Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.03%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$85630.33 (-3.86%)Fear at Greed Index21(Extreme fear)

Total spot Bitcoin ETF netflow -$937.9M (1D); -$1.99B (7D).Coins listed in Pre-MarketMEMHASH,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.03%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$85630.33 (-3.86%)Fear at Greed Index21(Extreme fear)

Total spot Bitcoin ETF netflow -$937.9M (1D); -$1.99B (7D).Coins listed in Pre-MarketMEMHASH,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.03%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$85630.33 (-3.86%)Fear at Greed Index21(Extreme fear)

Total spot Bitcoin ETF netflow -$937.9M (1D); -$1.99B (7D).Coins listed in Pre-MarketMEMHASH,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

ARbit presyoARB

Hindi naka-list

Quote pera:

USD

Kinukuha ang data mula sa mga third-party na provider. Ang pahinang ito at ang impormasyong ibinigay ay hindi nag-eendorso ng anumang partikular na cryptocurrency. Gustong i-trade ang mga nakalistang barya? Click here

$0.0009803+0.58%1D

Price chart

Last updated as of 2025-02-26 14:27:31(UTC+0)

Market cap:--

Ganap na diluted market cap:--

Volume (24h):--

24h volume / market cap:0.00%

24h high:$1.09

24h low:$1.05

All-time high:$1.32

All-time low:$0.0001507

Umiikot na Supply:-- ARB

Total supply:

10,830,050ARB

Rate ng sirkulasyon:0.00%

Max supply:

--ARB

Price in BTC:24.28 BTC

Price in ETH:0.{6}4109 ETH

Price at BTC market cap:

--

Price at ETH market cap:

--

Mga kontrata:--

Ano ang nararamdaman mo tungkol sa ARbit ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng ARbit ngayon

Ang live na presyo ng ARbit ay $0.0009803 bawat (ARB / USD) ngayon na may kasalukuyang market cap na $0.00 USD. Ang 24 na oras na dami ng trading ay $0.00 USD. Ang presyong ARB hanggang USD ay ina-update sa real time. Ang ARbit ay 0.58% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 0 .

Ano ang pinakamataas na presyo ng ARB?

Ang ARB ay may all-time high (ATH) na $1.32, na naitala noong 2023-07-20.

Ano ang pinakamababang presyo ng ARB?

Ang ARB ay may all-time low (ATL) na $0.0001507, na naitala noong 2016-01-20.

Bitcoin price prediction

Kailan magandang oras para bumili ng ARB? Dapat ba akong bumili o magbenta ng ARB ngayon?

Kapag nagpapasya kung buy o mag sell ng ARB, kailangan mo munang isaalang-alang ang iyong sariling diskarte sa pag-trading. Magiiba din ang aktibidad ng pangangalakal ng mga long-term traders at short-term traders. Ang Bitget ARB teknikal na pagsusuri ay maaaring magbigay sa iyo ng sanggunian para sa trading.

Ayon sa ARB 4 na teknikal na pagsusuri, ang signal ng kalakalan ay Neutral.

Ayon sa ARB 1d teknikal na pagsusuri, ang signal ng kalakalan ay Neutral.

Ayon sa ARB 1w teknikal na pagsusuri, ang signal ng kalakalan ay Sell.

Ano ang magiging presyo ng ARB sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni ARB, ang presyo ng ARB ay inaasahang aabot sa $0.001186 sa 2026.

Ano ang magiging presyo ng ARB sa 2031?

Sa 2031, ang presyo ng ARB ay inaasahang tataas ng +33.00%. Sa pagtatapos ng 2031, ang presyo ng ARB ay inaasahang aabot sa $0.004084, na may pinagsama-samang ROI na +316.66%.

ARbit price history (USD)

The price of ARbit is +319597.44% over the last year. The highest price of in USD in the last year was $1.32 and the lowest price of in USD in the last year was $0.0001963.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+0.58%$1.05$1.09

7d+6.18%$0.9968$1.13

30d-3.32%$0.9780$1.23

90d+25.31%$0.7749$1.23

1y+319597.44%$0.0001963$1.32

All-time+11858.23%$0.0001507(2016-01-20, 9 taon na ang nakalipas )$1.32(2023-07-20, 1 taon na ang nakalipas )

ARbit impormasyon sa merkado

ARbit's market cap history

ARbit holdings by concentration

Whales

Investors

Retail

ARbit addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

ARbit na mga rating

Mga average na rating mula sa komunidad

4.6

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

ARB sa lokal na pera

1 ARB To MXN$0.021 ARB To GTQQ0.011 ARB To CLP$0.921 ARB To UGXSh3.611 ARB To HNLL0.031 ARB To ZARR0.021 ARB To TNDد.ت01 ARB To IQDع.د1.281 ARB To TWDNT$0.031 ARB To RSDдин.0.111 ARB To DOP$0.061 ARB To MYRRM01 ARB To GEL₾01 ARB To UYU$0.041 ARB To MADد.م.0.011 ARB To OMRر.ع.01 ARB To AZN₼01 ARB To KESSh0.131 ARB To SEKkr0.011 ARB To UAH₴0.04

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-02-26 14:27:31(UTC+0)

ARbit balita

Inilabas ang ApeChain: Ang Blockchain na Nagpapalaki sa Legacy ng BAYC na may 132% Token Surge sa Unang Araw

Ano ang ApeChain at ApeCoin? Ang ApeChain ay isang bagong inilunsad na blockchain platform na binuo sa Arbitrum technology stack. Dinisenyo ito bilang isang dedikadong layer ng imprastraktura upang paganahin ang ApeCoin ecosystem, na nakatuon sa pagbibigay ng pinakamahusay na karanasan ng user at d

Bitget Academy•2024-10-30 08:44

Anunsyo sa Pagpapatuloy ng UXLINK-Arbitrum One Mga Serbisyo sa Pag-withdraw ng Network

Bitget Announcement•2024-09-30 10:48

Paunawa ng Pagsuspinde para sa Arbitrum Pagdeposito at Pag-withdraw

Upang makapagbigay ng mas magandang karanasan sa pangangalakal, sinuspinde ng Bitget ang mga function ng pagdeposito at pag-withdraw ng Arbitrum mula Setyembre 4 (UTC) hanggang sa susunod na petsa. Pakitandaan na ang trading ay hindi maaapektuhan sa panahon ng downtime. Kapag nagdeposito at nag-wit

Bitget Announcement•2024-09-04 01:07

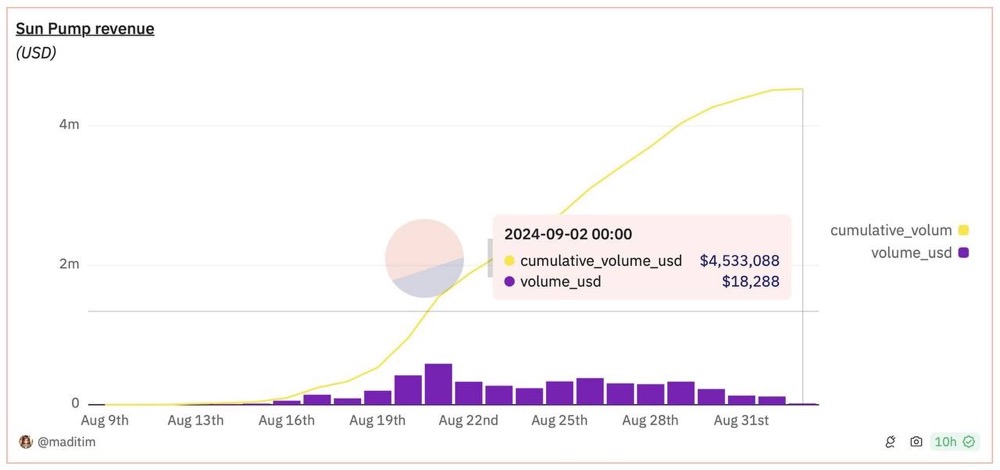

Sa Web3, Casino > Teknolohiya?

白泽研究院•2024-09-03 03:48

Paano tingnan ang kasalukuyang naratibo ng chain at ang hinaharap na pag-unlad nito

cryptoHowe.eth•2024-08-30 03:07

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng ARbit.

Ano ang kasalukuyang presyo ng ARbit?

The live price of ARbit is $0 per (ARB/USD) with a current market cap of $0 USD. ARbit's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. ARbit's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng ARbit?

Sa nakalipas na 24 na oras, ang dami ng trading ng ARbit ay $0.00.

Ano ang all-time high ng ARbit?

Ang all-time high ng ARbit ay $1.32. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa ARbit mula noong inilunsad ito.

Maaari ba akong bumili ng ARbit sa Bitget?

Oo, ang ARbit ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa ARbit?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng ARbit na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng ARbit online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng ARbit, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng ARbit. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

ARB mga mapagkukunan

Mga tag:

Mineable

Hybrid - PoW & PoS

MineableHybrid - PoW & PoS

Bitget Insights

muphy

9h

Top Altcoins to Watch in February: Which Coins Could Outperform the Market?

🔴As the crypto market evolves in February, some altcoins are positioned to outperform based on strong fundamentals, technical setups, and emerging narratives. Here are the top picks across key sectors.

---

🎯Stacks ($STX ) – The Leader in Bitcoin Layer 2

✔ Why It’s Bullish: Stacks is enabling smart contracts on Bitcoin, making it a key player in the BTC Layer 2 narrative.

✔ Catalysts:

Upcoming Stacks Nakamoto Upgrade for better scalability and security.

Institutional focus on Bitcoin-native DeFi.

✔ Key Levels: $2.50 - $3.00 resistance, looking for breakout confirmation.

---

🎯Injective ($INJ ) – DeFi’s Next Big Growth Story

✔ Why It’s Bullish: A high-performance Layer 1 blockchain built for decentralized finance (DeFi).

✔ Catalysts:

Strong developer adoption and protocol integrations.

Expanding ecosystem in perpetuals and decentralized trading.

✔ Key Levels: Needs to hold above $30 for continuation to $40+.

---

🎯 Fetch.ai ($FET ) – AI and Blockchain Innovation

✔ Why It’s Bullish: One of the top AI-driven crypto projects, benefiting from the AI market boom.

✔ Catalysts:

Increasing adoption of AI in Web3 applications.

Growing ecosystem of automation and machine-learning-based tools.

✔ Key Levels: Above $1.50 could push toward new highs.

---

🔴 Ondo Finance ($ONDO ) – Real-World Asset (RWA) Tokenization Leader

✔ Why It’s Bullish: Ondo is leading the charge in tokenized real-world assets, such as U.S. Treasury bonds.

✔ Catalysts:

Institutional interest in on-chain finance.

Real-world asset tokenization is a major 2024 narrative.

✔ Key Levels: Watch for consolidation above $0.80 before a potential run toward $1.20+.

---

🎯Immutable X ($IMX ) – Web3 Gaming Powerhouse

✔ Why It’s Bullish: Leading Layer 2 solution for gaming and NFT ecosystems.

✔ Catalysts:

More partnerships with AAA gaming studios.

Growth in blockchain gaming adoption.

✔ Key Levels: Holding above $2.50 could lead to a push toward $3.50.

---

Bonus: Sleeper Picks with High Potential

Arbitrum (ARB): Leading Ethereum Layer 2, benefiting from increasing adoption and DeFi growth.

Celestia (TIA): Modular blockchain innovation gaining traction.

Gala Games (GALA): Gaming and entertainment ecosystem showing signs of recovery.

---

➡️Final Thoughts: How to Position for February

High-Conviction Plays: Bitcoin Layer 2s, AI, and RWA tokenization projects.

Momentum Trades: DeFi and gaming tokens gaining strength.

Risk Management: Take profits on pumps and set stop-losses to protect gains.

@Muphy✍️

FET-4.21%

BTC-3.33%

Cryptofrontnews

14h

Crypto Bargains: 3 Altcoins Under $0.50 with 10x Potential in 2025

The crypto market is buzzing with Arbitrum (ARB), Sei (SEI), and XDC Network (XDC) are poised for massive growth, with game-changing innovations in scaling, decentralized trading, and trade finance

Current price: $0.4069

Market cap: $1.79B

Arbitrum maintains active involvement in blockchain innovation as an Ethereum layer-two scaling solution that uses optimistic rollups. The system handles most operations outside the Ethereum network but keeps its core features intact to deliver lower costs and decreased congestion.

The native token ARB supports Arbitrum DAO governance functions that enable token holders to participate in Arbitrum decision-making processes. The DAO framework created by Offchain Labs for Arbitrum permits ARB token holders to vote on protocol updates and both funding selections and security council member choices. An ARB token airdrop initiated on March 16, 2023 sent 12.75% of the total tokens to early users as well as Dao communities operating in the ecosystem. ARB tokens became available during the March 23rd 2023 token generation event.

Current price: $0.2695

Market cap: $1.25B

Sei Network has developed optimized infrastructure for decentralized exchanges (DEXes) that provides specialist blockchain performance specifically for trading protocols. Sei functions as the initial sector-specific Layer 1 blockchain which targets to make trading operations faster and steadier by preserving protocol stability during exchanges.

DEXes operate as fundamental trading platforms which enable asset exchange as well as NFT transactions and in-game merchandise swaps. The existing limitations within blockchain networks create scalability obstacles that affect operational continuity. Sei resolves trading difficulties through increased network reliability and lower downtime exposure while delivering fluid operations. The platform at Sei implements environmental sustainability measures to achieve carbon-neutral performance in its operational functions. The network’s development receives backing from alliances with different blockchain projects which secures its position among the ecosystem.

Current price: $0.07693

DMarket cap: $1.2B

XDC Network functions as an EVM-compatible blockchain that provides trade finance capabilities and supports real-world asset (RWA) tokenization. The network protects its transactions through Delegated Proof of Stake (DPoS) which creates an environment for rapid transactions while remaining secure and scalable. XDC Network users can create private side chains using its Layer-2 subnet system regardless of the mainnet security features they inherit.

The XDC Network implements 300 masternode candidates who can participate in blockchain security but maintains 108 active validators protecting blockchain transactions as of January 6, 2025. For validator participation one must stake 10 million XDC tokens. XDC 2.0 brought enhanced Byzantine Fault Tolerance (BFT) and forensic monitoring systems when the network upgraded during Q4 2024.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

CORE-1.41%

ARB-2.38%

Hustler🥰

15h

🎯The recent altcoin crash has left traders in a tough spot—should they hold and wait for recovery,

🎯The recent altcoin crash has left traders in a tough spot—should they hold and wait for recovery, cut losses and sell, or take advantage of lower prices and buy the dip? While market corrections can be brutal, history shows that strategic decisions during these moments often define long-term success.

Let’s break down what’s driving the decline, how to assess your portfolio, and whether this dip is a warning sign or a major buying opportunity.

---

1. Why Are Altcoins Dropping?

Several key factors are fueling the altcoin freefall:

🔻 Bitcoin Dominance is Rising

As BTC maintains dominance above 50-55%, liquidity is shifting out of altcoins.

Historically, altcoins don’t recover until BTC stabilizes.

🔻 High Leverage & Liquidations

Many traders used leverage in altcoins, leading to cascading liquidations.

Over $500M+ in longs were liquidated recently, accelerating the downturn.

🔻 Institutional Rotation & ETF Impact

Bitcoin ETFs are pulling capital away from speculative altcoins.

Institutional money is focusing on BTC and ETH, leaving smaller tokens vulnerable.

🔻 Macroeconomic Uncertainty

Federal Reserve’s rate policy and inflation concerns are limiting risk appetite.

The crypto market often struggles when traditional markets are weak.

---

2. Should You Hold, Sell, or Buy?

✅ When to HOLD

You should hold if:

✔️ The altcoin has strong fundamentals (active development, real-world adoption).

✔️ It is a long-term investment, and you believe in its future growth.

✔️ You bought at a lower price and are still in profit or near break-even.

✔️ You staked or earn passive rewards, reducing selling pressure.

Examples of strong holds:

Ethereum (ETH): The backbone of DeFi and NFTs.

Solana (SOL): Despite volatility, it has a growing ecosystem.

Chainlink (LINK): Critical for DeFi, with increasing adoption.

---

❌ When to SELL

Consider selling if:

🚩 The altcoin is down 80-90% with no recovery signs.

🚩 The project has weak fundamentals (no updates, lost community trust).

🚩 You need capital for stronger opportunities (reallocating to BTC, ETH, or stronger altcoins).

🚩 The token pumped and dumped due to hype and lacks long-term utility.

Examples of risky tokens:

Hype-driven meme coins with no real use case.

Failed DeFi or GameFi projects that have lost traction.

---

🟢 When to BUY THE DIP

Buying the dip is a good strategy if the asset has strong fundamentals and is oversold.

🔹 Best Buy Indicators:

RSI (Relative Strength Index) below 30 (indicating oversold conditions).

Retesting key support levels from past bull markets.

Whale accumulation (big players buying while retail panic sells).

Upcoming catalysts (network upgrades, new partnerships).

Best Dip-Buying Opportunities:

1️⃣ Ethereum (ETH): A long-term bet on smart contracts.

2️⃣ Solana (SOL): Fast-growing ecosystem and strong developer activity.

3️⃣ Arbitrum (ARB) & Optimism (OP): Leading Layer 2 scaling solutions.

4️⃣ AI Tokens (FET, RNDR): AI & blockchain integration is a growing trend.

5️⃣ Chainlink (LINK): Increasing partnerships make LINK a key infrastructure player.

---

3. Risk Management Strategies During a Dip

🔹 Dollar-Cost Averaging (DCA)

Invest small amounts over time instead of making a single large buy.

Reduces risk and helps you catch the bottom gradually.

🔹 Diversification

Avoid going all-in on one altcoin—spread risk across sectors (Layer 1, DeFi, AI, etc.).

BTC & ETH should remain core holdings while altcoins are high-risk, high-reward plays.

🔹 Setting Stop-Loss Orders

Protect capital by setting stop-losses at key support levels.

Helps avoid holding bags if the market turns worse.

🔹 Staking & Yield Farming

If you're holding long-term, staking assets can generate passive income.

Bitget’s staking & copy trading can help maximize returns.

---

4. Bitget Insights: How Smart Money is Trading

📊 Whale Accumulation: Some large investors are buying ETH, SOL, and LINK at lower levels.

📊 Top-Traded Pairs on Bitget: BTC/USDT, ETH/USDT, and SOL/USDT are seeing the most action.

📊 Futures Traders: Many are shorting weak altcoins but longing strong assets at key levels.

---

5. Final Thoughts: What’s Next?

This dip is testing patience, but historically, strong altcoins recover. The key is knowing what to hold, what to sell, and what to buy.

✔️ Action Plan:

✅ HOLD high-utility altcoins like ETH, SOL, and LINK.

✅ SELL weak, hype-driven tokens with no real future.

✅ BUY THE DIP on oversold, high-potential projects.

✅ USE DCA & Risk Management to navigate volatility.

BTC-3.33%

ARB-2.38%

Mahnoor-Baloch007

20h

🎯The recent altcoin crash has left traders in a tough spot—should they hold and wait for recovery

🎯The recent altcoin crash has left traders in a tough spot—should they hold and wait for recovery, cut losses and sell, or take advantage of lower prices and buy the dip? While market corrections can be brutal, history shows that strategic decisions during these moments often define long-term success.

Let’s break down what’s driving the decline, how to assess your portfolio, and whether this dip is a warning sign or a major buying opportunity.

---

1. Why Are Altcoins Dropping?

Several key factors are fueling the altcoin freefall:

🔻 Bitcoin Dominance is Rising

As BTC maintains dominance above 50-55%, liquidity is shifting out of altcoins.

Historically, altcoins don’t recover until BTC stabilizes.

🔻 High Leverage & Liquidations

Many traders used leverage in altcoins, leading to cascading liquidations.

Over $500M+ in longs were liquidated recently, accelerating the downturn.

🔻 Institutional Rotation & ETF Impact

Bitcoin ETFs are pulling capital away from speculative altcoins.

Institutional money is focusing on BTC and ETH, leaving smaller tokens vulnerable.

🔻 Macroeconomic Uncertainty

Federal Reserve’s rate policy and inflation concerns are limiting risk appetite.

The crypto market often struggles when traditional markets are weak.

---

2. Should You Hold, Sell, or Buy?

✅ When to HOLD

You should hold if:

✔️ The altcoin has strong fundamentals (active development, real-world adoption).

✔️ It is a long-term investment, and you believe in its future growth.

✔️ You bought at a lower price and are still in profit or near break-even.

✔️ You staked or earn passive rewards, reducing selling pressure.

Examples of strong holds:

Ethereum (ETH): The backbone of DeFi and NFTs.

Solana (SOL): Despite volatility, it has a growing ecosystem.

Chainlink (LINK): Critical for DeFi, with increasing adoption.

---

❌ When to SELL

Consider selling if:

🚩 The altcoin is down 80-90% with no recovery signs.

🚩 The project has weak fundamentals (no updates, lost community trust).

🚩 You need capital for stronger opportunities (reallocating to BTC, ETH, or stronger altcoins).

🚩 The token pumped and dumped due to hype and lacks long-term utility.

Examples of risky tokens:

Hype-driven meme coins with no real use case.

Failed DeFi or GameFi projects that have lost traction.

---

🟢 When to BUY THE DIP

Buying the dip is a good strategy if the asset has strong fundamentals and is oversold.

🔹 Best Buy Indicators:

RSI (Relative Strength Index) below 30 (indicating oversold conditions).

Retesting key support levels from past bull markets.

Whale accumulation (big players buying while retail panic sells).

Upcoming catalysts (network upgrades, new partnerships).

Best Dip-Buying Opportunities:

1️⃣ Ethereum (ETH): A long-term bet on smart contracts.

2️⃣ Solana (SOL): Fast-growing ecosystem and strong developer activity.

3️⃣ Arbitrum (ARB) & Optimism (OP): Leading Layer 2 scaling solutions.

4️⃣ AI Tokens (FET, RNDR): AI & blockchain integration is a growing trend.

5️⃣ Chainlink (LINK): Increasing partnerships make LINK a key infrastructure player.

---

3. Risk Management Strategies During a Dip

🔹 Dollar-Cost Averaging (DCA)

Invest small amounts over time instead of making a single large buy.

Reduces risk and helps you catch the bottom gradually.

🔹 Diversification

Avoid going all-in on one altcoin—spread risk across sectors (Layer 1, DeFi, AI, etc.).

BTC & ETH should remain core holdings while altcoins are high-risk, high-reward plays.

🔹 Setting Stop-Loss Orders

Protect capital by setting stop-losses at key support levels.

Helps avoid holding bags if the market turns worse.

🔹 Staking & Yield Farming

If you're holding long-term, staking assets can generate passive income.

Bitget’s staking & copy trading can help maximize returns.

---

4. Bitget Insights: How Smart Money is Trading

📊 Whale Accumulation: Some large investors are buying ETH, SOL, and LINK at lower levels.

📊 Top-Traded Pairs on Bitget: BTC/USDT, ETH/USDT, and SOL/USDT are seeing the most action.

📊 Futures Traders: Many are shorting weak altcoins but longing strong assets at key levels.

---

5. Final Thoughts: What’s Next?

This dip is testing patience, but historically, strong altcoins recover. The key is knowing what to hold, what to sell, and what to buy.

✔️ Action Plan:

✅ HOLD high-utility altcoins like ETH, SOL, and LINK.

✅ SELL weak, hype-driven tokens with no real future.

✅ BUY THE DIP on oversold, high-potential projects.

✅ USE DCA & Risk Management to navigate volatility.

BTC-3.33%

ARB-2.38%

muphy

1d

Altcoins in Freefall: Should You Hold, Sell, or Buy the Dip?

🎯The recent altcoin crash has left traders in a tough spot—should they hold and wait for recovery, cut losses and sell, or take advantage of lower prices and buy the dip? While market corrections can be brutal, history shows that strategic decisions during these moments often define long-term success.

Let’s break down what’s driving the decline, how to assess your portfolio, and whether this dip is a warning sign or a major buying opportunity.

---

1. Why Are Altcoins Dropping?

Several key factors are fueling the altcoin freefall:

🔻 Bitcoin Dominance is Rising

As BTC maintains dominance above 50-55%, liquidity is shifting out of altcoins.

Historically, altcoins don’t recover until BTC stabilizes.

🔻 High Leverage & Liquidations

Many traders used leverage in altcoins, leading to cascading liquidations.

Over $500M+ in longs were liquidated recently, accelerating the downturn.

🔻 Institutional Rotation & ETF Impact

Bitcoin ETFs are pulling capital away from speculative altcoins.

Institutional money is focusing on BTC and ETH, leaving smaller tokens vulnerable.

🔻 Macroeconomic Uncertainty

Federal Reserve’s rate policy and inflation concerns are limiting risk appetite.

The crypto market often struggles when traditional markets are weak.

---

2. Should You Hold, Sell, or Buy?

✅ When to HOLD

You should hold if:

✔️ The altcoin has strong fundamentals (active development, real-world adoption).

✔️ It is a long-term investment, and you believe in its future growth.

✔️ You bought at a lower price and are still in profit or near break-even.

✔️ You staked or earn passive rewards, reducing selling pressure.

Examples of strong holds:

Ethereum (ETH): The backbone of DeFi and NFTs.

Solana (SOL): Despite volatility, it has a growing ecosystem.

Chainlink (LINK): Critical for DeFi, with increasing adoption.

---

❌ When to SELL

Consider selling if:

🚩 The altcoin is down 80-90% with no recovery signs.

🚩 The project has weak fundamentals (no updates, lost community trust).

🚩 You need capital for stronger opportunities (reallocating to BTC, ETH, or stronger altcoins).

🚩 The token pumped and dumped due to hype and lacks long-term utility.

Examples of risky tokens:

Hype-driven meme coins with no real use case.

Failed DeFi or GameFi projects that have lost traction.

---

🟢 When to BUY THE DIP

Buying the dip is a good strategy if the asset has strong fundamentals and is oversold.

🔹 Best Buy Indicators:

RSI (Relative Strength Index) below 30 (indicating oversold conditions).

Retesting key support levels from past bull markets.

Whale accumulation (big players buying while retail panic sells).

Upcoming catalysts (network upgrades, new partnerships).

Best Dip-Buying Opportunities:

1️⃣ Ethereum (ETH): A long-term bet on smart contracts.

2️⃣ Solana (SOL): Fast-growing ecosystem and strong developer activity.

3️⃣ Arbitrum (ARB) & Optimism (OP): Leading Layer 2 scaling solutions.

4️⃣ AI Tokens (FET, RNDR): AI & blockchain integration is a growing trend.

5️⃣ Chainlink (LINK): Increasing partnerships make LINK a key infrastructure player.

---

3. Risk Management Strategies During a Dip

🔹 Dollar-Cost Averaging (DCA)

Invest small amounts over time instead of making a single large buy.

Reduces risk and helps you catch the bottom gradually.

🔹 Diversification

Avoid going all-in on one altcoin—spread risk across sectors (Layer 1, DeFi, AI, etc.).

BTC & ETH should remain core holdings while altcoins are high-risk, high-reward plays.

🔹 Setting Stop-Loss Orders

Protect capital by setting stop-losses at key support levels.

Helps avoid holding bags if the market turns worse.

🔹 Staking & Yield Farming

If you're holding long-term, staking assets can generate passive income.

Bitget’s staking & copy trading can help maximize returns.

---

4. Bitget Insights: How Smart Money is Trading

📊 Whale Accumulation: Some large investors are buying ETH, SOL, and LINK at lower levels.

📊 Top-Traded Pairs on Bitget: BTC/USDT, ETH/USDT, and SOL/USDT are seeing the most action.

📊 Futures Traders: Many are shorting weak altcoins but longing strong assets at key levels.

---

5. Final Thoughts: What’s Next?

This dip is testing patience, but historically, strong altcoins recover. The key is knowing what to hold, what to sell, and what to buy.

✔️ Action Plan:

✅ HOLD high-utility altcoins like ETH, SOL, and LINK.

✅ SELL weak, hype-driven tokens with no real future.

✅ BUY THE DIP on oversold, high-potential projects.

✅ USE DCA & Risk Management to navigate volatility.

BTC-3.33%

ARB-2.38%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.

Maihahambing na market cap

Sa lahat ng asset ng Bitget, ang 8 na ito ang pinakamalapit sa ARbit sa market cap.