Bitget Beginner's Guide — What Are Futures?

What is futures trading?

Futures trading is a form of financial derivative that, unlike spot trading, enables investors to profit from both shorting and leveraging.

Bitget Futures offers over 300 leverage trading pairs with up to 125x leverage. Traders can go long (buy) or short (sell) futures contracts based on their predictions of an asset's price movement, using leverage to maximize potential gains.

How futures trading works

The underlying logic behind futures trading is quite simple — it allows investors to borrow fiat or crypto to trade at a specific price at a specific point in the future.

Take BTC futures as an example:

1. Initial condition

○ Investor A's principal: 10,000 USDT

○ BTC price: $50,000

○ Leverage trading: Borrow 90,000 USDT (total assets = principal + borrowed funds = 100,000 USDT).

○ Futures position: Initial value = 2 BTC (100,000 USDT)

2. Market movement

○ BTC price rises to $60,000

○ Current position value: 2 BTC × $60,000 = $120,000 (120,000 USDT)

3. Position closure

4. Sell/close the futures position to realize 120,000 USDT

5. Loan to repay: 90,000 USDT

6. Account balance: 120,000 – 90,000 = 30,000 USDT

7. Profit calculation

○ Account balance: 30,000 USDT

○ Net profit after deducting principal: 30,000 – 10,000 = 20,000 USDT

8. ROI: Profit ÷ principal = 20,000 ÷ 10,000 = 200%

By using leverage, Investor A achieved a 200% return from a 20% increase in Bitcoin's price (from $50,000 to $60,000).

Notes:

1. Leverage: Trader A can choose their own leverage level to borrow funds. The higher the leverage, the greater the risk.

2. Go long/short: Trader A can go long (buy) in bullish markets or go short (sell) in bearish markets based on their market outlook.

3. Post-trade options: After placing a trade, the trader can hold the position, increase it, close it entirely, or take partial profits.

4. Downside risk: If the price of Bitcoin fails, additional margin may be required to keep the position open.

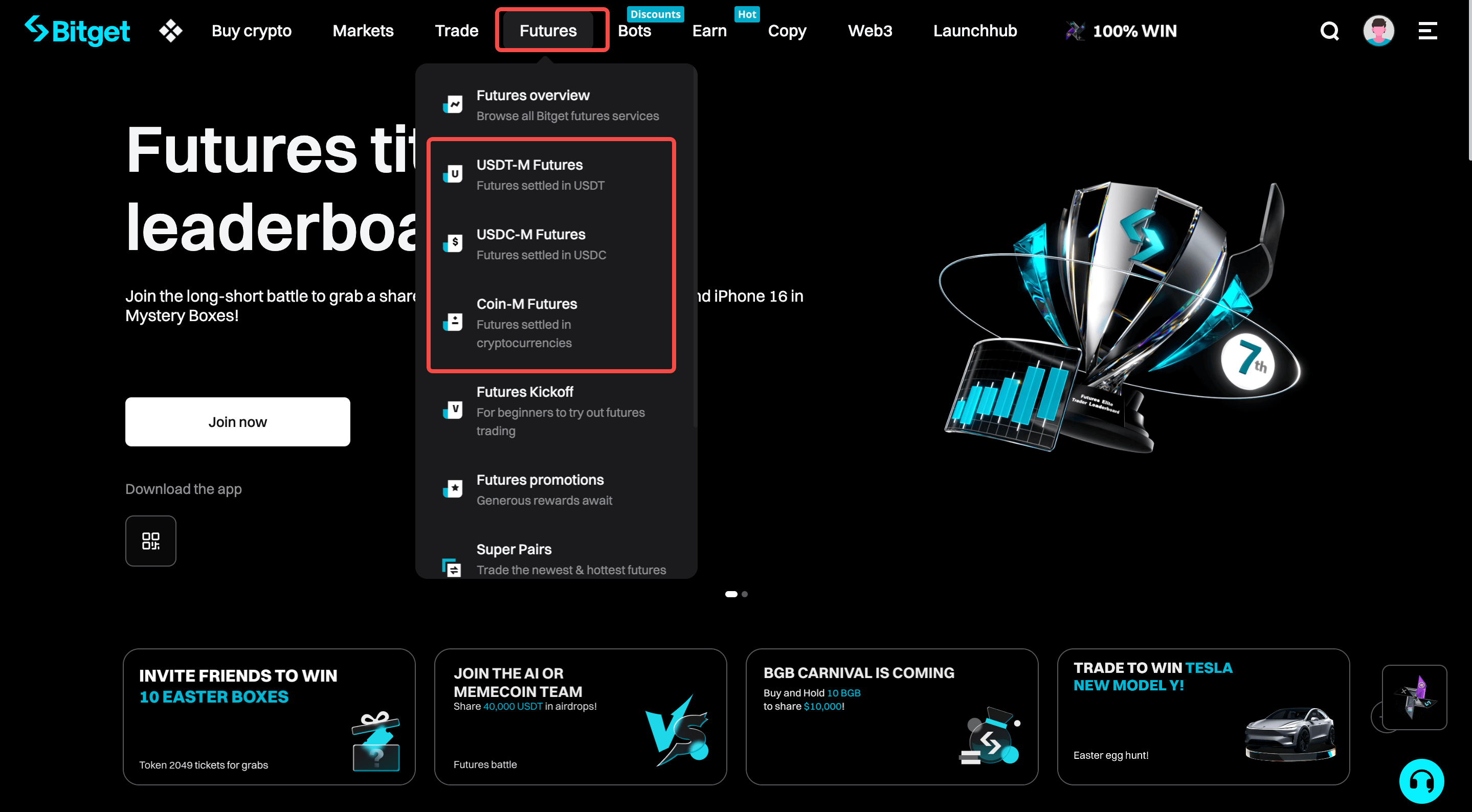

How to access Bitget Futures

• Website

1. Visit the Bitget homepage, click Futures in the top navigation bar, and select USDT-M Futures, USDC-M Futures, or Coin-M Futures.

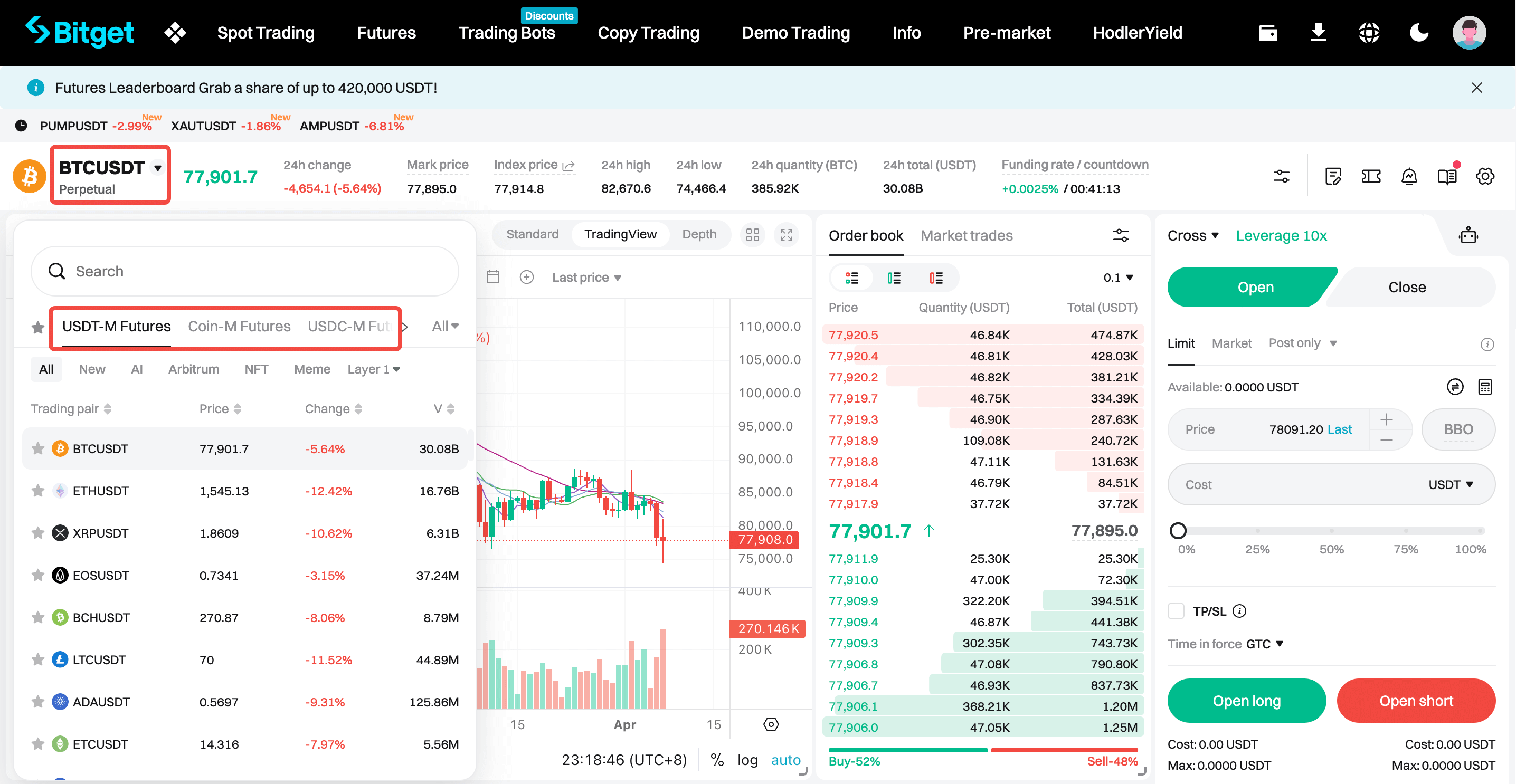

2. After selecting the futures type, choose the trading pair you want to trade on the futures trading page.

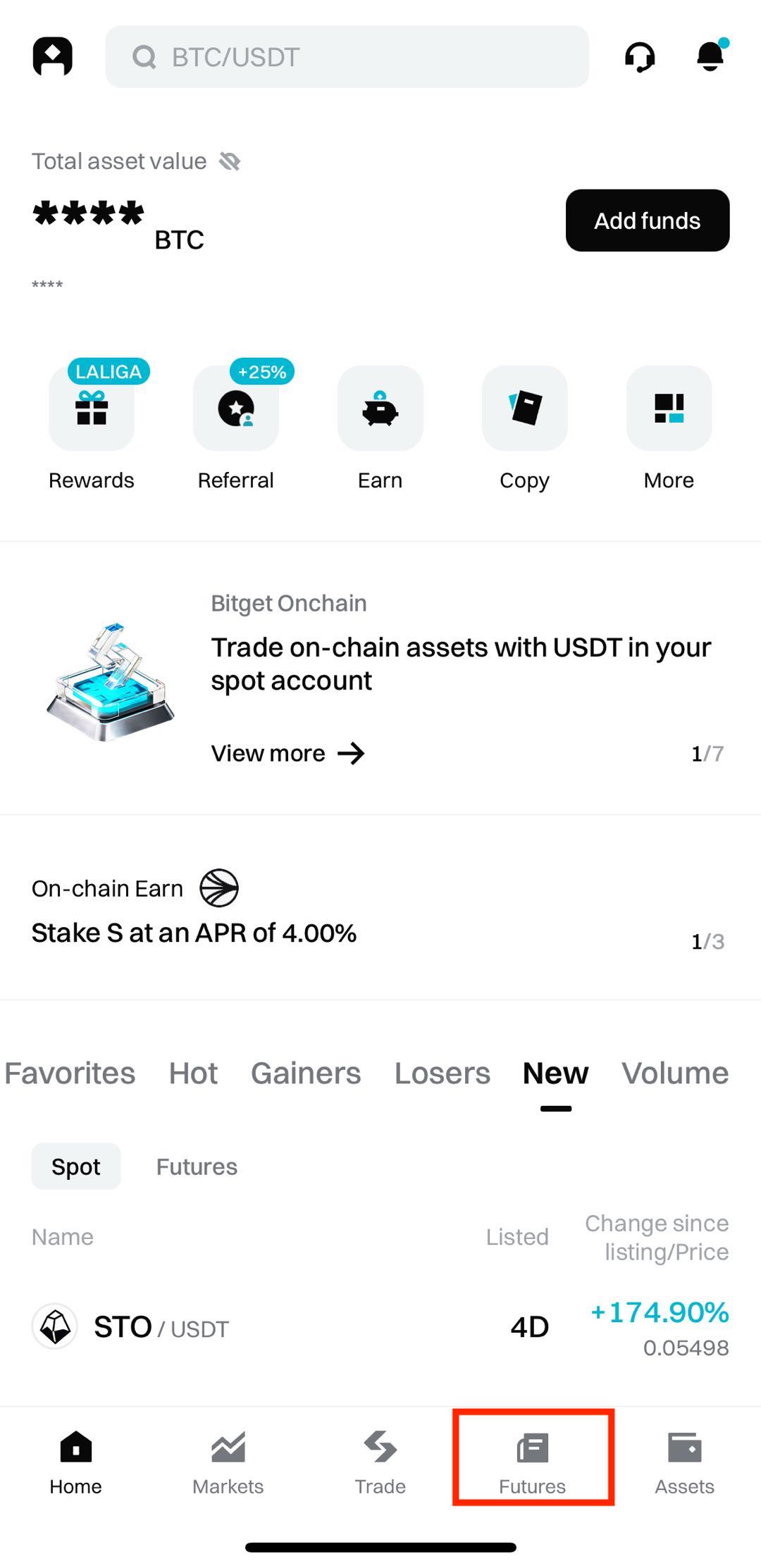

• App

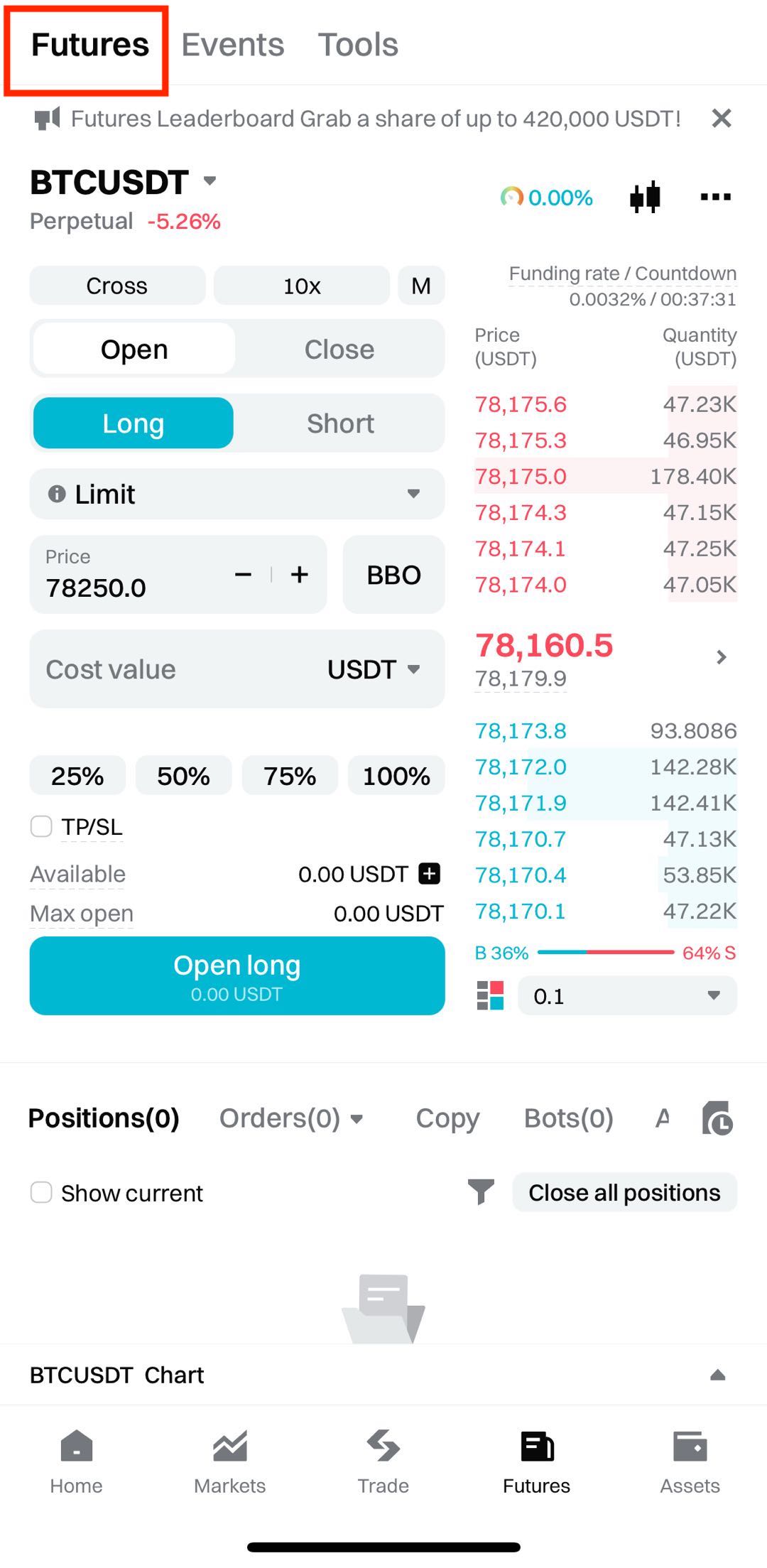

1. Open the Bitget app and tap Futures in the bottom navigation bar.

2. Select the trading pair and futures type you want to trade.

Pros and cons of futures trading

Pros:

1. Leverage boost: Bitget supports up to 125x leverage to boost capital utilization (Note: High leverage carries significant risk, especially for beginners.)

2. Faster potential returns: In spot trading, doubling your profit requires multiple price increases. With futures trading, a 10% price increase can double your principal with a 10x leverage.

3. Profit in both directions: Go long in bull markets and short in bear markets to take advantage of market trends in either direction.

4. Hedging: Miners and experienced traders can use futures to hedge against potential losses from spot market declines.

Cons:

1. High risk: Leverage amplifies your losses. A 5% drop in price with a 20x leverage can wipe out your principal, even if the market later recovers.

2. Emotional stress: High market volatility can affect a trader's ability to make rational decisions.

Related articles:

1. Bitget beginner's guide — How to make your first futures trade

3. Bitget beginner's guide — Key futures trading terms and their application scenarios