ON–307: Derivatives 📊Hyperliquid 🌊dYdX 🔮Drift 🏎️GMX 🫐Orderly 🔀

From our network

Hyperliquid 🌊

👥 Aishat Suleiman | Website | Dashboard

📈 Hyperliquid Hits $21B Daily Trading Volume, Securing 64.8% Perps Market Share

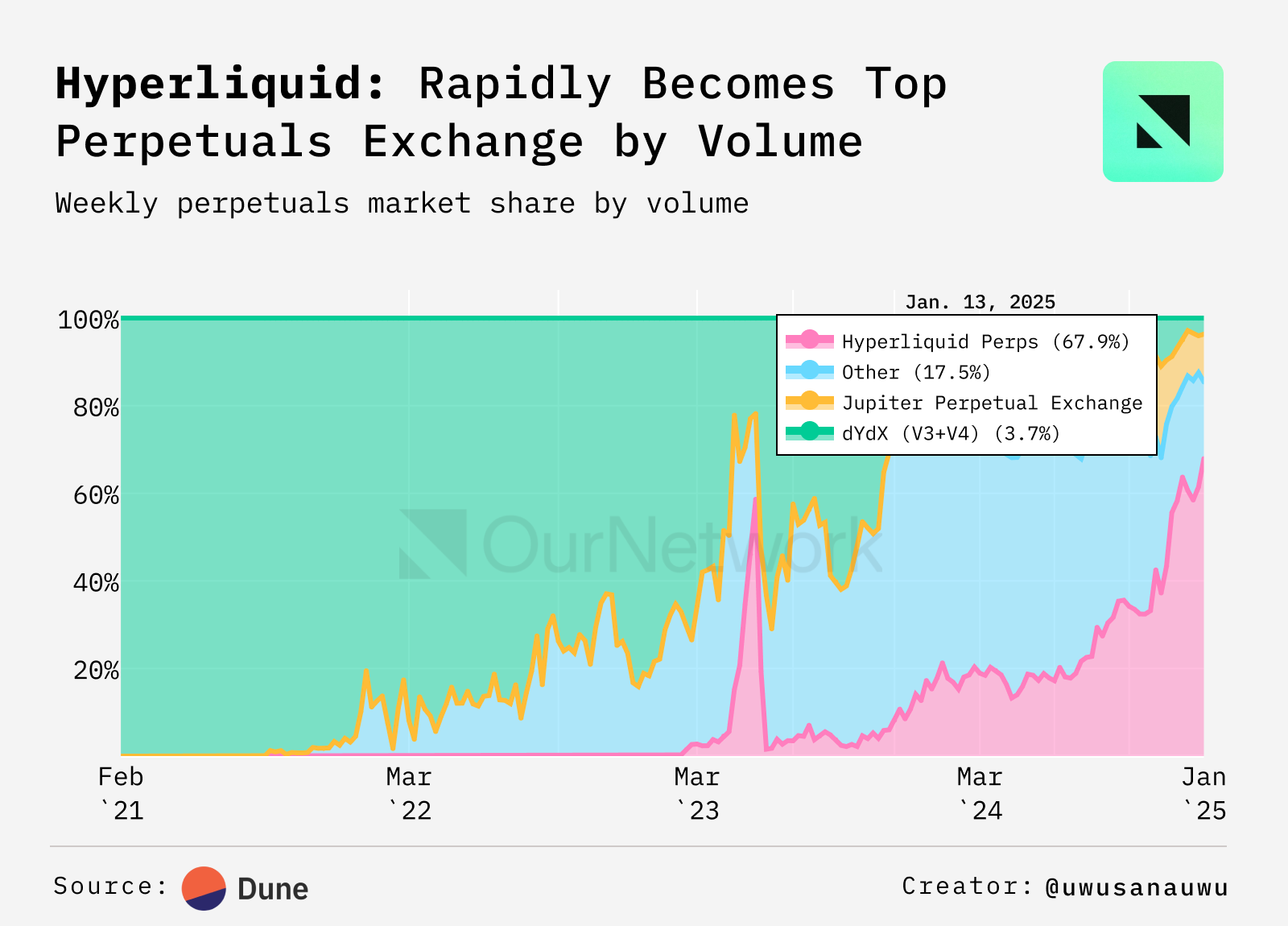

- On Jan. 19, 2025, Hyperliquid, a decentralized perpetual protocol hit an all-time high, with $21B in daily trading volume, capturing 64.8% of the perpetual market and 72.3% of the top 10 apps. Just two years ago, dYdX dominated with over 80% market share. Things changed in February 2023 when Hyperliquid launched with just 0.3% market share — by April 2024, the platform had nearly caught up to dYdX, with 19.5% of total volume versus dYdX's 19.6%, marking the start of its extraordinary rise to dominance.

Dune - @uwusanawu

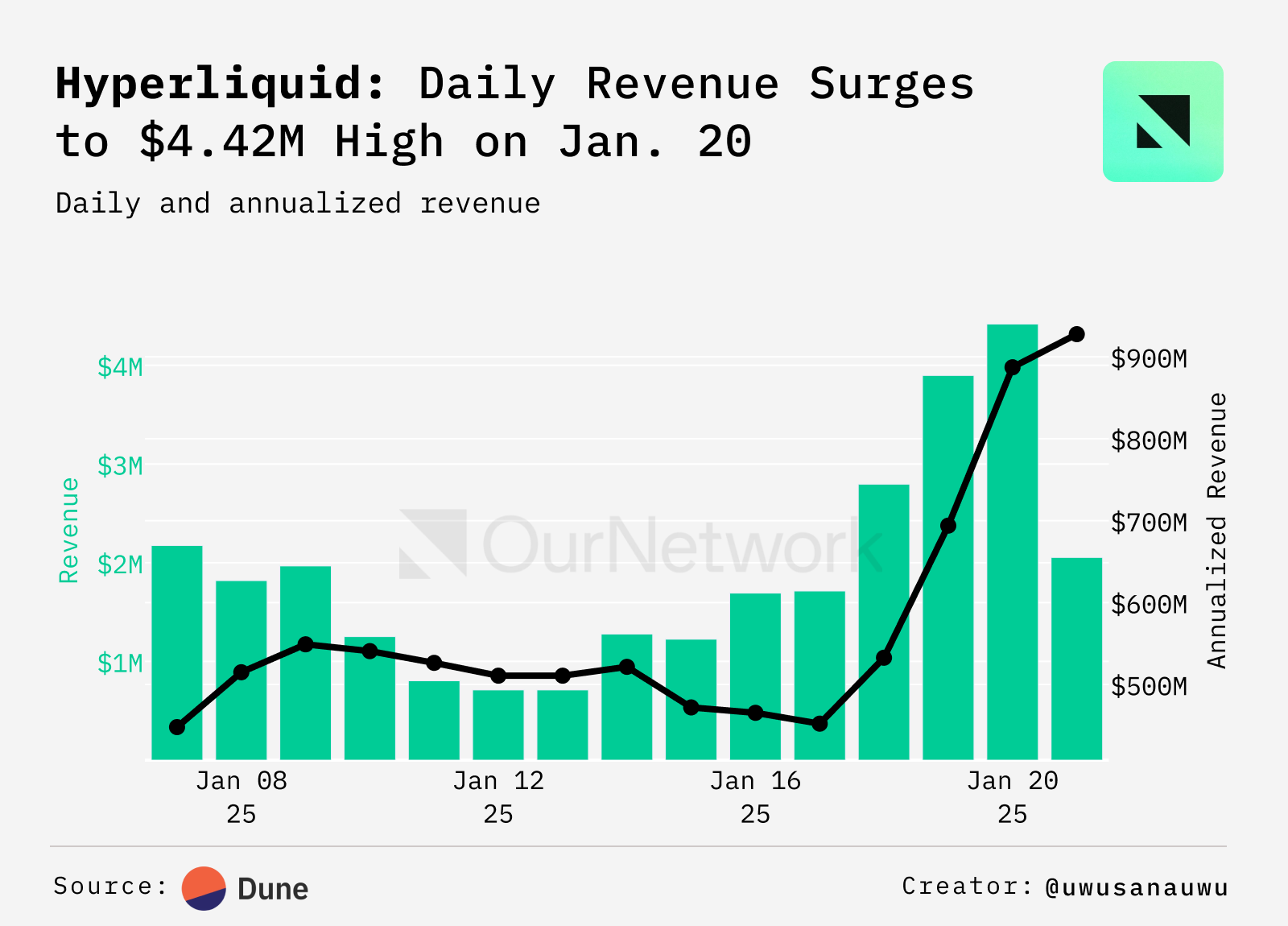

- A day after Hyperliquid's all-time high in terms of volume, it also generated a protocol-record $4.42M in daily revenue. The spike reflects Hyperliquid's increasing appeal in decentralized markets.

Dune - @uwusanawu

- Hyperliquid’s market share steadily grew into the dominance of Binance, the centralized exchange. By early 2024, Hyperliquid gained traction, which accelerated in December 2024 as the perpetuals protocol reduced Binance’s share from over 90% to 57.8% by Jan 2025, showcasing its rising influence.

Dune - @uwusanawu 🔦Transaction Spotlight: A whale borrowed $25M USDC from AAVE to long Bitcoin at $101,662.9 with 50X leverage on Hyperliquid. Initially up $4.4M as BTC hit $108K, the whale refused to close the position. As BTC's price dropped, losses mounted to $7M over a month, with $1M in funding fees adding pressure. As of Jan. 20 2024, data shows the trader's position slightly recovering, now holding 700 BTC with a $1.78M unrealized profit, though funding costs remain high at $1.35M.

dYdX 🔮

👥 Chris Grundy | Website | Dashboard

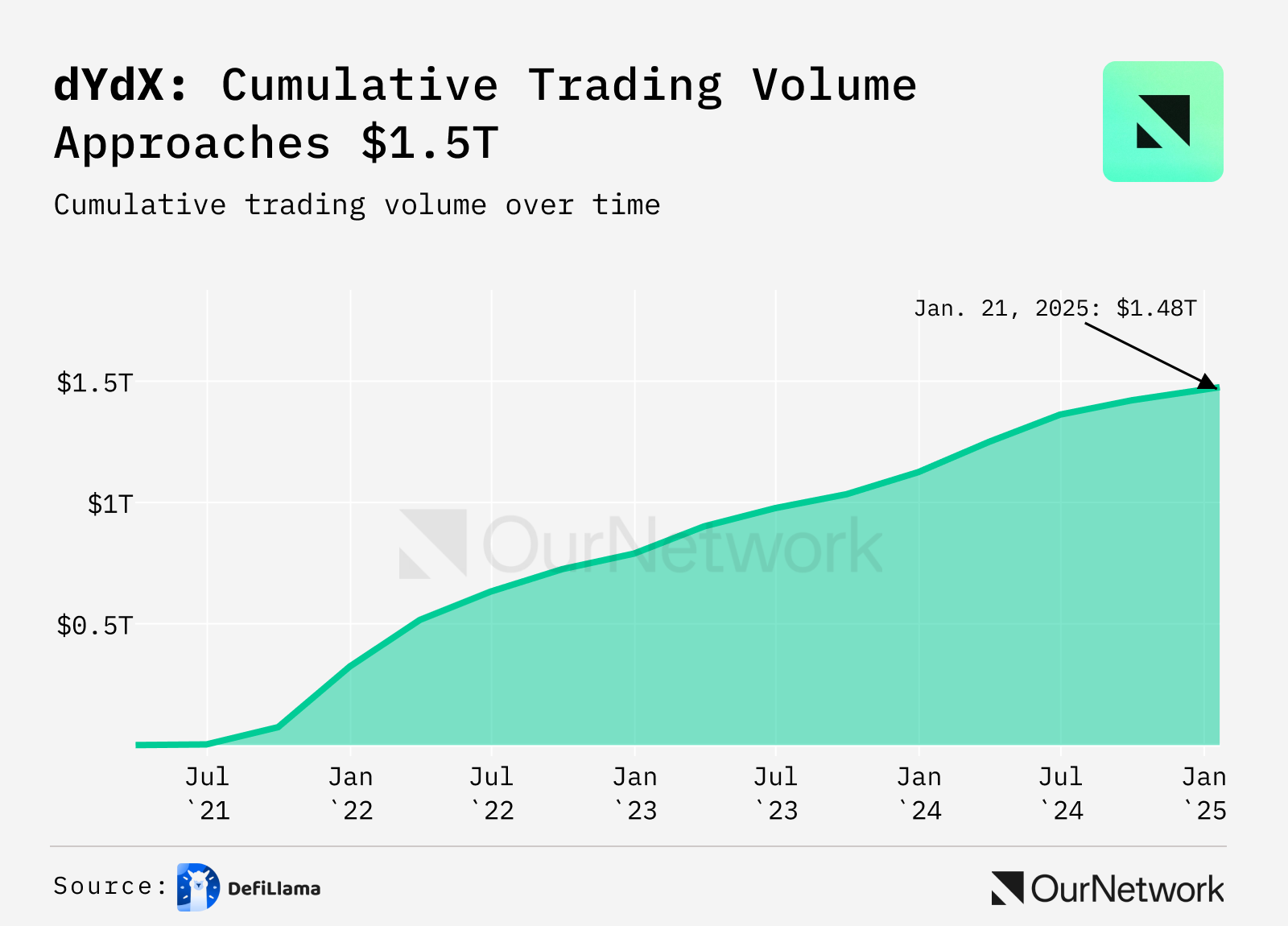

📈 dYdX Surpasses $1.4T in Trading Cumulative Volume

- In 2024, dYdX, the decentralized exchanged focused on perpetual futures, generated $250B in trading volume, pushing the cumulative total across v3 and v4 to $1.47T since 2021. This milestone reflects the growing adoption and trust in dYdX as DeFi's pro trading platform. With features like Instant Market Listings and MegaVault, dYdX continues to innovate at the cutting edge of DeFi, enabling anyone to launch a new perp market in minutes with automatic liquidity.

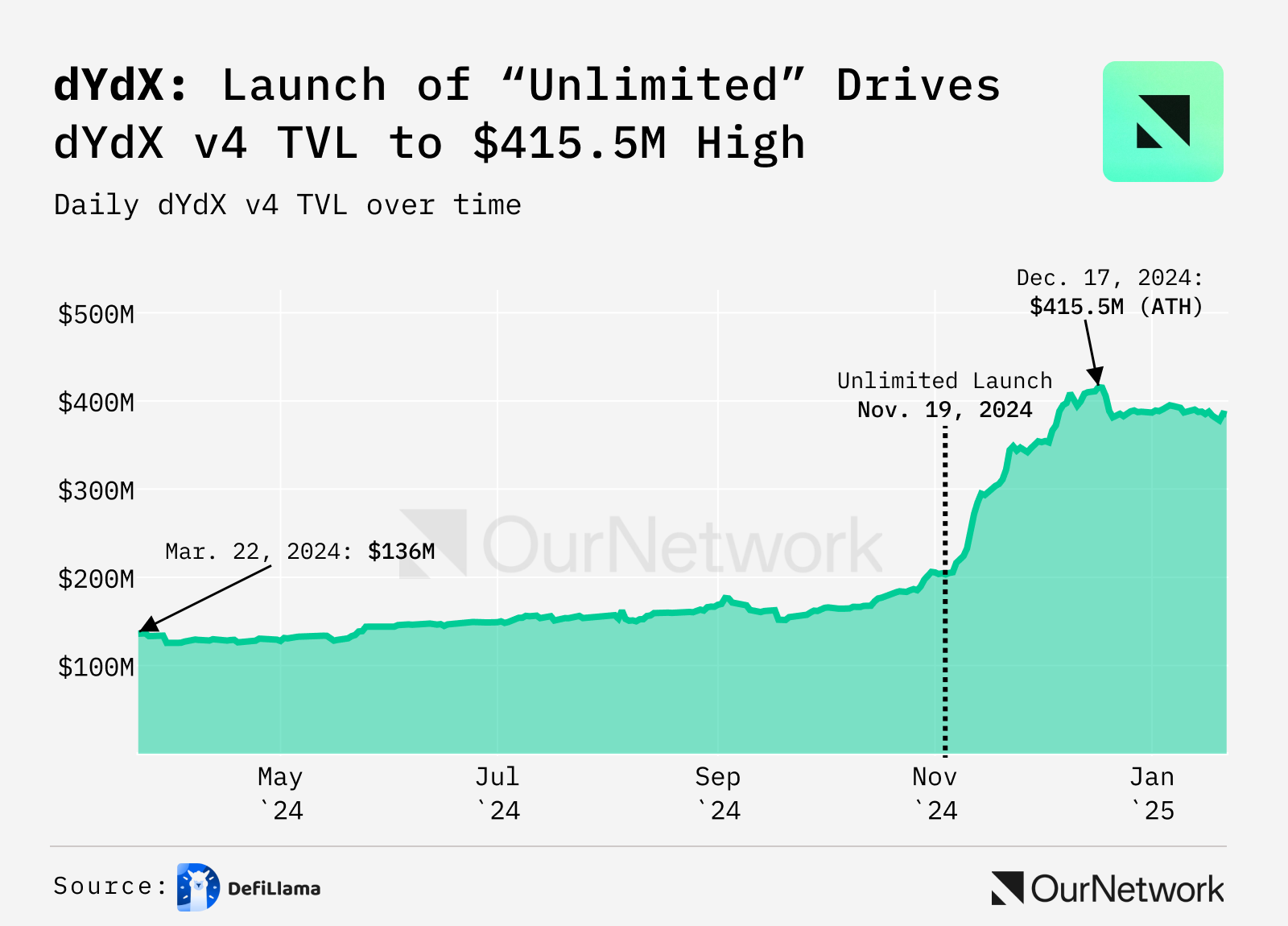

DeFiLlama

- The launch of dYdX Unlimited and MegaVault, a next-generation liquidity and yield-generation tool, led to a 3x increase in USDC inflows, rising from $41M in October to $148M in November. During the same period, total value locked (TVL) grew significantly, climbing from $206M to $354M.

DeFiLlama

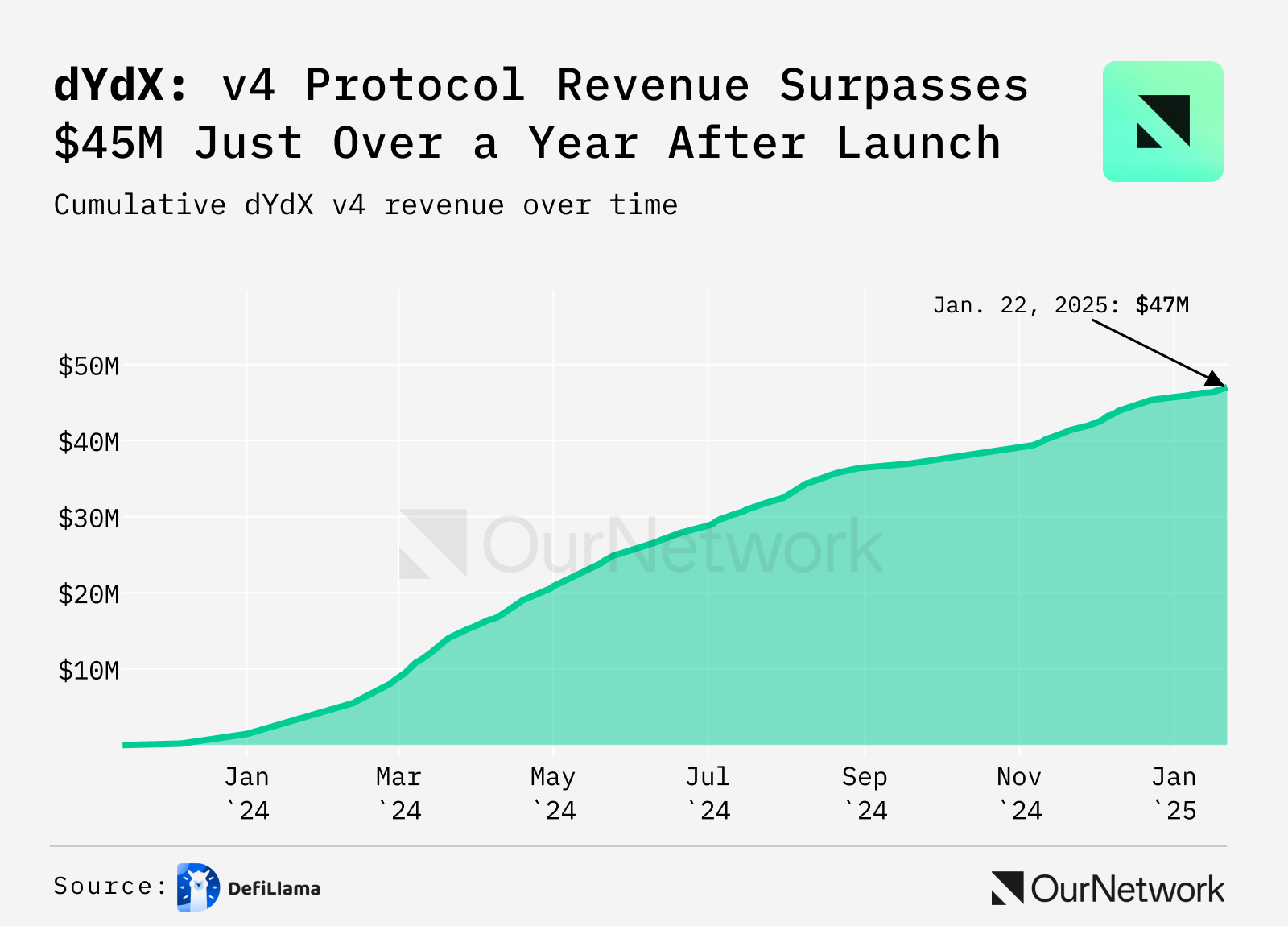

- Growth in trading volume, TVL, and USDC inflows drove a significant increase in protocol revenue, rising from $1.4M in January to $45M by the end of 2024.

DeFiLlama

Drift 🏎️

👥 James Hanley | Website | Dashboard

📈 Drift Hits $1B in TVL, Vaults Front and Centre

- Drift Protocol is a DeFi protocol built on Solana featuring borrowing, lending, a perpetual exchange, asset swaps, prediction market and, most recently, Vaults . Drift cracked $1B in TVL this month for the first time in its history. Key to this recent growth was the successful launch of vaults which have attracted over $200M of TVL in their first two months. Vaults are high-yield investment strategies managed by external risk management teams on Drift's infrastructure. Anyone can create and run a vault on Drift.

Artemis

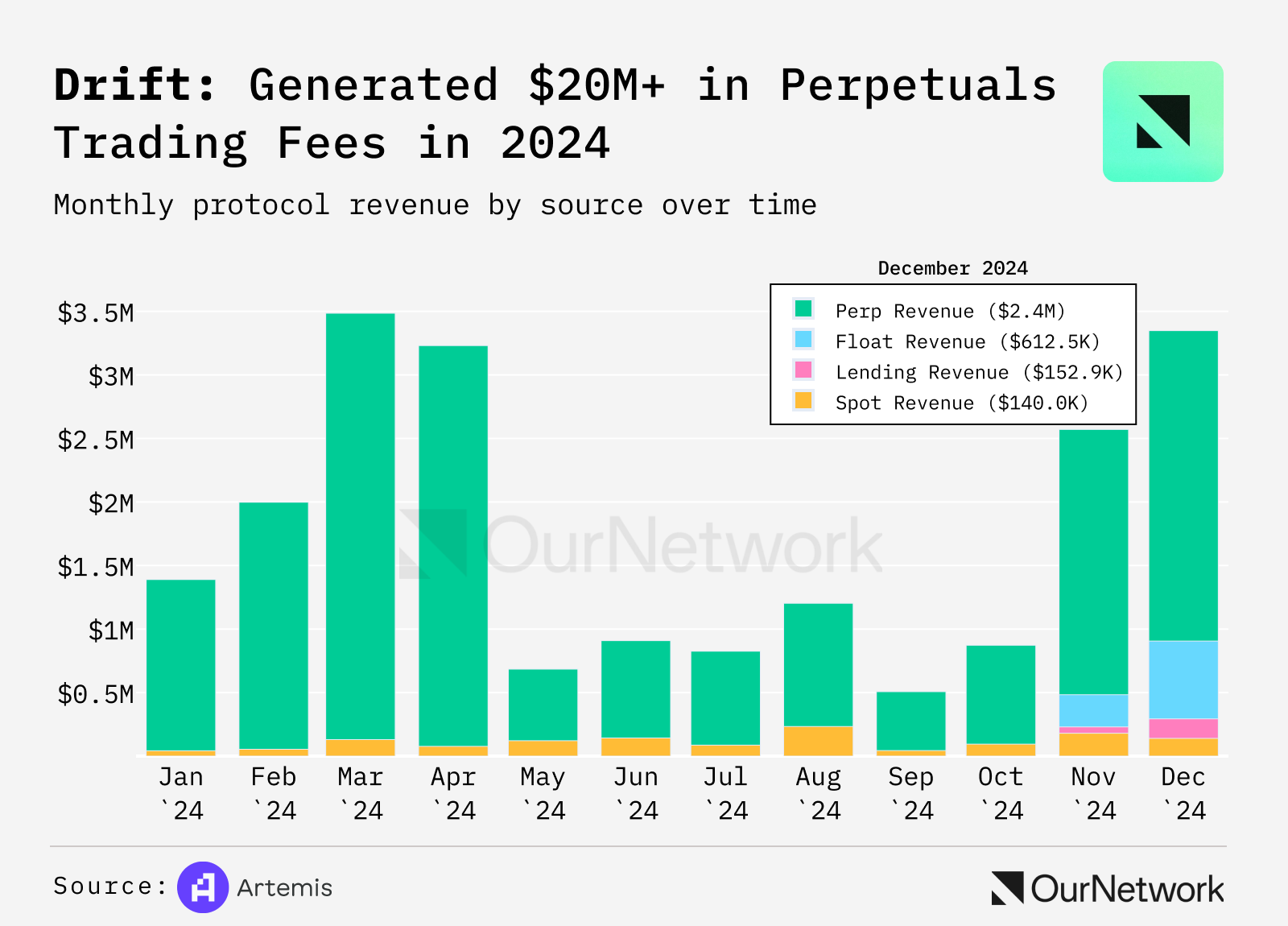

- Protocol revenue grew steadily over the year with the largest contributor being trading activity on perpetuals. Drift Protocol generated over $20M from perpetual fees alone in 2024. Float revenue, revenue from Drift's vAMM , was the second largest contributor. Note — float revenue data collection began in November 2024.

Artemis

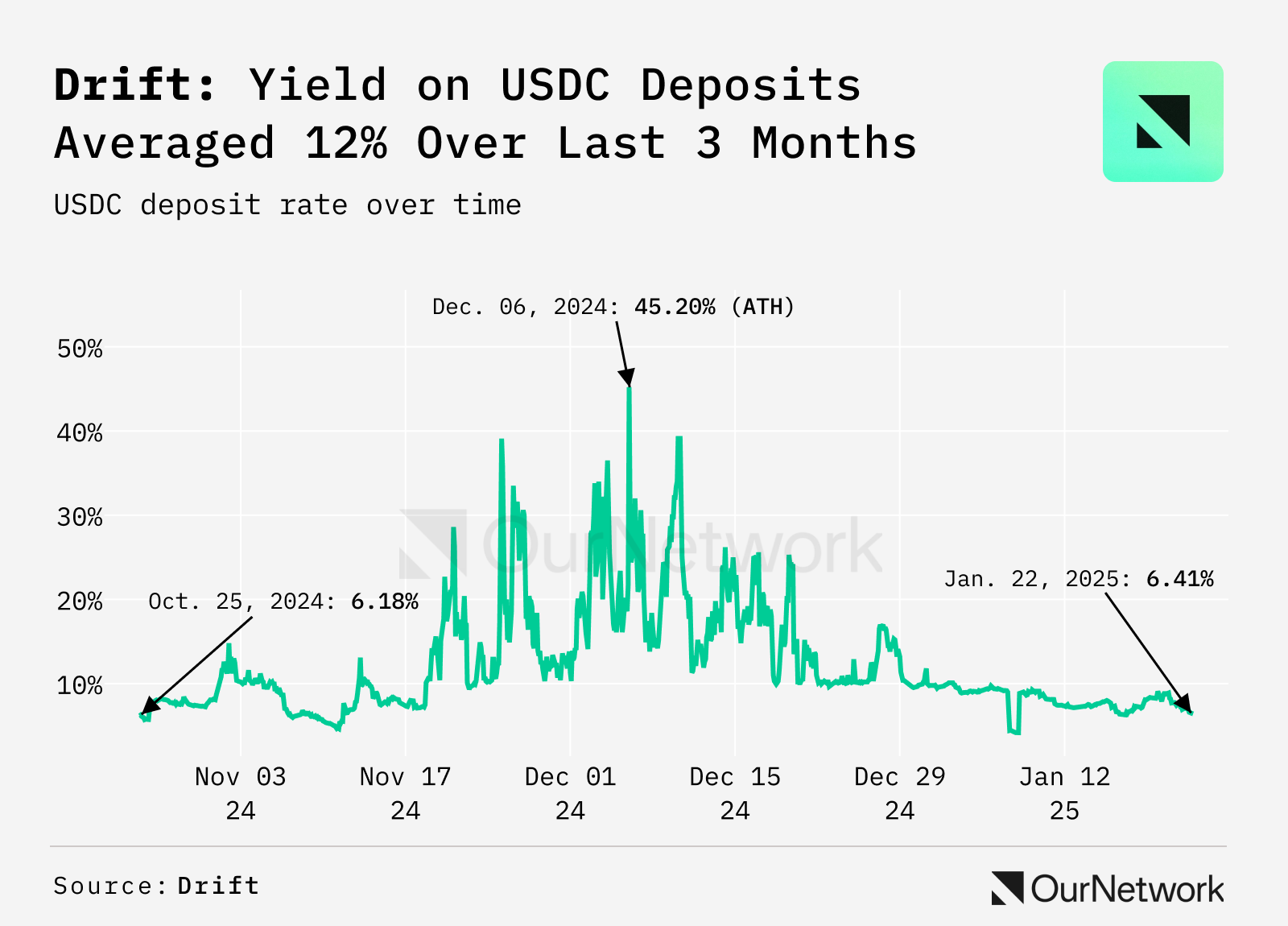

- All perps on Drift settle in the stablecoin USDC. This has made Drift one of the most competitive places for USDC yield on Solana. In past 90-days, yield on USDC deposits averaged an annualized 12.14%.

Drift 🔦Transaction Spotlight:Over the weekend, shortly after Drift launched TRUMP perp and spot assets, one user deposited 1,500 of TRUMP, approximately a $50K. They then used as collateral to long TRUMP at $38, took profits and hedged position with short-perp shortly after. They then collected funding, earned yield on USDC, collecting funding again, and ended the day with hedged portfolio value of approximately $100K. Well played.

GMX 🫐

👥 Shogun | Website | Dashboard

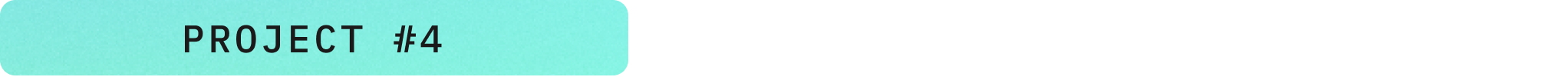

📈 GMX Closes 2024 with $250B Volume, $250M Open Interest, and a $250M Market Cap

- In 2024, GMX's trading volume peaked at $706.28M in March, when the Layer 2 Arbitrum's Short Term Incentive Program ( STIP ) launched, when there were just 14 perp markets to trade. Today volumes sits closer to $198.46M, with 67 new markets, primarily driven by the increase in the oracle network Chainlink's data streams, GMX's listing committee, and additionally the efforts by the development labs. Even though volumes aren't as close as early 2024, the STIP acted as a catalyst for volumes to switch from V1 to V2.

Dune - @gmx-io

- The breakthrough for GMX's V2 TVL growth, was the multitude of yield-generating markets for liquidity providers, now composing of 80% of protocol liquidity, and peaking at $467.85M in November 2024. Total TVL currently sits at $436.78M, with V2 TVL making up $360.99M, and V1 contributing $79.23M.

Dune - @gmx-io

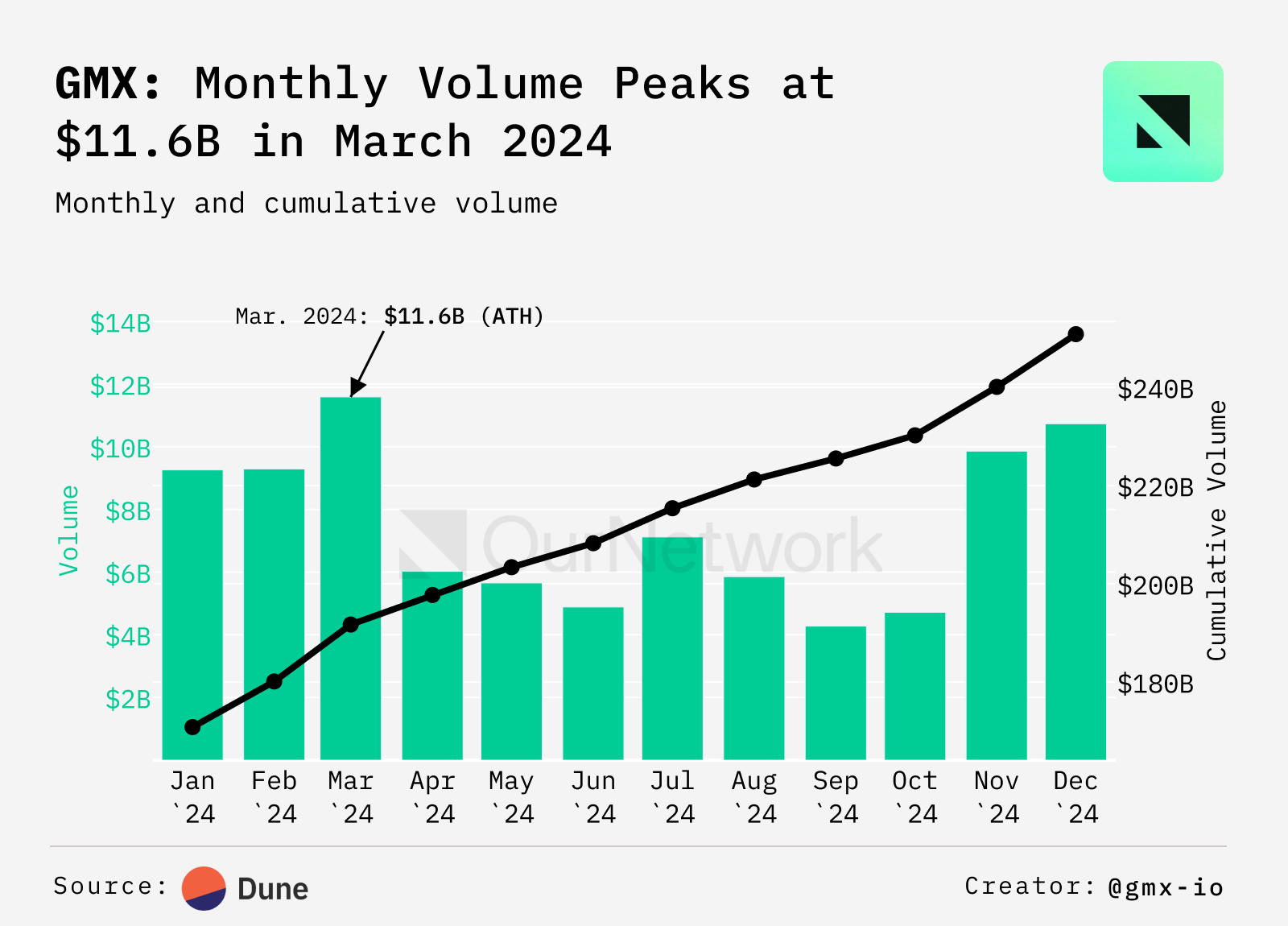

- GMX's open interest continued to remain above the $200M range throughout 2024 — the majority of the open interest still remains in BTC, ETH, and SOL, at $107.11M, $81.73M, and $12.61M respectively. The dominance of narratives can increase interest evidenced by the spikes of SUI, DOGE, and AAVE.

Dune - @gmx-io 🔦Transaction Spotlight:GMX's most profitable trader, who has a total net profit-and-loss of $5.26M, has opened up several large positions for BTC and a total of $20M in notional size at a 10x leverage, utilizing two different markets —single token market for BTC and WBTC/USDC— for the same underlying (BTC). This is a significant benefit, positions are routed through to various markets to give an effective quote and slippage. Long-term GMX's aim is to minimize slippage for large orders, and offer CEX-like experiences.

Orderly 🔀

👥 Tharanga Gamage | Website | Dashboard

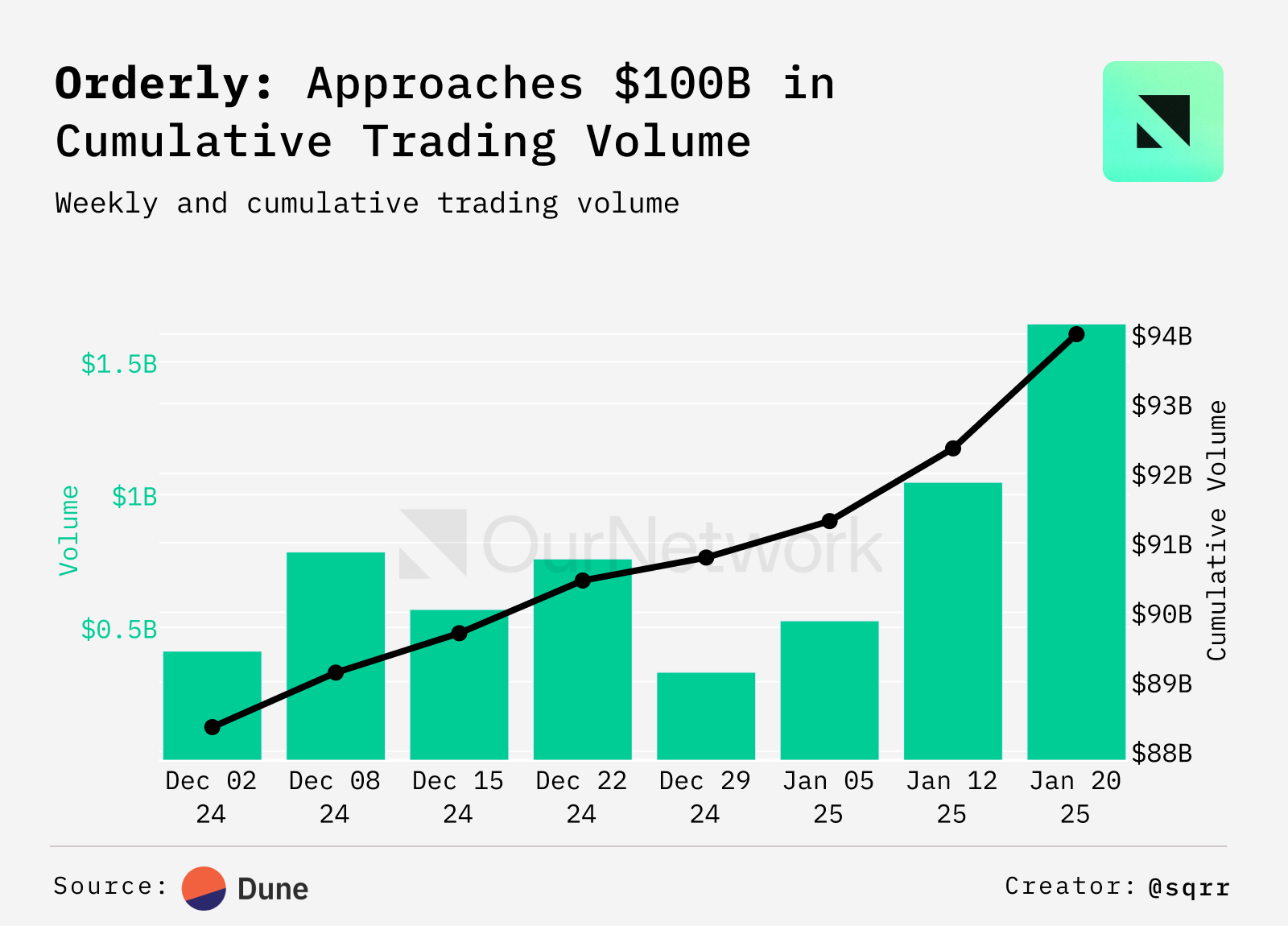

📈 Trading Volume Nearing $100B on Orderly, $19M TVL Across 10 Chains

- Cumulative trading volume on Orderly Network, a decentralized orderbook protocol offering perpetual futures, is approaching $100B. However, daily trading volumes have moderated since the end of August. As a result, approximately $80B of the cumulative trading volume was achieved prior to the end of August. However, since January 2025, there has been an uptick in the daily trading volumes. This recent increase in trading activity may reflect traders taking positions in response to heightened market volatility.

Dune - @sqrr

- Of 98 supported markets, the trading is dominated by ETH and BTC perps pairs, which account for ~80% of the volume. This reflects the broader crypto market structure. The listing of TRUMP perps was accompanied by increased SOL volumes, demonstrating Orderly's permissionless listing in action.

Dune - @sqrr

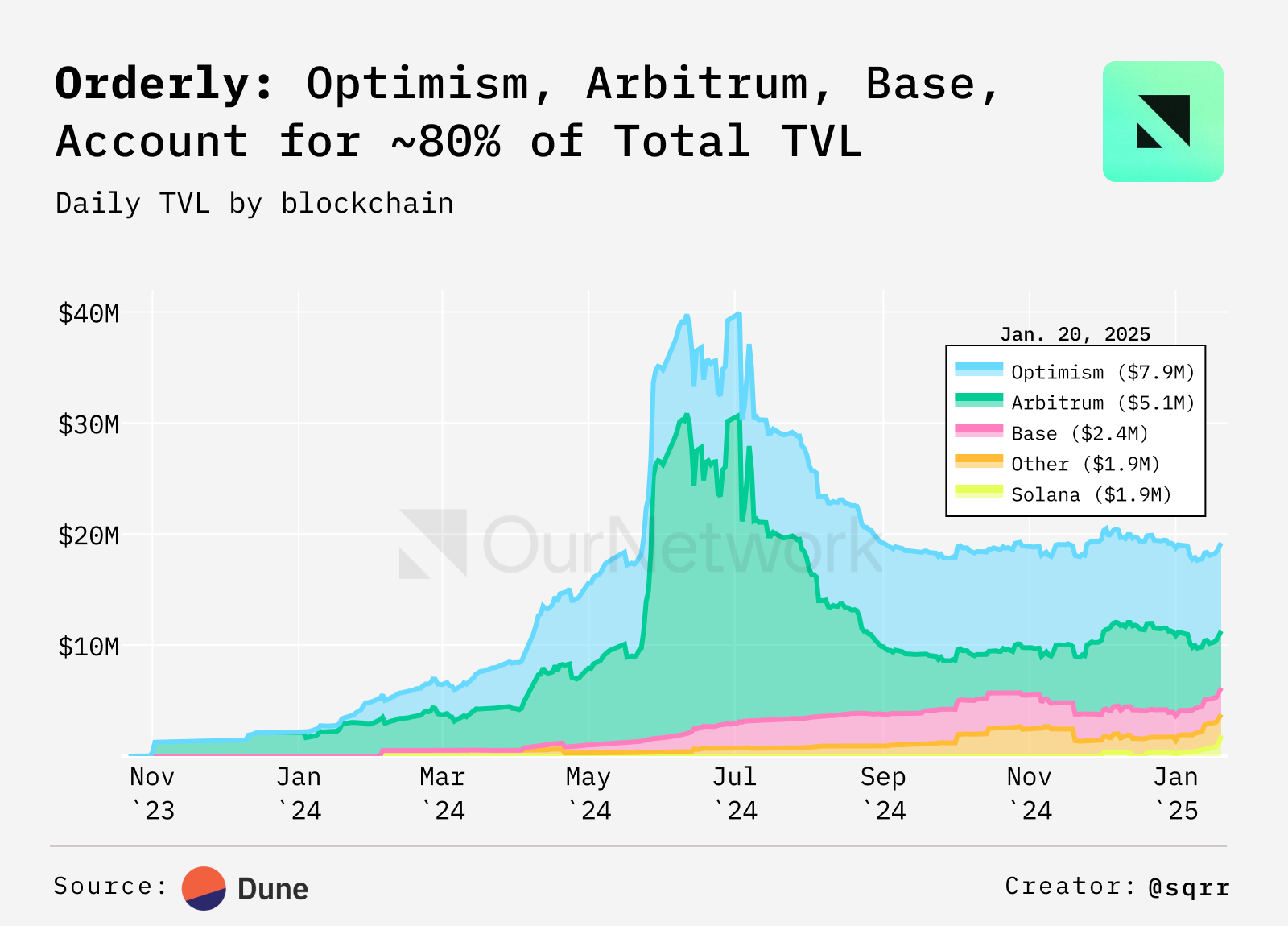

- Orderly has seen its TVL stabilize between 17 and 20M USDC, currently at around 19M. The top three chains contributing to this TVL are Optimism, Arbitrum, and Base, accounting for about 80% of the total. Solana has seen its share grow to nearly 10%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitpanda Secures MiCA License, Expanding Across 27 EU Countries

MANTRA Finance: Transforming Real-World Asset Tokenization in the UAE and Beyond

FTSE Russell expands into crypto indexes with SonarX partnership

Nvidia's $600B drop and crypto IPOs could boost Bitcoin