News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Wall Street’s biggest banks are finally backing Trump’s pro-crypto agenda after his new executive order cleared regulatory hurdles. Trump stacked his administration with crypto advocates, like SEC pick Paul Atkins and Treasury nominee Scott Bessent, to drive his plans. The SEC scrapped its restrictive accounting rule, SAB 121, letting banks hold crypto without the crushing capital requirements.

TRUMP token’s decline from its $79 peak reflects waning interest and trading momentum. Can breaking $34 spark a sustainable recovery?

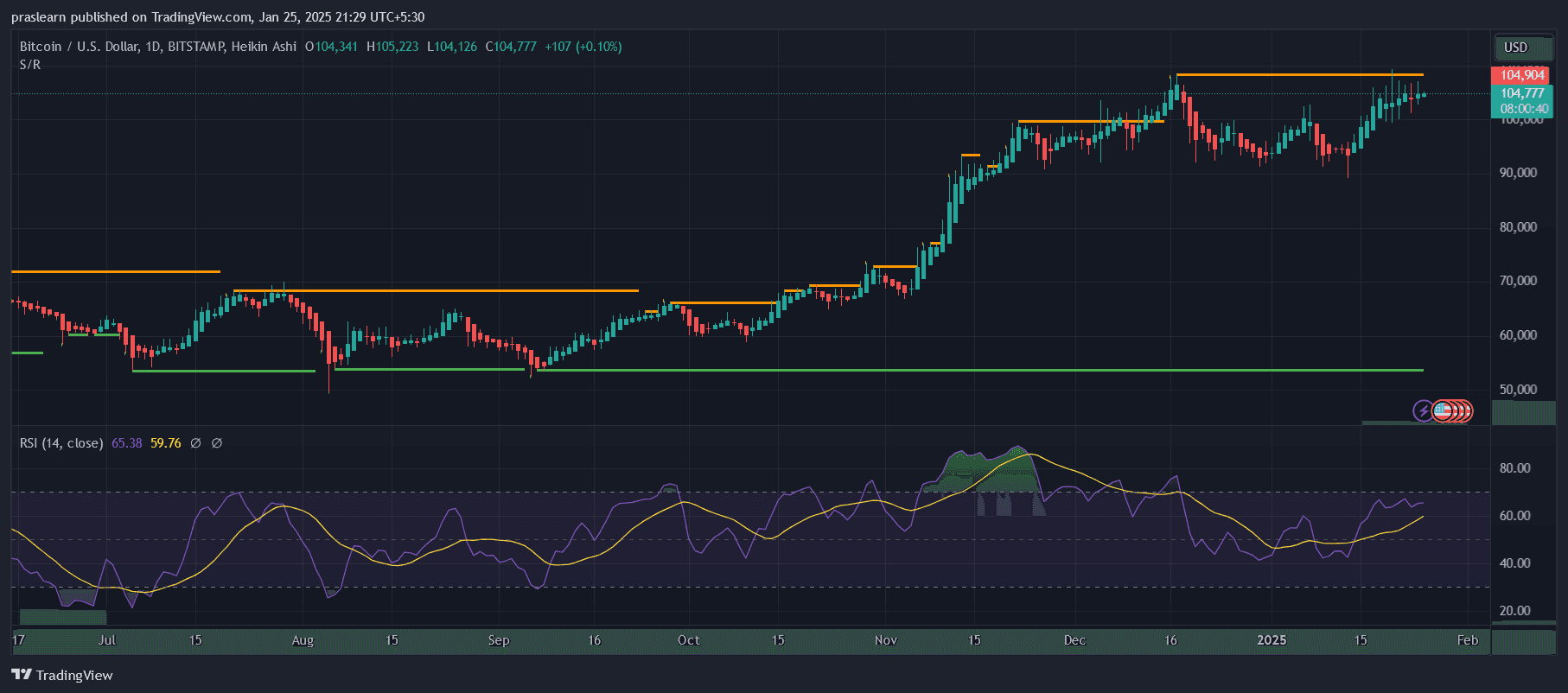

Deciphering Bitcoin's Market Behavior: Crucial Price Points under the Microscope as Financial Experts Brace for FOMC Decision

XRP's Surprising Performance: A Disruptor to U.S. BTC Reserves or Speculation Bubble in the Making?

Major token unlock events are scheduled next week for Optimism and other projects, releasing previously blocked tokens under fundraising terms. These events can lead to price volatility based on market conditions and investor reactions.

Quick Take This is an excerpt from the 20th edition of The Funding sent to our subscribers on Jan. 26. The Funding is a fortnightly newsletter written by Yogita Khatri, The Block’s longest-serving editorial member. To subscribe to the free newsletter, click here.

Quick Take The Metropolitan Museum of Art has launched a new blockchain-powered game in conjunction with TRLab that rewards players for finding connections between different works of art with NFT badges and a chance to win one of 500 Met-related prizes. The Met’s first foray into blockchain and NFT technology has the goal of deepening audience engagement with the museum’s works.

- 16:43Bitcoin Spot ETFs Total Net Outflows of $1.139 Billion Yesterday Reached a Record HighAccording to SoSoValue data, Bitcoin spot ETFs saw total net outflows of $1.139 billion yesterday (25 February EST). GBTC, the Grayscale ETF, saw a net outflow of $66,143,400 in a single day yesterday, and GBTC's historical net outflow now stands at $22,232 million. The Grayscale (Grayscale) Bitcoin Mini-Trust ETF BTC had a single-day net outflow of $85,762,800, and the total historical net inflow of Grayscale Bitcoin Mini-Trust BTC is currently $1.107 billion. As of press time, the total net asset value of the Bitcoin Spot ETF is $101.012 billion, the ETF's net asset ratio (market capitalisation over the total market capitalisation of Bitcoin) stands at 5.78%, and the cumulative historical net inflows have reached $37.878 billion.

- 16:42SAFE falls briefly to touch 0.42USDT, down 8.64% in 24HThe market showed that SAFE fell to 0.42 USDT in short term and now recovered to 0.4539 USDT, down 8.64% in 24H, or due to the impact of CEX's hacking forensics report.

- 16:01Standard Chartered: Further ETF Outflows Could Drive Bitcoin Price LowerGeoff Kendrick, Global Head of Digital Asset Research at Standard Chartered, has warned that continued outflows from the Bitcoin Spot ETF could drive the cryptocurrency's price lower, reports The Block. This comes after the ETF saw one of its largest one-day outflows on record yesterday, selling nearly $1 billion, continuing a trend of significant outflows over the past few weeks. I don't think the sell-off is over yet, with net ETF buying now losing about $1.3 billion since the U.S. election,’ he said. Since then, the average purchase price using the daily bitcoin closing price has been $97,000.’