Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.51%

Altcoin season index:0(Bitcoin season)

BTC/USDT$96295.05 (+0.16%)Fear at Greed Index46(Neutral)

Total spot Bitcoin ETF netflow +$171.3M (1D); +$1.11B (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.51%

Altcoin season index:0(Bitcoin season)

BTC/USDT$96295.05 (+0.16%)Fear at Greed Index46(Neutral)

Total spot Bitcoin ETF netflow +$171.3M (1D); +$1.11B (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.51%

Altcoin season index:0(Bitcoin season)

BTC/USDT$96295.05 (+0.16%)Fear at Greed Index46(Neutral)

Total spot Bitcoin ETF netflow +$171.3M (1D); +$1.11B (7D).Welcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

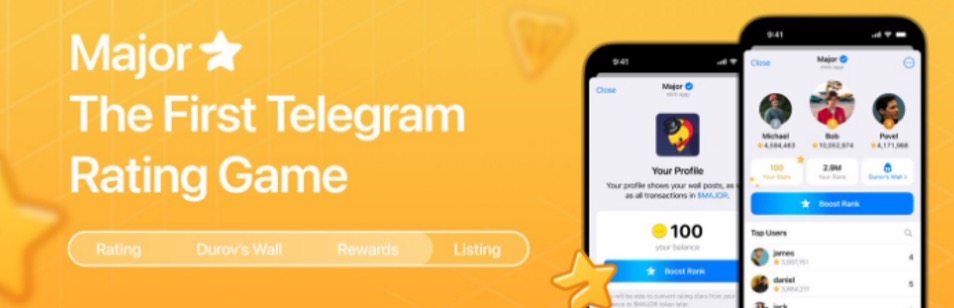

Major presyoMAJOR

Listed

BumiliQuote pera:

USD

$0.1581-4.54%1D

Huling na-update 2025-02-09 15:17:40(UTC+0)

Market cap:$13,179,069.28

Ganap na diluted market cap:$13,179,069.28

Volume (24h):$39,443,565.62

24h volume / market cap:299.28%

24h high:$0.1688

24h low:$0.1566

All-time high:$36.75

All-time low:$0.1492

Umiikot na Supply:83,349,870 MAJOR

Total supply:

99,999,999MAJOR

Rate ng sirkulasyon:83.00%

Max supply:

99,999,999MAJOR

Mga kontrata:

EQCuPm...U_MAJOR(TON)

Higit pa

Ano ang nararamdaman mo tungkol sa Major ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng Major ngayon

Ang live na presyo ng Major ay $0.1581 bawat (MAJOR / USD) ngayon na may kasalukuyang market cap na $13.18M USD. Ang 24 na oras na dami ng trading ay $39.44M USD. Ang presyong MAJOR hanggang USD ay ina-update sa real time. Ang Major ay -4.54% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 83,349,870 .

Ano ang pinakamataas na presyo ng MAJOR?

Ang MAJOR ay may all-time high (ATH) na $36.75, na naitala noong 2024-11-27.

Ano ang pinakamababang presyo ng MAJOR?

Ang MAJOR ay may all-time low (ATL) na $0.1492, na naitala noong 2025-02-03.

Bitcoin price prediction

Kailan magandang oras para bumili ng MAJOR? Dapat ba akong bumili o magbenta ng MAJOR ngayon?

Kapag nagpapasya kung buy o mag sell ng MAJOR, kailangan mo munang isaalang-alang ang iyong sariling diskarte sa pag-trading. Magiiba din ang aktibidad ng pangangalakal ng mga long-term traders at short-term traders. Ang Bitget MAJOR teknikal na pagsusuri ay maaaring magbigay sa iyo ng sanggunian para sa trading.

Ayon sa MAJOR 4 na teknikal na pagsusuri, ang signal ng kalakalan ay Malakas na nagbebenta.

Ayon sa MAJOR 1d teknikal na pagsusuri, ang signal ng kalakalan ay Sell.

Ayon sa MAJOR 1w teknikal na pagsusuri, ang signal ng kalakalan ay Sell.

Ano ang magiging presyo ng MAJOR sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni MAJOR, ang presyo ng MAJOR ay inaasahang aabot sa $0.2070 sa 2026.

Ano ang magiging presyo ng MAJOR sa 2031?

Sa 2031, ang presyo ng MAJOR ay inaasahang tataas ng +28.00%. Sa pagtatapos ng 2031, ang presyo ng MAJOR ay inaasahang aabot sa $0.4659, na may pinagsama-samang ROI na +196.62%.

Major price history (USD)

The price of Major is -88.76% over the last year. The highest price of MAJORNEW in USD in the last year was $36.75 and the lowest price of MAJORNEW in USD in the last year was $0.1492.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h-4.54%$0.1566$0.1688

7d-27.90%$0.1492$0.1994

30d-63.76%$0.1492$0.5266

90d-86.05%$0.1492$36.75

1y-88.76%$0.1492$36.75

All-time-88.48%$0.1492(2025-02-03, 6 araw ang nakalipas )$36.75(2024-11-27, 74 araw ang nakalipas )

Major impormasyon sa merkado

Major's market cap history

Major holdings by concentration

Whales

Investors

Retail

Major addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Major na mga rating

Mga average na rating mula sa komunidad

4.2

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

MAJOR sa lokal na pera

1 MAJOR To MXN$3.251 MAJOR To GTQQ1.231 MAJOR To CLP$152.011 MAJOR To UGXSh583.331 MAJOR To HNLL4.051 MAJOR To ZARR2.911 MAJOR To TNDد.ت0.511 MAJOR To IQDع.د207.131 MAJOR To TWDNT$5.191 MAJOR To RSDдин.17.911 MAJOR To DOP$9.81 MAJOR To MYRRM0.71 MAJOR To GEL₾0.441 MAJOR To UYU$6.881 MAJOR To MADد.م.1.591 MAJOR To AZN₼0.271 MAJOR To OMRر.ع.0.061 MAJOR To KESSh20.41 MAJOR To SEKkr1.731 MAJOR To UAH₴6.58

- 1

- 2

- 3

- 4

- 5

Huling na-update 2025-02-09 15:17:40(UTC+0)

Paano Bumili ng Major(MAJOR)

Lumikha ng Iyong Libreng Bitget Account

Mag-sign up sa Bitget gamit ang iyong email address/mobile phone number at gumawa ng malakas na password para ma-secure ang iyong account.

Beripikahin ang iyong account

I-verify ang iyong pagkakakilanlan sa pamamagitan ng paglalagay ng iyong personal na impormasyon at pag-upload ng wastong photo ID.

Bumili ng Major (MAJOR)

Gumamit ng iba't ibang mga pagpipilian sa pagbabayad upang bumili ng Major sa Bitget. Ipapakita namin sa iyo kung paano.

I-trade ang MAJOR panghabang-buhay na hinaharap

Pagkatapos ng matagumpay na pag-sign up sa Bitget at bumili ng USDT o MAJOR na mga token, maaari kang magsimulang mag-trading ng mga derivatives, kabilang ang MAJOR futures at margin trading upang madagdagan ang iyong inccome.

Ang kasalukuyang presyo ng MAJOR ay $0.1581, na may 24h na pagbabago sa presyo ng -4.54%. Maaaring kumita ang mga trader sa pamamagitan ng alinman sa pagtagal o pagkukulang saMAJOR futures.

Sumali sa MAJOR copy trading sa pamamagitan ng pagsunod sa mga elite na traders.

Pagkatapos mag-sign up sa Bitget at matagumpay na bumili ng mga token ng USDT o MAJOR, maaari ka ring magsimula ng copy trading sa pamamagitan ng pagsunod sa mga elite na traders.

Major balita

Malapit nang ilunsad ang pangunahing tampok sa pagpapaupa ng NFT

Bitget•2024-12-11 02:56

![[Initial Listing] Bitget Will List Major(MAJOR) sa Innovation at TON Ecosystem Zone!](/price/_next/static/media/cover-placeholder.a3a73e93.svg)

[Initial Listing] Bitget Will List Major(MAJOR) sa Innovation at TON Ecosystem Zone!

Bitget Announcement•2024-11-14 13:40

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng Major.

Ano ang kasalukuyang presyo ng Major?

The live price of Major is $0.16 per (MAJOR/USD) with a current market cap of $13,179,069.28 USD. Major's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Major's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng Major?

Sa nakalipas na 24 na oras, ang dami ng trading ng Major ay $39.44M.

Ano ang all-time high ng Major?

Ang all-time high ng Major ay $36.75. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa Major mula noong inilunsad ito.

Maaari ba akong bumili ng Major sa Bitget?

Oo, ang Major ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa Major?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng Major na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng Major (MAJOR)?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng Major online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng Major, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng Major. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

Bitget Insights

BRIA_Quen

7h

6-Month Prediction: Is $BERA a Strong Buy or a Risky Bet?

$BERA has recently experienced an 24% decline on February 08th 2025, bringing its price down to $6.03 While short-term traders are focused on immediate recovery or further downside, long-term investors are more concerned about where the stock will be in the next six months. Will $BERA regain its momentum, or is it headed for a prolonged bearish phase?

Evaluating the Current Downtrend:

A steep drop in price often raises questions about the underlying causes. If $BERA’s decline was due to short-term factors, such as market corrections or temporary bad news, it may recover within six months. However, if the drop reflects deeper issues—such as declining revenues, weak business fundamentals, or industry struggles—the stock may struggle to rebound.

Long-term investors should consider whether $BERA has strong fundamentals to support future growth. Key areas to analyze include:

• Revenue and profitability trends

• Debt levels and financial stability

• Industry growth prospects

• Competitive positioning

If $BERA’s fundamentals remain intact, the current price drop could be an opportunity for long-term investors to buy at a discount. However, if there are structural issues within the company or industry, the downtrend could continue.

Technical Analysis: Can $BERA Reverse Its Trend?

Key Support and Resistance Levels

Over the next six months, $BERA must establish a solid base and break through major resistance points to confirm a trend reversal.

• Support Level: If $BERA stabilizes above $6.00 and avoids dropping below $5.50, it could be forming a bottom. A break below $5.50, however, would suggest deeper downside risk.

• Resistance Level: The first major resistance is at $7.00, followed by $8.00. If $BERA can break past these levels, it would indicate renewed bullish momentum.

Moving Averages and Momentum Indicators

• 50-Day and 200-Day Moving Averages: If $BERA climbs above these key moving averages, it would signal a long-term reversal. If it remains below, the downtrend could persist.

• Relative Strength Index (RSI): If RSI moves above 50 in the coming months, it would indicate increased buying interest. If it stays below 40, bearish momentum may continue.

Industry and Market Trends: How Will They Impact $BERA?

$BERA’s long-term performance will also depend on broader market conditions and sector trends.

• Stock Market Trends: If the overall market remains bullish, $BERA could benefit from improved sentiment. However, if the market faces economic uncertainty or a downturn, the stock may struggle to gain traction.

• Sector Strength: If $BERA operates in a growing industry, it may have better chances of recovering. However, if the sector is underperforming, the stock could face additional challenges.

• Economic Indicators: Inflation, interest rates, and Federal Reserve policies will influence investor confidence. A favorable economic environment could support a recovery, while negative macroeconomic trends could keep the stock under pressure.

Company-Specific Factors: What Could Drive a Rebound?

Investors should monitor any upcoming earnings reports, product launches, or strategic developments that could impact $BERA’s valuation. Key questions to consider:

• Does $BERA have strong revenue growth and profitability trends?

• Is the company expanding into new markets or launching innovative products?

• Are there any regulatory or competitive risks that could hinder growth?

If $BERA delivers positive earnings surprises or announces strategic moves that enhance its long-term prospects, investor confidence could increase, leading to a stock price recovery.

Potential Scenarios for the Next Six Months

1. Bullish Recovery: If $BERA stabilizes, improves its fundamentals, and benefits from strong market conditions, it could recover to $8.00 or higher.

2. Sideways Consolidation: If investor sentiment remains uncertain, $BERA may trade within a range of $6.00 to $7.00 without a clear breakout.

3. Extended Downtrend: If macroeconomic conditions worsen, or if $BERA faces company-specific issues, it could decline further below $5.50.

Is $BERA a Buy for the Next Six Months?

$BERA’s recovery over the next six months depends on several factors, including technical signals, company fundamentals, market sentiment, and economic conditions. If the stock stabilizes and delivers strong earnings or growth catalysts, it could present a solid buying opportunity. However, if bearish sentiment persists and external risks remain high, further downside cannot be ruled out.

Investors should closely monitor key price levels, earnings updates, and industry trends before making long-term investment decisions. Those with a higher risk tolerance may consider buying at current levels, while conservative investors may wait for confirmation of a trend reversal

MAJOR0.00%

SIX0.00%

waqarzaka

7h

📉 BERA/USDT Market Update – Buy & Sell Strategy for Maximum Gains 🚀

📉 BERA/USDT Market Update – Buy & Sell Strategy for Maximum Gains 🚀

The cryptocurrency market is experiencing increased volatility, and BERA/USDT is no exception. Currently trading at $5.9020, the coin is down 6.86% in the last 24 hours. With a 24-hour high of $6.8084 and a low of $5.7650, traders are closely watching key support and resistance levels to determine the next move.

So, should you buy the dip or wait for confirmation? Let’s analyze the market and set up a strategic trading plan.

📊 Key Support & Resistance Levels

Major Support (Buy Zone): $5.75 - $5.90

Resistance (Sell Zone): $6.50 - $6.80

The recent price action suggests that $5.75 is a strong support level, as the price bounced from this zone. Meanwhile, resistance around $6.50 - $6.80 could act as a selling area where traders take profits.

📈 When to Buy? (Best Entry Strategy)

The best entry for BERA/USDT is within the buy zone of $5.75 - $5.90. Here’s why:

✅ Support Confirmation: The price bounced from $5.7650, suggesting buyers are active in this range.

✅ Moving Averages (MA) Analysis:

MA(5): $5.8904

MA(10): $5.9207

MA(20): $6.0378

The price is hovering near MA(5) & MA(10), indicating consolidation before a possible breakout

📌 Ideal Buy Strategy:

Buy between $5.75 - $5.90 when the price shows strength.

Stop-Loss at $5.65 to minimize risk in case of further downside.

Target $6.20 - $6.50 in the short term.

📉 When to Sell? (Profit-Taking Strategy)

If BERA moves upward, it will face resistance at $6.50 - $6.80. This is an ideal selling zone for short-term traders.

📍 Resistance at $6.50 - $6.80:

This area acted as a previous high, where sellers are likely to step in.

If BERA breaks $6.80 with high volume, the next target is $7.20+.

📌 Ideal Sell Strategy:

Take partial profits at $6.50 - $6.80 to secure gains.

If the price breaks $6.80, hold for a potential move toward $7.20 - $7.50.

🔮 Future Price Prediction – What’s Next for BERA?

📊 Based on technical indicators, here are two possible scenarios:

1️⃣ Bullish Scenario:

If BERA holds above $5.75, expect a bounce toward $6.20 - $6.50 in the short term.

If momentum builds, breaking $6.80 could push the price to $7.20+

2️⃣ Bearish Scenario:

A break below $5.75 could trigger a drop to $5.50.

Increased selling pressure may push the price towards $5.30 - $5.40.

🚀 Trading Strategy for Maximum Profits

📌 Best Buy Zone: $5.75 - $5.90

📌 Take Profit: $6.50 - $6.80

📌 Breakout Target: $7.20+

📌 Stop-Loss: $5.65

🔔 Final Thoughts:

BERA is trading near a key support level, making it an attractive buy opportunity for swing traders.

Watch for price action confirmation & volume surges before entering trades.

If BERA breaks $6.80, expect further upside momentum.

📢 Trade smart, set stop-losses, and maximize your profits! 🚀

$BERA

HOLD0.00%

MAJOR0.00%

BGUSER-0J6XK340

8h

🔥 $ARC is Gearing Up for a Potential Breakout! 🚀

Momentum is shifting, and $ARC is showing strong signs of a bullish reversal! Sellers are losing grip, and buying pressure is building up—could this be the start of a major comeback? Stay ahead of the trend and keep a close watch on $ARC! 👀📈

Crypto #ARC #Altcoins #CryptoTrading #BullishReversal

MAJOR0.00%

UP0.00%

WasimM

8h

Donald Trump’s latest push for ‘reciprocal tariffs’ is shaking up the global economy

$TRUMP crypto, you might be wondering—how does this affect Bitcoin, Ethereum, and the broader market? Let’s break it down.

▪️What Are Reciprocal Tariffs?

Trump’s idea is simple: if another country imposes high tariffs on American goods, the U.S. will hit them with the same tariffs in return. The goal is to level the playing field, but in reality, it often leads to trade wars, market uncertainty, and economic turbulence.

▪️How This Impacts Crypto

If you’ve been watching crypto prices lately, you’ve probably noticed some volatility. The moment Trump made his tariff announcement, Bitcoin and other major cryptos took a hit. Investors saw the news, panicked, and started pulling out of riskier assets—including crypto. But why does this happen?

1. Uncertainty Shakes Markets

When governments start slapping tariffs on each other, businesses get nervous. Investors hate uncertainty, and they tend to move money into safer assets like gold or the U.S. dollar, leaving crypto exposed to sell-offs.

2. The U.S. Dollar Strengthens

Tariffs can drive up the value of the dollar, especially if they reduce the trade deficit. A strong dollar often means weaker crypto prices since Bitcoin and other digital assets are seen as alternatives to traditional currencies.

3. Inflation & Spending Power

Higher tariffs can lead to higher prices on imported goods, which fuels inflation. In theory, some investors turn to Bitcoin as an inflation hedge. But if inflation forces the Federal Reserve to tighten monetary policy, it could drain liquidity from the markets—making it harder for crypto to rally.

▪️What’s Next for Crypto?

If Trump continues pushing for more tariffs, expect continued volatility in the crypto market. Some traders might see buying opportunities in the dips, while others will wait to see how things unfold.

One thing’s for sure—crypto is no longer a niche asset. It reacts to major economic policies just like stocks and commodities do. Whether you’re a trader or a long-term investor, staying informed is key to navigating these market swings.

$BTC $ETH $XRP

BTC0.00%

MOVE0.00%

WasimM

8h

In the cryptocurrency market, major altcoins have been struggling to hold their ground since

Many altcoins have undergone a steep correction, largely influenced by the rapid rise in BTC dominance, which continues to add bearish pressure.

Among the hardest-hit altcoins are Thorchain ( $RUNE ) and Oasis ( $ROSE ), both of which have experienced substantial drops of 80% and 62%, respectively, in the past 60 days. Now, they are at a critical juncture, testing key support levels.

Thorchain ( $RUNE )

The monthly chart for Thorchain (RUNE) shows that the price has been consolidating within a three-year-long descending triangle pattern. The recent downtrend, which began on December 2, was triggered by a rejection from the upper resistance of the triangle at $7.58 after news of the protocol’s mounting debts.

This decline brought RUNE to a major support zone, hitting a low of $0.95. However, the price has managed to hold and is now trading around $1.19.

Historically, this level has acted as a strong rebound zone, and if the pattern follows previous trends, RUNE may challenge the 100-day SMA as a key resistance. A breakout above this moving average could open the doors for a retest of the descending trendline.

Oasis ( $ROSE )

The weekly chart for Oasis (ROSE) shows consolidation within a descending triangle pattern. The recent downtrend, which started on December 2, was triggered by a rejection at the upper resistance trendline around $0.14.

This decline brought ROSE to a major support zone, hitting a low of $0.034. However, the price has managed to hold and is now trading around $0.040.

Previously, this level has acted as a strong rebound zone, and if the pattern follows previous trends, ROSE may challenge the 100-day SMA as a key resistance. A breakout above this moving average could open the doors for a retest of the descending trendline.

Is a Bounce Back Ahead ?

Both RUNE and ROSE are showing resilience at their key support levels. Their next moves will largely depend on Ethereum (ETH), which is currently trading at $2,600, and the broader crypto market sentiment. If ETH continues its recovery, it could provide the momentum needed for altcoins like RUNE and ROSE to confirm a breakout and start a new bullish trend.

The MACD on both charts is bearish but showing signs of weakening momentum, indicating a potential reversal if a bullish crossover occurs. If buyers step in at these critical levels, both RUNE and ROSE could see a strong bounce in the coming weeks.

Investors should keep a close eye on these support levels, as a break below could trigger further downside, while a confirmed bounce could present an attractive entry point for long-term gains.

BTC0.00%

HOLD0.00%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.

Maihahambing na market cap

Sa lahat ng asset ng Bitget, ang 8 na ito ang pinakamalapit sa Major sa market cap.

.png)