News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (February 13) | Market sentiment on "crypto religion" $PI divided, officials suggest memecoins may not be regulated by the SEC 2The Daily: Trump to tap a16z's Brian Quintenz for CFTC chief, Elon Musk-related memecoin dumps and more3Franklin Templeton extends FOBXX fund to Solana, marking its latest blockchain extension

Superminority Power Play: Can Solana Stay Truly Decentralized?

Coinedition·2024/06/21 08:04

BAYC NFTs Crash to 150-Week Low Amid Market Decline

DailyCoin·2024/06/21 06:55

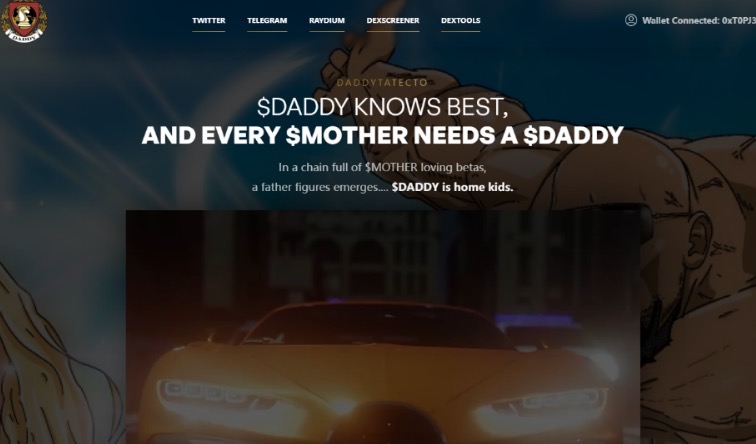

Daddy Tate (DADDY) Market Research Analysis

Bitget·2024/06/21 06:34

Coin hunting strategy: How can memecoin snipers get a hundredfold return?

Odaily·2024/06/21 05:19

US spot bitcoin ETFs shed $140 million as fund exit continues

The U.S. spot bitcoin ETFs saw $139.88 million in daily net outflows on Thursday.This marked the fifth consecutive day of net outflows for the funds.

The Block·2024/06/21 04:13

Bitget Futures Market Update: Canada's 3iQ applies to list Solana ETP in Toronto

Bitget·2024/06/21 03:48

Bitcoin, Ethereum Options Worth $1.96 Billion Expire Today Amid Market Uncertainty

BeInCrypto·2024/06/21 03:31

3iQ Files to Launch First Solana ETF in Canada

BeInCrypto·2024/06/21 00:04

Bitcoin’s $100,000 Target Remains Feasible

BeInCrypto·2024/06/21 00:04

Flash

- 12:21JPMorgan Chase: Tether may need to sell Bitcoin to comply with proposed US stablecoin regulationsMorgan Stanley analysts estimate that only 66%-83% of Tether's reserves comply with proposed U.S. stablecoin regulations, and may require asset restructuring. Analysts suggest that if the regulations are passed, Tether might need to sell off Bitcoin and other non-compliant assets, and instead purchase U.S. Treasury bonds and liquid reserves.

- 12:19Midas collaborates with MEV Capital, Edge Capital, and RE7 Capital to launch "Yield Tokens"According to The Block, Dennis Dinkelmeyer, CEO of tokenization protocol Midas, revealed that Midas is launching Liquidity Yield Tokens (LYTs), a new type of "on-chain hedge fund" structure. These products are designed to compete with relatively newer yield tools such as Ethena's USDe and BUIDL tokens from Balancer, which Dinkelmeyer claims are already "outdated". Like USDe and BUIDL, each Midas LYT will tokenize specific trades or investment strategies to generate returns for holders. However, unlike these "quasi-stablecoins", LYT's will have a floating reference value. Dinkelmeyer argues that while these "synthetic dollars" may maintain their pegging to the dollar like traditional asset-backed stablecoins (including USDT and USDC), they are actually a completely different financial product used more for investing than as means of payment or trading pairs. LYTs address these risks by treating the hedge fund as an on-chain hedge fund and allowing the token value to track its asset performance. The first batch of Midas LYT’s will tokenize active management trading strategies from decentralized finance (DeFi) asset management companies Edge Capital, RE7 Capital and MEV Capital. In addition, unpegging the on-chain hedge funds aims at promoting investment flexibility and broadening access to assets beyond U.S Treasury bonds. According to the prospectus all Midas LYTs will share a common liquidity pool allowing atomic redemptions at face value. Each LYT is issued as an ERC-20 asset meaning they'll be composable within Ethereum DeFi space.

- 12:18Algorand Foundation invests in peer-to-peer collateral platform ValarThe Algorand Foundation announces investment in the decentralized peer-to-peer collateral platform Valar, with the specific investment amount undisclosed.