meme (Ordinals) 價格MEME

您今天對 meme (Ordinals) 感覺如何?

meme (Ordinals) 今日價格

MEME 的最高價格是多少?

MEME 的最低價格是多少?

meme (Ordinals) 價格預測

什麼時候是購買 MEME 的好時機? 我現在應該買入還是賣出 MEME?

MEME 在 2026 的價格是多少?

MEME 在 2031 的價格是多少?

meme (Ordinals) 價格歷史(USD)

最低價

最低價 最高價

最高價

meme (Ordinals) 市場資訊

meme (Ordinals) 行情

meme (Ordinals) 持幣

meme (Ordinals) 持幣分布矩陣

meme (Ordinals) 持幣分布集中度

meme (Ordinals) 地址持有時長分布

meme (Ordinals) 評級

meme (Ordinals) (MEME) 簡介

MEME幣種 - 創新加密貨幣的新時代象徵

近年來,加密貨幣在全球經濟地位越趨重要。這個全球性的數字擴張現象為消費者、企業和投資者提供了一種新的資產類型- MEME幣種。MEME幣種不僅將成為金融科技革新的典範,更是反映了加密貨幣深刻且多面向的社會影響。

MEME的起源與意義

MEME幣種是一種被稱為去中心化金融(DeFi)的新類型加密貨幣的代表。MEME的思維方式與傳統金融相矛盾,主張金融權力應該歸還給人民,而非僅僅由幾個大型金融機構所控制。數字資產的所有權由其所有者直接控制,不需要中介就能自由交易。

MEME的應用

MEME幣種不僅僅是一種投資工具。它也是NFT(非同質化代幣)的一種形式,適合用於收藏、遊戲或虛擬世界的應用。這使得MEME幣種在數字藝術品市場,甚至在實體物品市場有了實際的使用價值。

MEME的投資價值

在投資者看來,MEME幣種有著巨大的潛力。它的去中心化特性,不受特定國家或政策影響。况且,隨著更多的人開始認可數字資產,MEME幣種的需求和價值也將繼續上升。

結語

通过对MEME Token的介绍,我们能够看出加密货币市场增长的势头。其实,每一种加密货币都有其特别的历史、功能和影响力。作为一个全新的数字领域,加密货币正在为我们揭示一个既激动人心又充满未知的财务未来。

MEME 兌換當地法幣匯率表

- 1

- 2

- 3

- 4

- 5

如何購買 meme (Ordinals)(MEME)

建立您的免費 Bitget 帳戶

認證您的帳戶

將 meme (Ordinals) 兌換為 MEME

交易 MEME 永續合約

在 Bitget 上註冊並購買 USDT 或 MEME 後,您可以開始交易衍生品,包括 MEME 合約和槓桿交易,增加收益。

MEME 的目前價格為 $0.006846,24 小時價格變化為 -3.54%。交易者可透過做多或做空 MEME 合約獲利。

meme (Ordinals) 動態

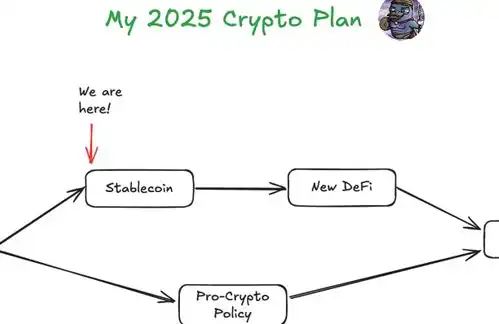

MEME 熱潮退去後,Solana 鏈上交易量斷崖式下跌超 90%;驗證者節點 7%-8% 的質押收益率如同黑洞般吸走流動性,借貸協議在收益率壓制下舉步維艱。

簡單來說 Magpie 推出了 Hyperpie 集成 DeFi 在 Hyperliquid 上推出之前,生態系統實現了流動性質押、MEME 代幣化和區塊鏈內的鏈上交易。

購買其他幣種

用戶還在查詢 meme (Ordinals) 的價格。

meme (Ordinals) 的目前價格是多少?

meme (Ordinals) 的 24 小時交易量是多少?

meme (Ordinals) 的歷史最高價是多少?

我可以在 Bitget 上購買 meme (Ordinals) 嗎?

我可以透過投資 meme (Ordinals) 獲得穩定的收入嗎?

我在哪裡能以最低的費用購買 meme (Ordinals)?

影片部分 - 快速認證、快速交易

Bitget 觀點

相關資產