News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Telegram Major — climb up ranks and earn Stars

Medium·2024/08/08 08:51

Over 100,000 stories in Telegram with the hashtag DOGS

Telegram·2024/08/03 02:51

On July 27 (local time), the current Republican presidential candidate Donald Trump attended the Bitcoin Conference. Essentially, the purpose of his appearance was to rally the mining community in the United States. The conference announced positive news for the mining industry, with a 12% increase in KAS over the past seven days and a noticeable net inflow of funds and traffic, indicating a certain wealth effect.

Bitget·2024/08/02 02:54

Hamster Kombat (HMSTR) Prepped for Big Airdrop, Roadmap Update, and Whitepaper Release

Bitget Academy·2024/07/31 11:13

Voyage Snapshot: Swell City Here We Come!

As the Voyage ends, a new opportunity arises to ride the waves and collect rewards every ten weeks.

Swell Blog·2024/07/31 08:17

The $AVACN token claim is open

X·2024/07/30 15:29

The AVAIL Token is Now Live on Mainnet

The AVAIL token powering the Avail ecosystem and the unification of web3 is now live on mainnet with the launch of Avail DA.

Avail Blog·2024/07/29 06:59

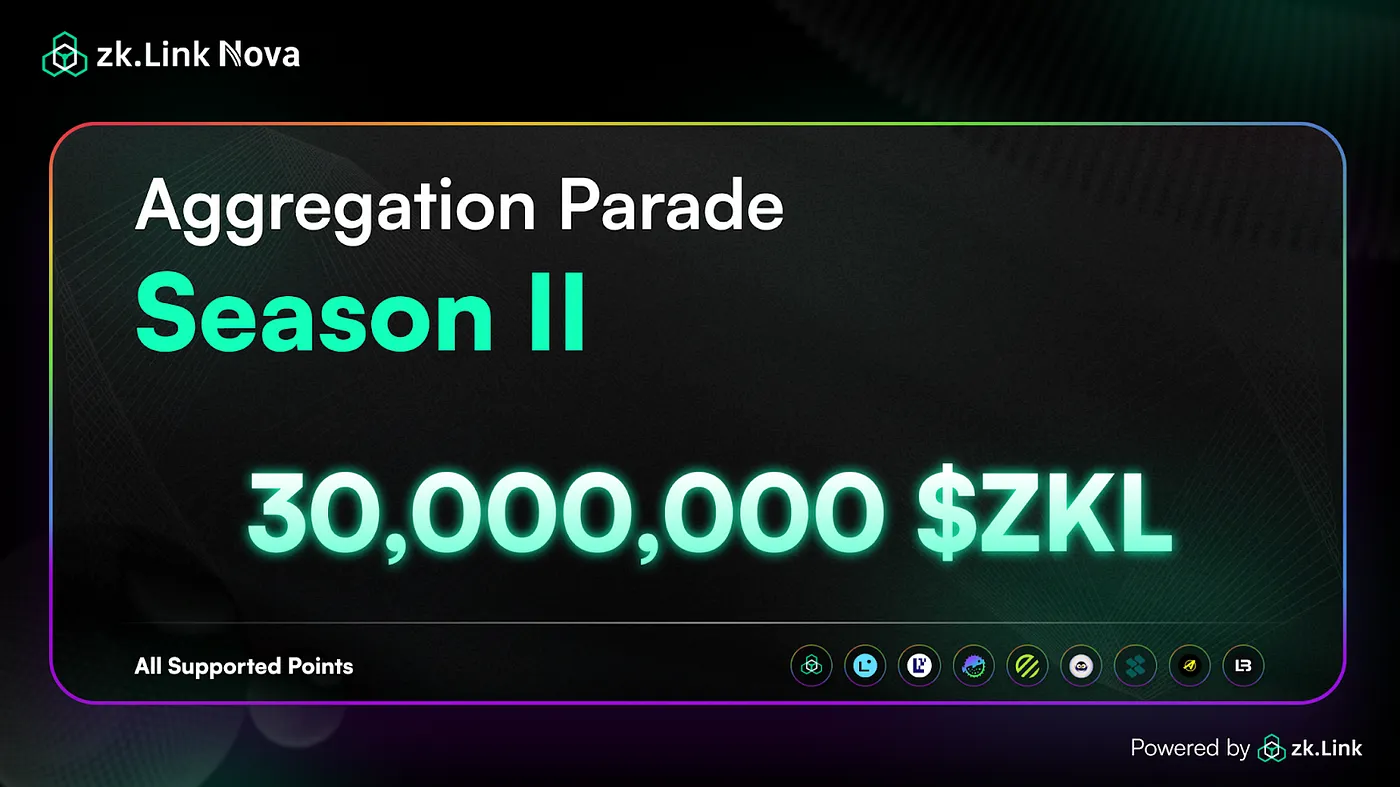

zkLINK: Aggregation Parade Season II: Join To Split A 30M $ZKL Prize Pool

zkLink Blog·2024/07/29 06:57

Time Wiki: ⏰Presale details

TimeWiki·2024/07/25 07:50

⌚Welcome to Timecoin Wiki!

Time Wiki·2024/07/25 07:47

Flash

- 02:40FIFA to launch cryptocurrencyPANews reported on March 9 that according to Crypto.news, Gianni Infantino, president of the International Football Federation (FIFA), said that the organization may develop its own cryptocurrency token. Infantino expressed FIFA's interest in creating digital tokens to interact with global fans when he attended President Trump's White House Cryptocurrency Summit on March 7. "FIFA is very interested in developing FIFA tokens, starting here, starting in the United States, to conquer 5 billion football fans around the world." "If anyone here is interested in working with FIFA, we are here, together with the United States of America, we will conquer the football world with FIFA tokens." Despite the lack of specific details or timelines, the statement hinted that FIFA is exploring blockchain technology as a potential way to attract fans and generate revenue. Trump responded: "The value of this coin may eventually exceed FIFA. In fact, it may be a very valuable token." The statement came as FIFA was preparing for the 2026 World Cup, when the United States, Canada and Mexico will co-host the World Cup. After the summit, a cryptocurrency called "FIFA" surged. The price of the token increased by 357,000% in a single day, reaching a market value of about $8.2 million. However, the token has no connection with FIFA.

- 02:38Derivatives trading protocol MYX Finance completes $5 million strategic round of financing, with participation from FL Foundation and othersAccording to ChainCatcher, the derivatives trading protocol MYX Finance announced today that it has completed a strategic round of financing. This round of financing was participated in by leading institutions such as FL Foudation, Woyong, D11-Labs, HashKey Capital, and Metalpha. Among them, D11-Labs, HashKey Capital and other institutions have previously participated in the seed round of financing of MYX Finance. This round of financing will accelerate MYX Finance's vision of creating a "chain abstraction liquidity layer", thereby solving the two major problems of DEX "liquidity" and "ease of use", while providing users with CEX-level trading experience, retaining the composability and scenario innovation potential of DEX. In November 2023, MYX Finance has completed a seed round of financing with a valuation of US$50 million led by HongShan (Sequoia China). It is reported that MYX Finance will conduct TGE in the first quarter of this year. At present, the project has launched the Pre-TGE Pioneer Reward multiple tasks on Galxe. Community users can share 200,000 MYX tokens by completing social media group tasks, trading tasks, MLP purchase tasks, etc.

- 02:23Mark Cuban: Federal spending cuts could trigger an economic downturnMark Cuban recently expressed concerns about the U.S. economic outlook, warning that significant cuts in federal government spending could trigger a chain reaction that may ultimately lead to an economic recession.