Solana Validators to Vote on SIMD-228—How Will It Impact SOL Inflation?

- The SIMD-228 proposal could slash Solana’s inflation below 1%, adjusting staking rewards dynamically based on participation rates.

- Supporters see economic stability and scarcity benefits, while critics warn of potential centralization and unpredictable staking yields.

A new governance proposal, SIMD-228, is set to reshape the blockchain’s economic foundation by altering how Solana (SOL) tokens are issued. The community is divided, with strong voices both for and against the shift. If passed, the proposal could slash Solana’s inflation rate below 1% and redefine staking incentives.

SIMD-0228:

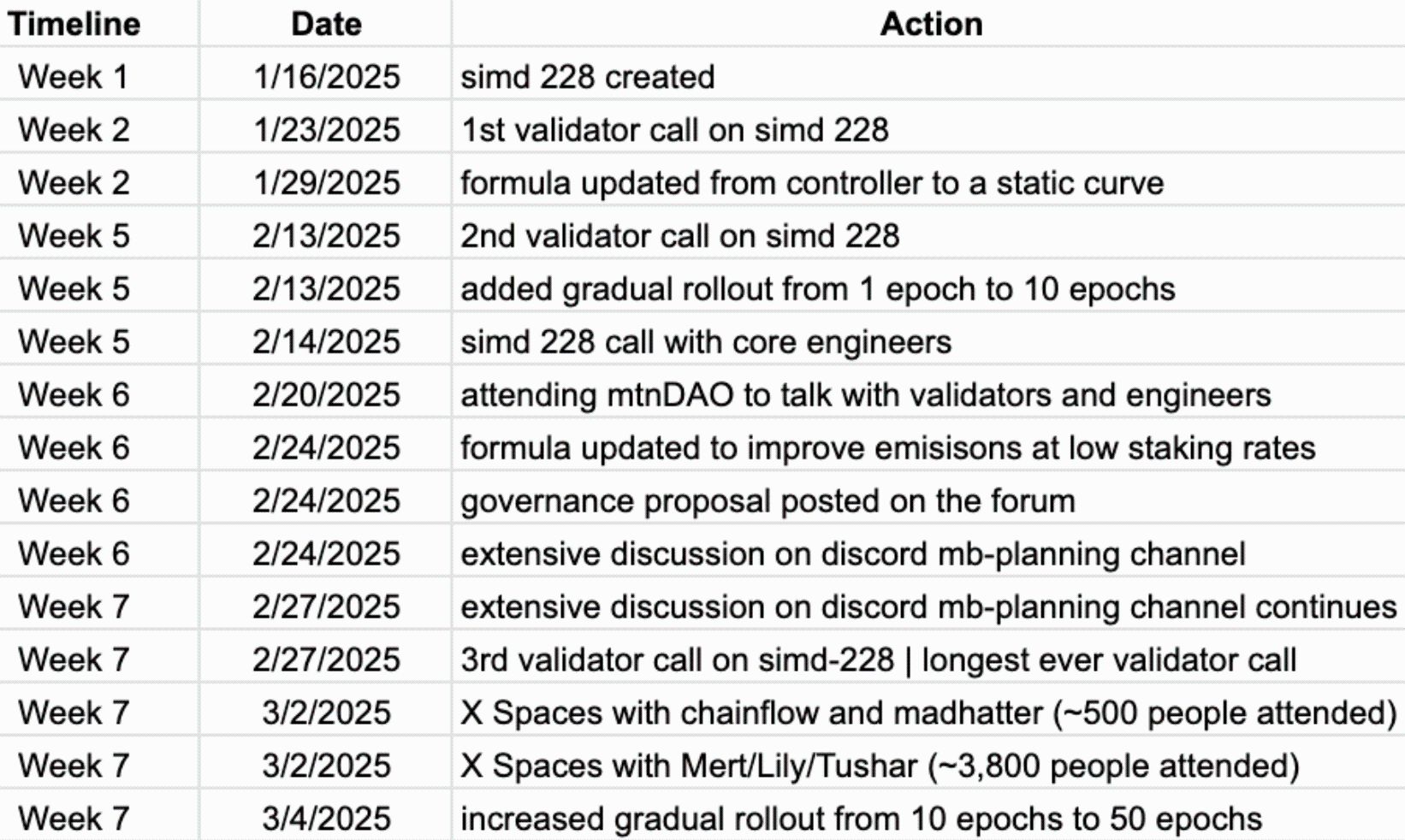

As we head to the vote in epoch 753, I am proud to share that we have spent almost two months discussing SIMD-0228 in public. (Check screenshot for details).

Throughout the process, we incorporated several pieces of community feedback:

1. Transitioned from a… pic.twitter.com/0g138cFGY8

— Vishal Kankani (@kankanivishal) March 6, 2025

The proposal suggests a flexible system for issuing tokens. Right now, Solana follows a set 4.6% yearly inflation rate, dropping 15% per year until it settles at 1.5%. The new method would adjust based on how many people stake their tokens. If staking dips under 33%, rewards increase to push more staking. If too many people stake, rewards shrink, pulling inflation down.

At present, 65% of SOL tokens are staked. Experts predict that with the new method, inflation could drop under 1% yearly. That shift might make SOL harder to get, possibly boosting its value while controlling the token supply. A vote is lined up for epoch 753, which might kick off as soon as this weekend.

Community Leaders Clash Over Proposal

The discussion around SIMD-228 has caught the eye of major figures in the Solana space. Mert Mumtaz, the founder of Helius, has backed the idea, saying the network needs to change how it works financially. In an X post, he made it clear that passing SIMD-228 would strengthen the network. Helius even put out an in-depth breakdown of what the proposal might mean.

On the other side of the argument, Solana Foundation president Lily Liu has urged caution. She criticized the proposal as “too half-baked” and warned that unpredictable staking yields could deter institutional investors. Her concerns highlight the broader uncertainty about how markets will respond if the proposal is implemented.

The proposal authors, Jain and Kankani, have defended their work, emphasizing that it has been under discussion for nearly two months. They argue that the proposal has incorporated feedback from across the community, making it a well-vetted strategy for Solana’s economic future.

Potential Impacts on Solana’s Economy

Supporters claim the new model could eliminate hundreds of millions of dollars in unnecessary inflationary leakage, benefiting long-term SOL holders. Proponents argue that the network will become more valuable over time by ensuring that SOL’s supply better aligns with demand.

Anza engineer trent.sol has praised the proposal for striking a balance between network security and economic sustainability. The proposal aims to align token emissions with real staking demand, ensuring Solana does not “overpay” for network security when participation is already high.

Critics, however, worry about unintended consequences. Smaller validators could see their earnings decline, potentially leading to greater centralization if only large stakeholders can afford to operate profitably. Additionally, any miscalculations in the new emissions model could destabilize staking incentives, creating short-term volatility in SOL’s value.

A Step Toward Ultra-Sound Money?

For those eyeing Solana’s long-term growth, SIMD-228 could be a pivotal moment. Estimates suggest the proposal could lead to a 20.9% reduction in overall emissions, aligning token creation with burning. That change could bolster SOL’s scarcity, increasing its appeal to long-term investors.

The shift would also bring more predictability to Solana’s monetary policy. Rather than rigid, scheduled inflation, the new system reacts dynamically to network conditions, potentially stabilizing token value while rewarding active participants. Apart from the SIMD-228 proposal, Solana also revealed a lattice-based hashing system to address the “state growth problem.”

Recommended for you:

- Solana Wallet Tutorial

- Check 24-hour Solana Price

- More Solana News

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.