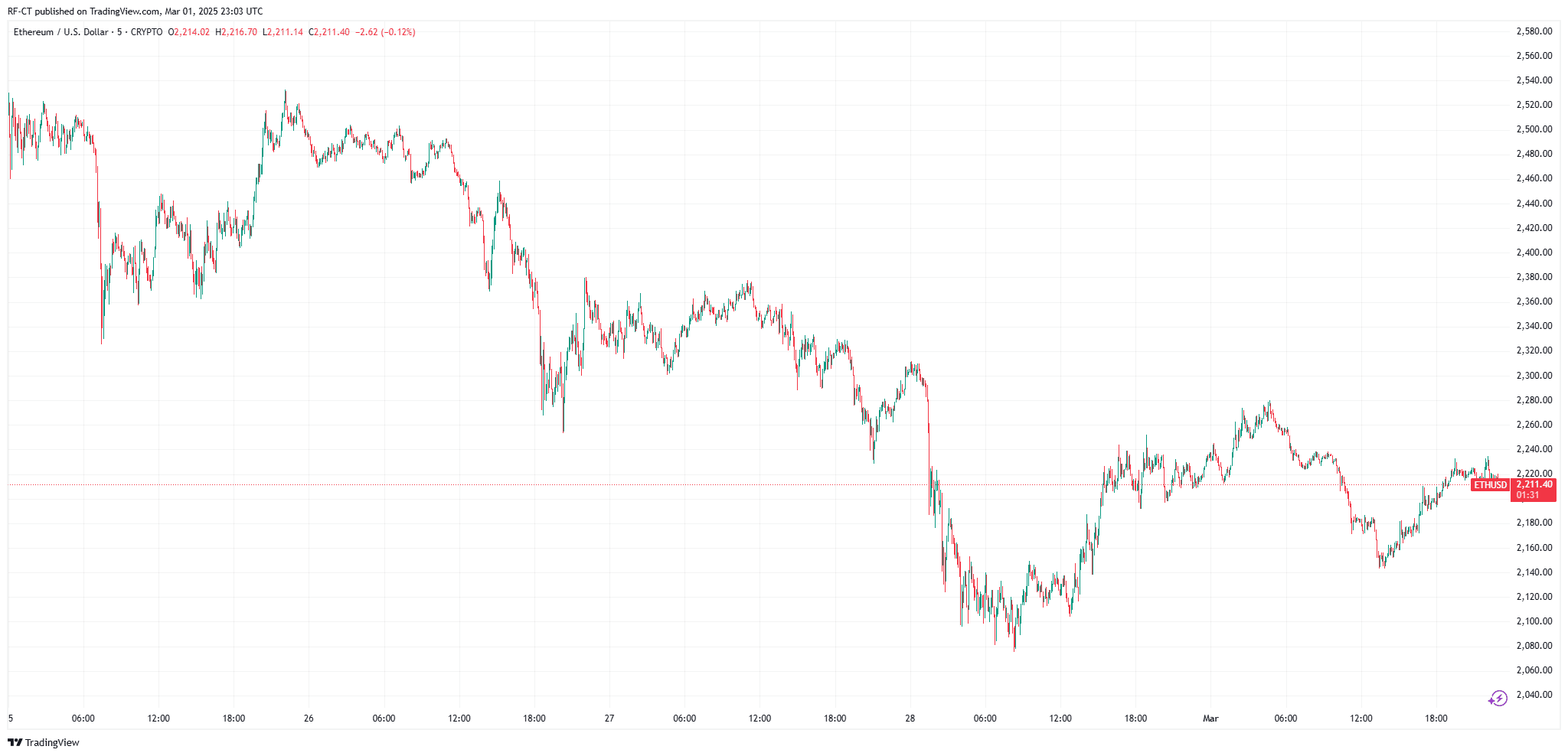

Ethereum Price Prediction March 2025: Can ETH Price Surge Back Over $3K?

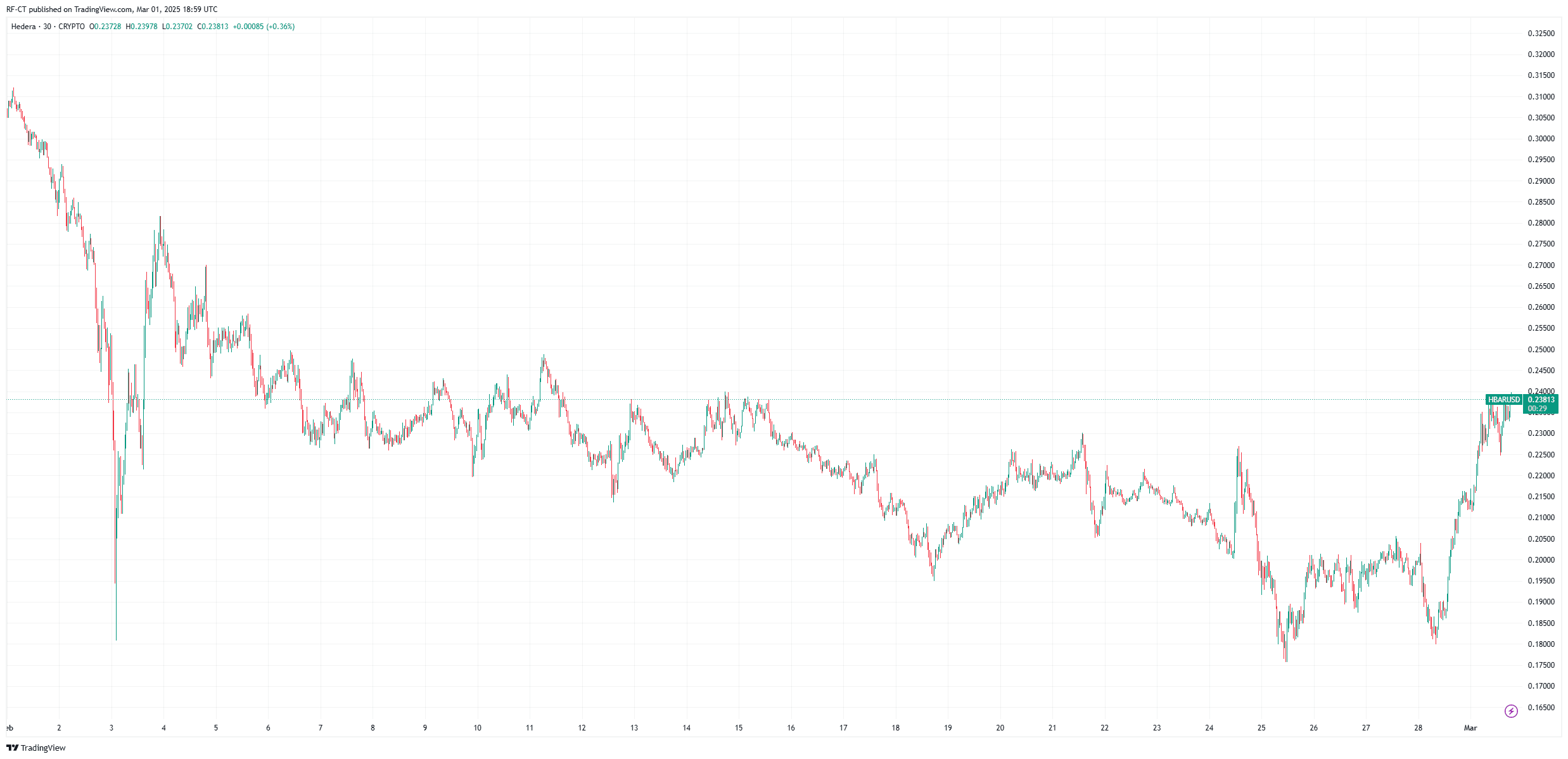

Hedera (HBAR) Rebounds from Key Support –Could This Next Move Confirm a Bullish Reversal?