Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

Comedian priceBAN

How do you feel about Comedian today?

Price of Comedian today

What is the highest price of BAN?

What is the lowest price of BAN?

Comedian price prediction

What will the price of BAN be in 2026?

What will the price of BAN be in 2031?

Comedian price history (USD)

Lowest price

Lowest price Highest price

Highest price

Comedian market information

Comedian market

Comedian holdings by concentration

Comedian addresses by time held

Comedian ratings

About Comedian (BAN)

What Is Comedian?

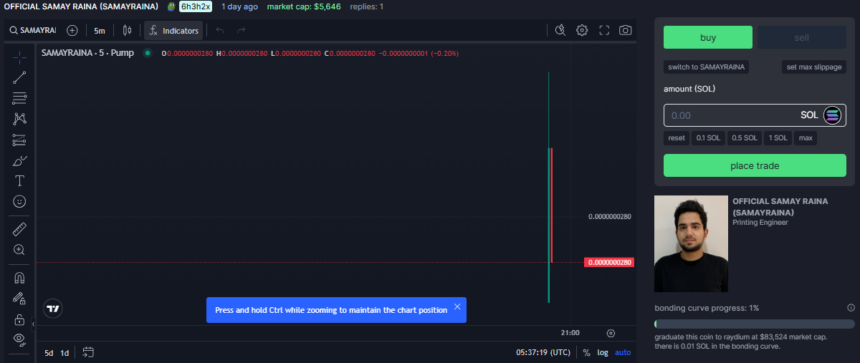

Comedian is a meme coin on the Solana blockchain. It is inspired by Maurizio Cattelan's well-known artwork, Comedian, which features a banana taped to a wall—a concept that became a viral sensation in the art world. This satirical take on high-value art, which sparked debate about value and symbolism, led to the launch of the BAN token.

Created by Michael Bouhanna, a Sotheby’s employee and digital art and NFT expert, Comedian was introduced as a project independent of his professional role at the auction house. The token quickly caught the attention of the cryptocurrency community, generating significant trading activity within days of its launch on the Pump.Fun platform in October 2024.

How Comedian Works

Comedian operates as a meme coin, a type of cryptocurrency that gains value through community interest and internet virality rather than underlying utility or technology advancements. Built on the Solana blockchain, Comedian benefits from Solana's quick transaction speeds and lower fees compared to more congested networks, such as Ethereum.

Meme coins like Comedian typically aim to attract attention through humor, culture, and internet trends. The value of Comedian is influenced mainly by market sentiment and speculative trading rather than intrinsic blockchain functionality or a decentralized protocol design. Its popularity surged when investors saw rapid returns, fueled by viral sharing and community enthusiasm rather than structured marketing or developmental efforts.

What Is BAN Token Used For?

The BAN token, which represents Comedian on the Solana blockchain, functions primarily as a digital asset within the speculative meme coin market. Unlike utility tokens or decentralized finance (DeFi) tokens, which may offer staking, voting rights, or other in-platform uses, BAN’s primary function is as a tradeable asset. Holders of BAN are mostly driven by the potential for short-term profit due to market fluctuations, which has characterized many meme coins’ appeal.

While the token does not have specific use cases or features, it has attracted crypto traders who employ strategic buying and selling during price surges. Since Bouhanna’s identity as the founder became public, he has stated that he did not anticipate the token’s rapid rise and emphasized that he has not promoted BAN or endorsed its investment potential.

Conclusion

Comedian and its BAN token are part of the meme coin market on the Solana blockchain, driven by community interest and internet culture. While offering an unconventional investment opportunity inspired by modern art, potential investors should understand the speculative nature of meme coins and exercise caution due to the inherent volatility in this market segment.

BAN to local currency

- 1

- 2

- 3

- 4

- 5

How to buy Comedian(BAN)

Create Your Free Bitget Account

Verify Your Account

Convert Comedian to BAN

Trade BAN perpetual futures

After having successfully signed up on Bitget and purchased USDT or BAN tokens, you can start trading derivatives, including BAN futures and margin trading to increase your income.

The current price of BAN is $0.05870, with a 24h price change of -0.17%. Traders can profit by either going long or short onBAN futures.

Join BAN copy trading by following elite traders.

Comedian news

ShibaBitcoin ($SHIBTC) simplifies digital payments, enabling seamless transactions, gaming purchases, and global transfers at low costs. Comedian ($BAN) merges satire with crypto speculation, reflecting meme coin volatility and the impact of social media-driven hype. AI Companions ($AIC) redefines digital relationships with AI-powered virtual partners, enhancing user interactions in the metaverse.

Buy more

FAQ

What is the current price of Comedian?

What is the 24 hour trading volume of Comedian?

What is the all-time high of Comedian?

Can I buy Comedian on Bitget?

Can I get a steady income from investing in Comedian?

Where can I buy Comedian with the lowest fee?

Where can I buy Comedian (BAN)?

Video section — quick verification, quick trading

BAN resources

Bitget Insights

Related assets