Daily Market Review: BTC, ETH, SPX, VIRTUAL, RAY

The bulls are in total control in today’s session, as seen from the decrease in the global market cap. The total cap stood at $3.24T as of press time, representing a 1.95% increase over the last 24 hours, while the trading volume jumped by 5% over the same period to stand at $98.08B as of press time.

Bitcoin Price Review

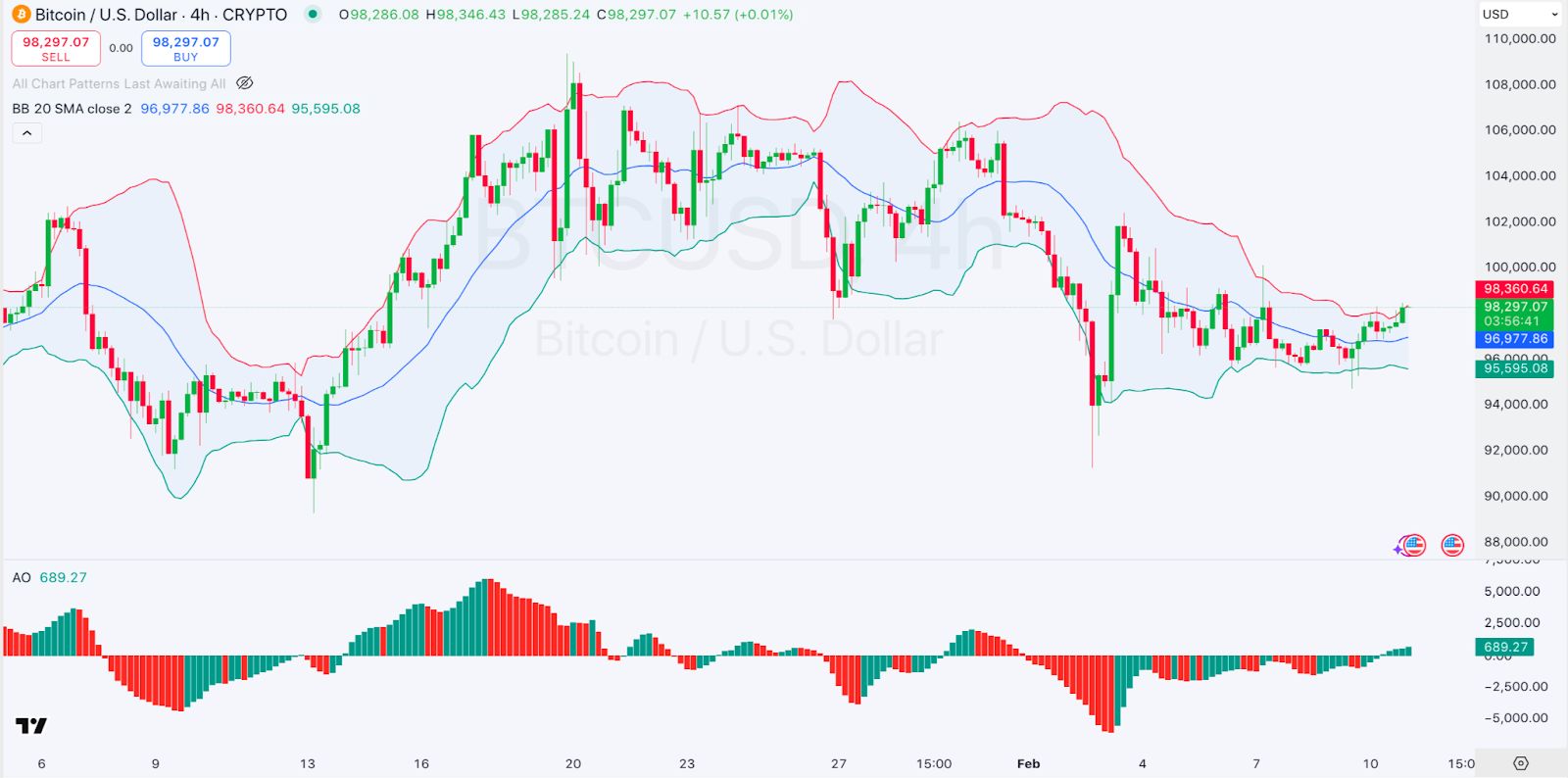

Bitcoin, $BTC, has posted minor gains in today’s session as seen from the price movements. Looking at an in-depth analysis, we see that the Bitcoin price is moving near the middle Bollinger Band, indicating a consolidation phase. The Bollinger Bands are slightly contracting, suggesting reduced volatility.

On the other hand, we see that the AO shows a slight bullish momentum as green bars are forming, but no strong uptrend confirmation yet. Bitcoin traded at $98,211 as of press time, representing a 0.34% increase over the last 24 hours.

Ethereum Price Review

Ethereum, $ETH, is also among the gainers in today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that the Alligator Indicator shows mixed signals, with the moving averages slightly converging, indicating indecision in the market.

On the other hand, we see that the MFI is at 53.82, suggesting a neutral state, neither overbought nor oversold. Ethereum traded at $2,709 as of press time, representing a 2.34% increase over the last 24 hours.

SPX6900 Price Review

SPX6900, $SPX, is also among the gainers in today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that the price is below the Ichimoku Cloud, suggesting bearish conditions.

On the other hand, the ADX is at 23.79, which is relatively low, indicating weak trend strength. The price recently bounced from the $0.6883 support, attempting a recovery. SPX6900 traded at $0.7929 as of press time, representing a 20.84% increase over the last 24 hours.

Virtuals Protocol Price Review

Virtuals Protocol, $VIRTUAL, is also among the gainers in today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that the price is below the 50, 100, and 200 SMAs, indicating a strong downtrend. The volume oscillator is at -3.00%, suggesting weak buying pressure.

Resistance is at $1.642 (50 SMA) and $2.282 (200 SMA), with support at $1.296. Virtuals Protocol traded at $1.44 as of press time, representing a 22.82% increase over the last 24 hours.

Raydium Price Review

Raydium, $RAY, is also among the gainers in today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that the Supertrend flipped bullish, indicating an early trend reversal.

On the other hand, we see that the RSI is at 62.60, nearing overbought levels but still in a bullish zone. Raydium traded at $5.68 as of press time, representing a 15.26% increase over the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenSea Rebrands with Multi-Blockchain Push and ICO Airdrop

OpenSea and Doodle token teasers are a potential vibes booster for crypto

The Drop’s Kate Irwin explains why OpenSea’s OS2 and SEA token are “exciting”

Analyst Sees Altcoin Season Ahead After SEC Approves XRP and DOGE ETFs

Barclays Joins Top Investors in BlackRock’s Bitcoin ETF