Bitget:全球日交易量排名前 4!

BTC 市占率61.10%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$81120.02 (+0.89%)恐懼與貪婪指數24(極度恐懼)

比特幣現貨 ETF 總淨流量:-$278.4M(1 天);-$923.3M(7 天)。盤前交易幣種WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率61.10%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$81120.02 (+0.89%)恐懼與貪婪指數24(極度恐懼)

比特幣現貨 ETF 總淨流量:-$278.4M(1 天);-$923.3M(7 天)。盤前交易幣種WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率61.10%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$81120.02 (+0.89%)恐懼與貪婪指數24(極度恐懼)

比特幣現貨 ETF 總淨流量:-$278.4M(1 天);-$923.3M(7 天)。盤前交易幣種WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

OneFinity 價格ONE

未上架

報價幣種:

USD

數據來源於第三方提供商。本頁面和提供的資訊不為任何特定的加密貨幣提供背書。想要交易已上架幣種? 點擊此處

$0.05738+9.58%1D

價格走勢圖

最近更新時間 2025-03-11 15:43:19(UTC+0)

市值:$250,836.44

完全稀釋市值:$250,836.44

24 小時交易額:$407.22

24 小時交易額/市值:0.16%

24 小時最高價:$0.05757

24 小時最低價:$0.04905

歷史最高價:$0.8604

歷史最低價:$0.03751

流通量:4,371,636 ONE

總發行量:

25,543,088ONE

流通率:17.00%

最大發行量:

25,546,534ONE

以 BTC 計價:0.{6}7073 BTC

以 ETH 計價:0.{4}3009 ETH

以 BTC 市值計價:

$368,078.2

以 ETH 市值計價:

$52,609.2

合約:

ONE-f9...-f9954f(Elrond)

您今天對 OneFinity 感覺如何?

注意:此資訊僅供參考。

OneFinity 今日價格

OneFinity 的即時價格是今天每 (ONE / USD) $0.05738,目前市值為 $250,836.44 USD。24 小時交易量為 $407.22 USD。ONE 至 USD 的價格為即時更新。OneFinity 在過去 24 小時內的變化為 9.58%。其流通供應量為 4,371,636 。

ONE 的最高價格是多少?

ONE 的歷史最高價(ATH)為 $0.8604,於 2024-03-14 錄得。

ONE 的最低價格是多少?

ONE 的歷史最低價(ATL)為 $0.03751,於 2023-12-28 錄得。

OneFinity 價格預測

什麼時候是購買 ONE 的好時機? 我現在應該買入還是賣出 ONE?

在決定買入還是賣出 ONE 時,您必須先考慮自己的交易策略。長期交易者和短期交易者的交易活動也會有所不同。Bitget ONE 技術分析 可以提供您交易參考。

根據 ONE 4 小時技術分析,交易訊號為 中立。

根據 ONE 1 日技術分析,交易訊號為 強力賣出。

根據 ONE 1 週技術分析,交易訊號為 強力賣出。

ONE 在 2026 的價格是多少?

根據 ONE 的歷史價格表現預測模型,預計 ONE 的價格將在 2026 達到 $0.05604。

ONE 在 2031 的價格是多少?

2031,ONE 的價格預計將上漲 +5.00%。 到 2031 底,預計 ONE 的價格將達到 $0.08264,累計投資報酬率為 +57.20%。

OneFinity 價格歷史(USD)

過去一年,OneFinity 價格上漲了 -91.78%。在此期間, 兌 USD 的最高價格為 $0.8604, 兌 USD 的最低價格為 $0.04905。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h+9.58%$0.04905$0.05757

7d-7.04%$0.04905$0.06928

30d-32.46%$0.04905$0.08581

90d-75.54%$0.04905$0.2568

1y-91.78%$0.04905$0.8604

全部時間-34.10%$0.03751(2023-12-28, 1 年前 )$0.8604(2024-03-14, 362 天前 )

OneFinity 市場資訊

OneFinity 持幣分布集中度

巨鯨

投資者

散戶

OneFinity 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

OneFinity 評級

社群的平均評分

4.6

此內容僅供參考。

ONE 兌換當地法幣匯率表

1 ONE 兌換 MXN$1.171 ONE 兌換 GTQQ0.441 ONE 兌換 CLP$53.881 ONE 兌換 UGXSh210.561 ONE 兌換 HNLL1.471 ONE 兌換 ZARR1.051 ONE 兌換 TNDد.ت0.181 ONE 兌換 IQDع.د75.161 ONE 兌換 TWDNT$1.891 ONE 兌換 RSDдин.6.151 ONE 兌換 DOP$3.591 ONE 兌換 MYRRM0.251 ONE 兌換 GEL₾0.161 ONE 兌換 UYU$2.431 ONE 兌換 MADد.م.0.561 ONE 兌換 OMRر.ع.0.021 ONE 兌換 AZN₼0.11 ONE 兌換 SEKkr0.581 ONE 兌換 KESSh7.411 ONE 兌換 UAH₴2.38

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-03-11 15:43:19(UTC+0)

OneFinity 動態

KOL修練指南:如何在社群網路上擴大受眾?

Panews•2025-02-28 22:30

以太坊做空倉位一週激增40%,空頭回補還是回天乏術?

Abmedia•2025-02-10 01:15

Velar 向聯合 Stacks 社區推出“.BTC 名稱授予計劃”

簡單來說 Velar 推出了“.BTC 名稱授予計劃”,以促進 Stacks 上數位身分的標準化,並推動“.btc”數位身分標準在比特幣生態系統中更廣泛的採用。

Mpost•2025-01-31 11:33

有雷慎入!《魷魚遊戲》第二季這個玩家竟是知名炒幣 Youtuber?導演想表達什麼社會現象?

Abmedia•2024-12-26 23:15

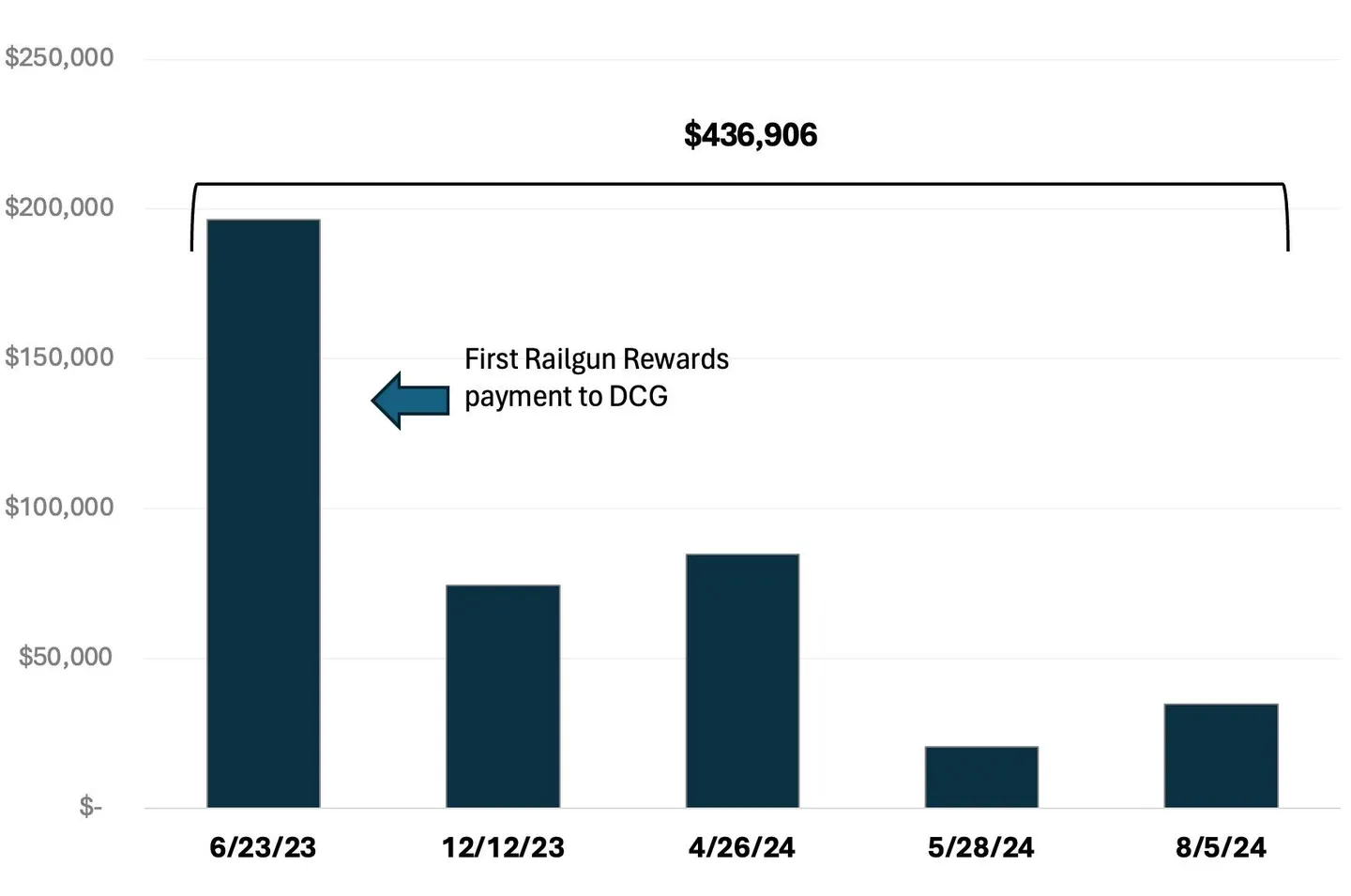

福布斯:DCG 是否從朝鮮黑客洗錢活動中獲利?

DCG 去年 6 月至今從混幣器 Railgun 獲得了約 43 萬美元資金。有調查顯示,Railgun 可能涉嫌朝鮮黑客集團 Lazarus Group 的非法洗錢活動。

Chaincatcher•2024-11-02 00:33

購買其他幣種

用戶還在查詢 OneFinity 的價格。

OneFinity 的目前價格是多少?

OneFinity 的即時價格為 $0.06(ONE/USD),目前市值為 $250,836.44 USD。由於加密貨幣市場全天候不間斷交易,OneFinity 的價格經常波動。您可以在 Bitget 上查看 OneFinity 的市場價格及其歷史數據。

OneFinity 的 24 小時交易量是多少?

在最近 24 小時內,OneFinity 的交易量為 $407.22。

OneFinity 的歷史最高價是多少?

OneFinity 的歷史最高價是 $0.8604。這個歷史最高價是 OneFinity 自推出以來的最高價。

我可以在 Bitget 上購買 OneFinity 嗎?

可以,OneFinity 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 指南。

我可以透過投資 OneFinity 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 OneFinity?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

在哪裡可以購買加密貨幣?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 OneFinity)具有市場風險。Bitget 為您提供購買 OneFinity 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 OneFinity 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

Jack*Liam

3小時前

Predicting the future price of $BMT is a bit tricky, but let's dive into some forecasts. According to various sources, $BMT's price is expected to fluctuate in the coming months and years ¹ ² ³.

*Short-term predictions:*

- Some forecasts suggest that $BMT's price will remain relatively stable, with a potential increase to $0.005385 by the end of 2025 ³.

- Others predict a slight decrease in price, with $BMT potentially reaching $0.001867 tomorrow ³.

*Long-term predictions:*

- One source suggests that $BMT's price could reach $14.24 by the end of 2025, with a potential gain of 372.61% ².

- Another forecast predicts that $BMT's price will increase to $0.009088 by 2030, with a potential gain of 386.77% ³.

It's essential to note that these predictions are based on technical analysis and should not be considered as investment advice. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly.

As for whether $BMT will pump or dump in the future, it's impossible to predict with certainty. However, some sources suggest that $BMT has a bullish sentiment for the month ahead, with a potential gain of 302.32% ².

Keep in mind that investing in cryptocurrencies carries risks, and it's crucial to do your own research and consider your own risk tolerance before making any investment decisions.

BMT+857.40%

S+0.63%

Dippy.eth_

3小時前

#ZEREBRO is almost at ZERO BRO

Feels like you got rugged if you didn't sell since January

I almost roundtripped all my profit here. Solana fugged this one up

UP-5.15%

ZEREBRO0.00%

Xzender-Trader

3小時前

The world of blockchain and cryptocurrency is rapidly evolving, with new projects and innovations e

The world of blockchain and cryptocurrency is rapidly evolving, with new projects and innovations emerging daily. One project that has been gaining significant attention in recent times is $MINT, a blockchain and cryptocurrency ecosystem that prioritizes security, decentralization, and community involvement. In this article, we'll delve into the world of $MINT, exploring its features, benefits, and potential use cases.

*What is $MINT?*

$MINT is a blockchain and cryptocurrency ecosystem that utilizes a decentralized, open-source protocol to facilitate secure, fast, and low-cost transactions. The project's native cryptocurrency, also called $MINT, is used to power the ecosystem and incentivize participants to contribute to the network.

*Key Features of $MINT*

So, what makes $MINT unique? Here are some of the project's key features:

1. *Decentralized Governance*: $MINT operates on a decentralized governance model, where decision-making power is distributed among network participants.

2. *Consensus Algorithm*: $MINT utilizes a proof-of-stake (PoS) consensus algorithm, which ensures that the network is secure, energy-efficient, and resistant to centralization.

3. *Smart Contract Functionality*: $MINT supports smart contract functionality, enabling developers to build decentralized applications (dApps) on top of the network.

4. *Cross-Chain Interoperability*: $MINT enables seamless interactions between different blockchain networks, promoting interoperability and expanding the reach of the ecosystem.

*Benefits of $MINT*

So, what are the benefits of using $MINT? Here are some of the most significant advantages:

1. *Security*: $MINT's decentralized governance model and PoS consensus algorithm ensure that the network is secure and resistant to centralization.

2. *Scalability*: $MINT's smart contract functionality and cross-chain interoperability enable the network to scale efficiently and support a wide range of use cases.

3. *Community Involvement*: $MINT's decentralized governance model ensures that community members have a say in the direction of the project, promoting transparency and accountability.

4. *Low Transaction Fees*: $MINT's low transaction fees make it an attractive option for individuals and businesses looking to reduce their transaction costs.

*Potential Use Cases of $MINT*

So, what are the potential use cases of $MINT? Here are some of the most exciting applications:

1. *Decentralized Finance (DeFi)*: $MINT's smart contract functionality and cross-chain interoperability make it an ideal platform for DeFi applications, such as lending, borrowing, and trading.

2. *Gaming*: $MINT's low transaction fees and fast transaction times make it an attractive option for gaming applications, such as in-game purchases and rewards.

3. *Supply Chain Management*: $MINT's decentralized governance model and smart contract functionality make it an ideal platform for supply chain management applications, such as tracking and verification.

4. *Social Media*: $MINT's decentralized governance model and smart contract functionality make it an attractive option for social media applications, such as decentralized social networks and content sharing platforms.

*Conclusion*

In conclusion, $MINT is a blockchain and cryptocurrency ecosystem that prioritizes security, decentralization, and community involvement. With its decentralized governance model, PoS consensus algorithm, smart contract functionality, and cross-chain interoperability, $MINT is poised to become a leading player in the blockchain and cryptocurrency space.

*FAQs*

Q: What is the native cryptocurrency of the $MINT ecosystem?

A: The native cryptocurrency of the $MINT ecosystem is also called $MINT.

Q: What consensus algorithm does $MINT utilize?

A: $MINT utilizes a proof-of-stake (PoS) consensus algorithm.

Q: What are the potential use cases of $MINT?

A: The potential use cases of $MINT include decentralized finance (DeFi), gaming, supply chain management, and social media.

SOCIAL0.00%

GAME-5.85%

WasimM

3小時前

Assessing the Bearish Risks for $ELX Amid Market Downturns

Assessing the bearish risks for $ELX amid market downturns requires a thorough analysis of various factors. To start, let's consider the current market conditions. The Nasdaq 100 has officially entered correction territory, defined as a decline of 10% or more from recent highs.¹ This milestone represents a significant shift in sentiment for a market that has been primarily driven by large-cap technology stocks.

*Key Factors Contributing to Bearish Risks*

- _Overvaluation in the Technology Sector_: Growing concerns about overvaluation in the technology sector, particularly among the largest components that had previously led market gains, are contributing to the bearish risks.

- _Recession Fears_: Investor sentiment has deteriorated as recession fears mount, making the sector's high-growth nature more vulnerable to economic downturns.

- _Interest Rate Expectations_: Markets are now pricing in three interest rate cuts for 2025, a significant adjustment from previous expectations, reflecting growing concerns about economic momentum.

*Bearish Candlestick Patterns to Watch*

- _Hanging Man_: A bearish reversal pattern that appears at the end of an uptrend, indicating that sellers pushed prices lower during the session, but buyers managed to bring the price back up.²

- _Dark Cloud Cover_: A two-candlestick pattern that signals a bearish reversal, indicating that sellers have taken control, potentially leading to further price declines.

- _Bearish Engulfing_: A pattern that consists of two candlesticks: a small bullish candlestick and a larger bearish engulfing candle that completely engulfs the previous one, indicating that sellers have overwhelmed buyers.

*Risk Management Strategies*

- _Stop-Loss Orders_: Set stop-loss orders to limit potential losses and take-profit points to secure gains.

- _Diversification_: Diversify your portfolio to minimize risk and maximize potential returns.

- _Technical Analysis_: Combine bearish patterns with technical indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), to enhance their reliability and effectiveness.

CLOUD-1.65%

ELX+13.38%

OMO_LOLA

3小時前

$MINT Blockchain and Cryptocurrency: A Secure and Decentralized Ecosystem

The $MINT Blockchain and its associated cryptocurrency form a cutting-edge system designed to offer decentralized, secure, and scalable solutions for a wide variety of applications. In this article, we will explore the core concepts behind $MINT , including its blockchain architecture, use cases, key features, security mechanisms, and the role of its native cryptocurrency.

1. Introduction to $MINT Blockchain

The$MINT Blockchain is a decentralized platform that facilitates secure, transparent, and efficient transactions. It is designed to enable the development of dApps (decentralized applications), smart contracts, and other blockchain-powered solutions. The ecosystem relies on blockchain technology to eliminate intermediaries, reduce transaction costs, and enhance security.

2. Key Components of the$MINT Blockchain Ecosystem

a. $MINT Blockchain Protocol

The core of the $MINT ecosystem is its blockchain protocol, which is responsible for handling the distributed ledger that tracks all transactions across the network. This protocol ensures consensus among network participants and validates transactions in a way that is immutable and transparent.

The $MINT Blockchain adopts a hybrid consensus mechanism that balances scalability, security, and decentralization. It may incorporate elements from popular consensus algorithms like Proof of Stake (PoS) or Delegated Proof of Stake (DPoS), which enables faster and more energy-efficient transactions compared to traditional Proof of Work (PoW) systems.

b. Native Cryptocurrency: $MINT Token

$MINT ’s native cryptocurrency, the $MINT token, serves as the medium of exchange within the blockchain network. It is used for paying transaction fees, staking, and rewarding network participants for their role in maintaining the system.

Transaction Fees: Users must pay $MINT tokens to perform various operations on the blockchain (e.g., sending tokens, executing smart contracts).

Staking and Security: $MINT tokens can be staked by validators (or nodes) to participate in securing the network. Validators are incentivized with rewards for processing and verifying transactions.

Governance: Token holders often have a say in the governance of the blockchain, meaning they can propose and vote on network upgrades or protocol changes.

3. Key Features of $MINT Blockchain

a. Decentralization

One of the foundational principles of $MINT Blockchain is decentralization. Unlike traditional centralized systems, the $MINT network is controlled by a distributed network of nodes (computers). Each node stores a copy of the blockchain ledger, ensuring that no single party has full control over the data. This decentralized structure minimizes the risk of manipulation and censorship.

b. Scalability

Scalability is a crucial factor for any blockchain to succeed in real-world applications. $MINT Blockchain addresses this challenge by implementing scalable consensus mechanisms and data sharding. This allows for faster transaction processing, high throughput, and reduced network congestion even as the network grows.

c. Smart Contracts and dApps

$MINT Blockchain supports the creation and execution of smart contracts, self-executing programs that automatically enforce contract terms without the need for intermediaries. These smart contracts can be used to build decentralized applications (dApps) across various industries, such as finance, gaming, supply chain management, and more.

Smart Contracts: These programmable scripts on the $MINT Blockchain can autonomously execute transactions based on predefined conditions.

dApps: By enabling decentralized applications, $MINT offers developers a platform to build solutions that are secure, transparent, and operate without central authorities.

d. Privacy and Security

$MINT Blockchain ensures data privacy and security through advanced cryptographic techniques. These may include zero-knowledge proofs (ZKPs), ring signatures, and advanced encryption protocols, which guarantee that sensitive data is not exposed while preserving transaction transparency and verifiability.

e. Interoperability

$MINT Blockchain aims to foster interoperability with other blockchains and legacy systems. It supports cross-chain transactions and information sharing, enabling seamless interaction between different blockchain ecosystems. This enhances the usability of $MINT for a wide range of applications, from digital currencies to enterprise-grade solutions.

4. Security Mechanisms in$MINT Blockchain

a. Consensus Mechanism

The security of the $MINT network is bolstered by its consensus mechanism. Whether it is a Proof of Stake (PoS) or Delegated Proof of Stake (DPoS) model, validators play a key role in verifying transactions and securing the blockchain. In these systems, validators are incentivized to act honestly because they have financial stakes ($MINT tokens) on the line. Any malicious behavior, such as double-spending or fraud, would result in the loss of staked tokens.

b. Cryptographic Security

$MINT uses advanced cryptographic techniques to ensure that all transactions are secure. Public and private key pairs are used to authenticate transactions and guarantee that only authorized participants can make changes to the ledger.

Digital Signatures: Users sign transactions with their private keys, ensuring that their actions are verified and cannot be altered.

Hashing Algorithms: Every block in the blockchain is hashed, and the hash of each block is linked to the previous block. This makes altering past transactions computationally infeasible.

c. Decentralized Validation

Since the network relies on a decentralized group of validators instead of a central authority, it becomes significantly harder for a malicious actor to take control of the system. Distributed consensus mechanisms ensure that no single participant can alter the state of the blockchain, providing strong protection against hacking, fraud, and censorship.

5. Use Cases of $MINT Blockchain

a. Decentralized Finance (DeFi)

$MINT Blockchain is well-suited for decentralized financial applications. Its smart contract functionality allows for the creation of decentralized exchanges (DEXs), lending platforms, and yield farming protocols. By leveraging $MINT ’s secure and scalable platform, DeFi projects can operate without intermediaries, reducing fees and increasing transparency.

b. Supply Chain Management

$MINT Blockchain can be used to track and verify the movement of goods and products across a supply chain. Each step in the journey of a product is recorded on the blockchain, making it easy to verify authenticity, improve transparency, and reduce fraud.

c. Identity Management

Blockchain-based identity systems are becoming increasingly important in the digital world. $MINT can provide a decentralized identity management system where individuals control their personal information, reducing the risks of data breaches and identity theft.

d. Tokenization of Assets

$MINT Blockchain facilitates the tokenization of real-world assets, such as real estate, stocks, and commodities. This allows for fractional ownership, easier transfer of assets, and enhanced liquidity.

6. Governance on the $MINT Blockchain

A critical aspect of$MINT Blockchain’s long-term sustainability is its governance model. Token holders typically have the ability to vote on proposals for network upgrades, changes to protocol rules, or allocation of funds. This decentralized governance ensures that decisions are made collectively, rather than by a centralized authority.

Governance mechanisms may include:

Proposals and Voting: Token holders can submit proposals for new features, upgrades, or policy changes.

Delegated Governance: In some models, token holders may delegate their voting power to trusted representatives (delegates) who make decisions on their behalf.

7. Conclusion

The $MINT Blockchain offers a comprehensive, secure, and scalable ecosystem for developers and users alike. By leveraging advanced cryptographic techniques, a decentralized consensus mechanism, and smart contracts, $MINT aims to provide a transparent, tamper-resistant infrastructure for a variety of industries. Its native cryptocurrency, $MINT tokens, plays a central role in ensuring the security, governance, and sustainability of the network.

As blockchain technology continues to evolve, the $MINT Blockchain positions itself as a powerful platform capable of transforming industries ranging from finance to supply chain, all while maintaining high levels of security and decentralization. The $MINT ecosystem holds the potential to play a key role in the ongoing shift towards a more decentralized digital economy.

CORE+2.16%

D+2.51%

相關資產

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 OneFinity。