Cryptocurrency vs. Government Currency: What’s the Difference?

We are now seeing the revolution of money. The battle between traditional government-issued currencies and cryptocurrency reshapes the financial ecosystem. This is forcing individuals, businesses, and policymakers to rethink the very nature of money itself.

While fiat currencies have ruled for centuries under government control, cryptocurrencies like Bitcoin are challenging this monopoly, presenting a borderless, censorship-resistant alternative.

But are cryptocurrencies the future of finance, or do they remain a speculative asset vulnerable to volatility and regulatory crackdowns? This article breaks down the core differences between crypto and fiat, looking at their impact on economic stability, inflation, security, and global adoption.

The key difference between cryptocurrencies and fiat currencies is who controls them.

Fiat currencies, such as the U.S. dollar (USD) and the Euro (EUR), are government-issued and centrally regulated. Their supply is controlled through monetary policies, such as interest rate adjustments and money printing.

Fiat currencies also have unlimited supplies, as governments can print more money as needed, which can lead to inflation. This happened during the 2008 financial crisis and COVID-19 stimulus programs.

On the other hand, cryptocurrencies are decentralized and operate on blockchain networks without government control. Transactions are verified through decentralized consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS.

Also, cryptocurrencies have limited supplies. For instance, Bitcoin (BTC) has a fixed cap (21 million BTC), making it resistant to inflation. Additionally, unlike fiat, crypto can be sent globally without intermediaries or banking restrictions like fiat.

One of the most significant differences between fiat currencies and cryptocurrencies is how governments regulate and recognize them. Fiat currencies operate within strict legal frameworks, while cryptocurrencies exist in a rapidly evolving regulatory landscape that varies by country.

Fiat currencies are fully regulated and enforced by law. Central banks, such as the Federal Reserve (U.S.) and the European Central Bank (ECB), control their issuance and ensure stability through monetary policies.

Conversely, cryptocurrencies operate in a legal gray area in many regions. Some countries have embraced them, while others have banned or restricted their use due to concerns over illicit activity, tax evasion, and financial stability.

While fiat transactions are private but heavily monitored, cryptocurrencies, depending on the blockchain, provide varying degrees of transparency and pseudonymity.

Fiat transactions are not publicly visible, but banks, financial institutions, and government agencies heavily track them.

Cryptocurrencies operate on public ledgers, where transactions are visible to anyone, but user identities are not directly linked to wallet addresses.

Fiat currencies have an unlimited supply controlled by governments, while many cryptocurrencies have fixed or limited issuance, making them resistant to inflation.

As mentioned earlier, fiat is issued by central banks, which can increase or decrease the money supply to influence economic conditions. However, excessive money printing can lead to inflation or hyperinflation, reducing purchasing power.

Fiat currency is naturally inflationary, as it loses value over time due to the continuous expansion of the money supply. Additionally, it has hyperinflation risks, as countries with weak economic policies can experience severe inflation, drastically devaluing their currency.

For instance, Venezuela’s inflation rate exceeded 1,000,000% in 2018 due to excessive money printing, rendering its currency nearly worthless.

Unlike fiat currency, most cryptocurrencies have a predetermined supply that cannot be changed by a central authority, making them deflationary or resistant to inflation.

Also, Ethereum moved to Proof of Stake (PoS), reducing its supply through burning mechanisms (EIP-1559).

Fiat currencies and cryptocurrencies handle transactions differently. While fiat transactions rely on banks and financial intermediaries, cryptocurrencies use decentralized blockchain networks to process payments without intermediaries.

Fiat transactions are processed through banks, payment networks (Visa, Mastercard), and financial institutions that act as intermediaries. Banks often allow fraudulent or mistaken transactions to be disputed and reversed.

Cryptocurrency, however, operates on blockchain networks, where transactions are verified by miners (Proof of Work) or validators (Proof of Stake). Transactions are sent directly between users without banks or payment processors. Once confirmed, transactions cannot be reversed, which reduces fraud but removes chargeback protections.

Security is crucial in fiat and cryptocurrency transactions, but the risks and protective measures differ. Fiat transactions rely on centralized oversight and consumer protection laws, while cryptocurrencies use cryptographic security but are vulnerable to hacking and scams.

Banks, financial regulators, and anti-fraud systems safeguard fiat transactions. However, centralization makes them vulnerable to identity theft and institutional failures. Banks employ fraud detection, encryption, and transaction monitoring to prevent unauthorized access.

Meanwhile, credit card companies and banks allow users to dispute fraudulent transactions and recover lost funds. However, government currency is poised to fiat-based fraud, including identity theft, counterfeit currency, and bank fraud, which remains a significant problem.

For example, in 2023, credit card fraud losses exceeded $30 billion worldwide, driven by data breaches and phishing attacks.

In contrast to government currency, cryptocurrencies leverage blockchain and cryptography for enhanced security, but the lack of a central authority means users bear full responsibility for protecting their funds.

Meanwhile, Crypto wallets and exchanges are frequent targets for hacks, phishing attacks, and rug pulls. Losing a private key means permanent loss of funds. For instance, the Bybit exchange was hacked in February, and hackers stole $1.4 billion in the largest single hack in crypto history.

Related: Bybit CEO: $1.4 Billion Crypto Hack Tracked, Majority Potentially Recoverable

Meanwhile, crypto users rely on self-custody security. They must safeguard their assets using hardware wallets, multi-signature security, and strong authentication methods.

One of the contrasts between fiat currencies and cryptocurrencies is their level of price stability. While fiat currencies are relatively stable thanks to central bank controls, cryptocurrencies are highly volatile, with prices fluctuating rapidly based on market demand.

Fiat currencies maintain relatively stable value due to government regulation and monetary policies.

For example, the U.S. dollar has lost over 97% of its purchasing power since 1913 due to inflation.

On the other hand, cryptocurrencies experience extreme price swings, often moving 10–20% daily due to speculation, investor sentiment, and market demand.

For example, Bitcoin reached its all-time high in January 2025, when it traded above $109,000, but it is currently trading below $88,000.

The adoption of fiat currencies and cryptocurrencies differs significantly. While fiat is universally accepted and legally required for transactions, crypto adoption is growing but remains limited due to regulatory uncertainty and volatility.

Fiat currencies are the default medium of exchange in every country. They are legally enforced, meaning businesses and individuals must accept them for transactions.

However, despite their rapid growth, cryptocurrencies are not universally accepted and face regulatory challenges that limit their mainstream use.

The environmental impact of fiat currencies and cryptocurrencies varies significantly. While fiat money production consumes physical resources, cryptocurrencies, especially Proof-of-Work (PoW) networks like Bitcoin, require high energy consumption for mining. However, newer crypto models are becoming more eco-friendly.

The production and circulation of fiat currencies involve printing banknotes, minting coins, and running financial infrastructure. For instance, the U.S. Federal Reserve prints over $700 billion in new banknotes annually, requiring vast amounts of paper and ink. While this has an environmental impact, it is relatively low compared to energy-intensive crypto mining.

On the other hand, cryptocurrency mining, particularly Proof-of-Work (PoW) blockchains, consumes vast amounts of energy due to computational mining processes. However, newer models are reducing their carbon footprint.

For instance, Bitcoin’s annual energy consumption is estimated at 86 TWh, which is comparable to Argentina’s entire electricity usage. However, more than 50% of Bitcoin mining is powered by renewable energy.

Both fiat currencies and cryptocurrencies are undergoing significant transformations due to technological advancements, regulatory shifts, and changing global economic conditions.

Governments and central banks are adapting to digital innovation by modernizing fiat currency infrastructure and exploring Central Bank Digital Currencies (CBDCs).

Related: Swiss National Bank: Crypto Not Ready for Prime Time, CBDC Is Key

Crypto markets have seen major innovations in blockchain scalability, regulation, and institutional adoption, which have driven mainstream interest and investment.

The debate between government currencies and cryptocurrencies is not limited to technology but also concerns the future of money itself. Government currencies have long been the foundation of global economies, offering stability, government backing, and universal acceptance. However, they are susceptible to inflation, central control, and economic manipulation.

Conversely, cryptocurrencies represent a decentralized, transparent, and borderless alternative that empowers individuals to control their wealth without intermediaries. Yet, their volatility, regulatory uncertainty, and security risks remain significant challenges to mass adoption.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Crypto Exchange Storage: Why “Not Your Keys, Not Your Coins”

Coin storage is a crucial aspect of cryptocurrency ownership and use. Most new cryptocurrency users adopt centralized exchanges for coin storage, and their reasons are understandable.

For instance, crypto exchanges are most users’ gateway into the crypto industry. They serve purposes like providing options to buy and trade cryptos easily. However, it is crucial to understand the inherent risks of leaving one’s crypto assets on such exchanges.

Apart from buying and trading cryptos, most centralized exchanges provide extended services that benefit crypto users.

Staking, lending, margin trading, and consistent liquidity represent some features that attract crypto users to centralized exchanges. Such users store their assets in custodial wallets on the exchanges to make it easy for them to carry out their activities. The question is whether a crypto holder would choose convenience over security.

Major Risks of Centralized Exchange Crypto Storage

No matter the attractive features of a centralized exchange, it is incomparable with the cons associated with centralized exchanges, it is nothing compared to the cons associated with centralized exchanges, especially when there is a superior alternative. The three major risks associated with using centralized exchanges include:

Centralized exchanges are prime targets for hackers because of the significant volume of funds they store and control. In a recent attack, hackers stole about $1.5 billion worth of digital assets from Bybit, marking the largest single attack theft in the history of cryptocurrency. Prior to now, there have been other high-profile hacks affecting top crypto exchanges like Mt. Gox and Binance.

Keeping your assets on such exchanges may put you in the line of fire, exposing you as collateral damage in the middle of the crossfire between the platforms and hackers.

Storing your crypto assets on platforms where you do not control the private keys means you have given up control of your wealth. The exchanges holding and controlling the keys can decide on what to do with the assets without your permission. For instance, centralized exchanges can decide to freeze a user’s account or impose withdrawal limits. Funds on centralized exchanges can become inaccessible in the face of bankruptcy, as seen in FTX’s situation.

Centralized exchanges collect sensitive personal information for KYC purposes. That is a regulatory requirement in many jurisdictions, meaning that users must submit such data to the platforms.

This requirement leaves users vulnerable, as they rely on the platform’s security infrastructure for their data safety. There have been several cases of data breaches where users’ data gets exposed, leaving them at risk of more severe implications.

Contrary to storing crypto on centralized exchanges, it is better to adopt non-custodial wallets where you have total control of your digital assets.

It is crucial to note the relative inconvenience this might pose, especially for users who engage in active trading or want to explore the extra features that centralized exchanges provide.

The level of security between both systems is incomparable, including the elimination of data privacy concerns. However, crypto practitioners using non-custodial wallets engage with centralized exchanges momentarily, exposing only a portion of their assets for specifics like trading and staking.

Thus, the bulk of their funds remain safe under their control and away from the prying eyes of hackers.

It is crucial to balance between custodial and non-custodial storage systems when trying to make the most out of one’s crypto adventure. As an individual crypto user, restricting yourself to non-custodial wallets might limit the benefits you can derive from the crypto industry.

Typically, you may need to adopt the following steps to maximize the opportunities the industry provides.

This is a risk management method where you can divide your assets between non-custodial wallets and centralized exchanges. This method is ideal for those involved in active crypto trading or explorers of the various features that centralized exchanges provide. Typically, you would store the bulk of your assets away from the exchange and keep only a part of your holdings on the platform for ease of access.

Several exchanges are offering a variety of crypto services. Do not get carried away by enticing offers with exciting returns.

Stick to well-known exchanges that have proven their reliability over time. In case you choose to go with an emerging platform, be sure to research them properly to ascertain their genuineness and the reliability of their services. Note that even reputable platforms are not immune to attacks and system failures.

Always follow developments in the crypto industry by tracking the news. That will allow you to access critical information, keeping you ahead with potential risks and opportunities.

Ensure that you keep the private keys of your non-custodial wallet in a safe place, where you would not lose them and where they are unreachable to anyone else. Do not share the keys with other people, and avoid using them on unsecured devices.

Your choice of crypto storage system has a lot to do with your investment habit. If you engage in daily active trading, you may need to adopt the services of centralized exchanges often, especially for those features that are not available under non-custodial storage. However, you must understand the potential risks involved.

At the same time, for any crypto asset not under active trading, staking, or any other investment instrument, your best option would be to keep them in non-custodial storage. A hybrid approach combined with proper monitoring of the crypto environment will help you to maximize your opportunities as a crypto practitioner without exposing yourself to unnecessary risks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

最低價

最低價 最高價

最高價

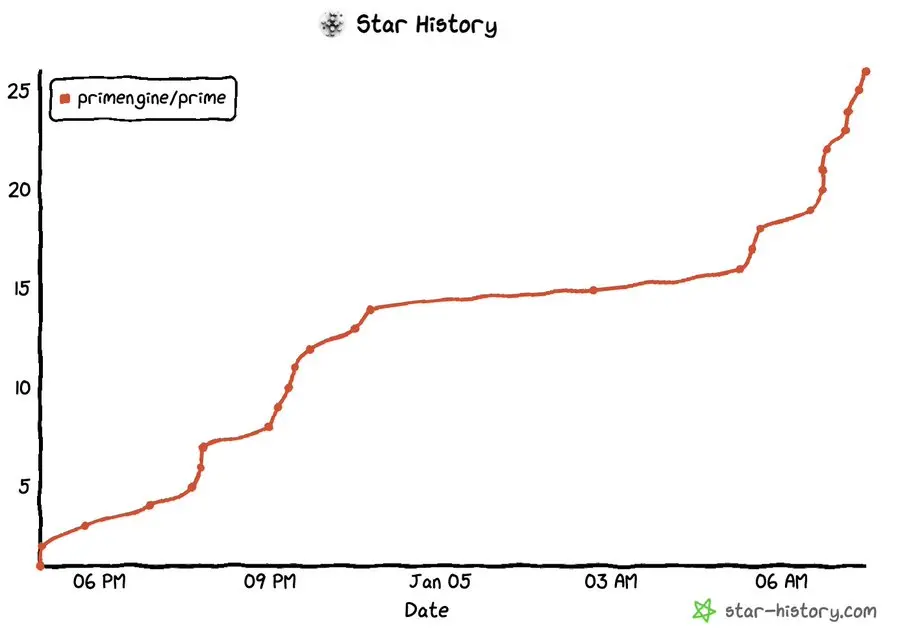

Echelon Prime 社群媒體數據

過去 24 小時,Echelon Prime 社群媒體情緒分數是 2.7,社群媒體上對 Echelon Prime 價格走勢偏向 看跌。Echelon Prime 社群媒體得分是 67,171,在所有加密貨幣中排名第 306。

根據 LunarCrush 統計,過去 24 小時,社群媒體共提及加密貨幣 1,058,120 次,其中 Echelon Prime 被提及次數佔比 0%,在所有加密貨幣中排名第 454。

過去 24 小時,共有 23 個獨立用戶談論了 Echelon Prime,總共提及 Echelon Prime 40 次,然而,與前一天相比,獨立用戶數 減少 了 39%,總提及次數減少。

Twitter 上,過去 24 小時共有 3 篇推文提及 Echelon Prime,其中 33% 看漲 Echelon Prime,67% 篇推文看跌 Echelon Prime,而 0% 則對 Echelon Prime 保持中立。

在 Reddit 上,最近 24 小時共有 0 篇貼文提到了 Echelon Prime,相比之前 24 小時總提及次數 減少 了 0%。

社群媒體資訊概況

2.7