News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

If smart contracts are the beginning of removing intermediaries, then the arrival of DeAgent must be the elimination of the intermediary role.

Ethereum may dominate institutional-level complex financial scenarios, while Solana has a greater advantage in pure consumer-level scenarios.

"Infrastructure layout" has become a new trend for OG NFT projects.

The total transaction fees for Memecoins on the Solana chain exceed 3 billion dollars.

If XRP continues to rise at the current price ratio, its performance may surpass that of Ethereum.

The core CPI data in the U.S. unexpectedly fell, and Trump's administration along with SEC regulatory reforms boosted a reversal in market pessimism.

The value capture of VIRTUAL has been upgraded again.

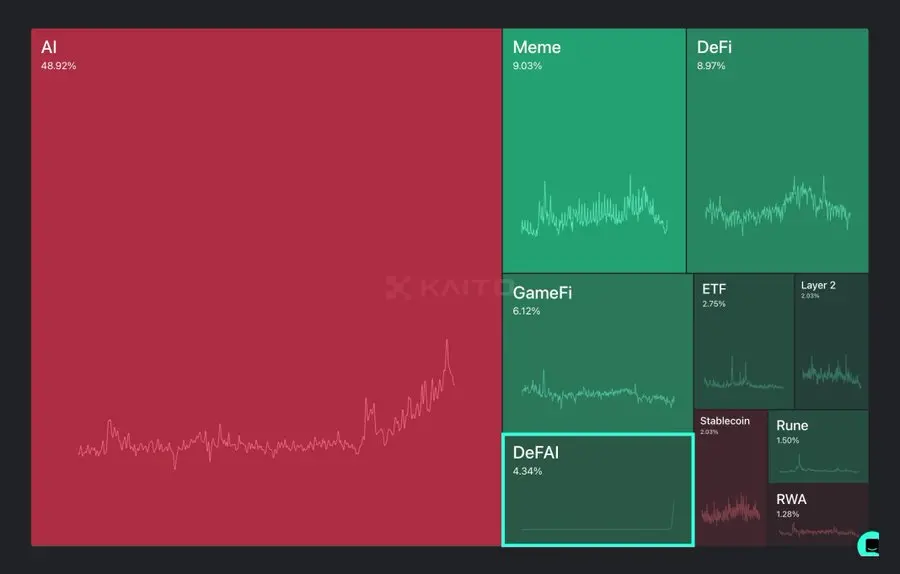

Overview of 6 High-Potential DeFAI Tokens

Only three key projects are clearly scheduled to launch on the mainnet in the first quarter, while the timelines for the other projects are still to be determined.

- 01:06The $1.4 billion International Monetary Fund loan agreement for El Salvador includes Bitcoin regulatory conditionsThe $1.4 billion IMF loan agreement for El Salvador includes Bitcoin oversight conditions. The new International Monetary Fund (IMF) loan terms reveal key measures related to Bitcoin that El Salvador must take: ending public participation in Chivo and stopping the use of public funds by July 2025. Liquidate Fidebitcoin Trust and publish audited financial data, establish a Bitcoin management framework for government-held BTC, disclose all cold and hot wallet addresses and BTC holdings to the IMF. The International Monetary Fund will conduct regular reviews to ensure compliance before 2025.

- 01:05Over 29.5 million XRP has been transferred from an unknown wallet to CEXAccording to the on-chain data tracking service Whale Alert, around 8:02 (UTC+8), 29,532,534 XRP (equivalent to $69,892,707) were transferred from an unknown wallet to CEX.

- 01:03Cryptocurrency risk investment funds reached $951 million in February, an increase of 14% from the previous monthIn February, the monthly growth of venture capital funds in encryption risk increased by 14%, reaching $951 million, involving 98 transactions. Stable coins and payments are the largest investment fields. Figure, Ethena and Bitwise have all received significant financing, indicating that institutions' confidence in digital assets is continuously strengthening.